简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Negative Oil Prices are Exceptional Rather than Normal

Abstract:Recently, some countries have seen crude oil price fallen to negative range. However, we believe that in light of the US crude oil futures contracts for June, the negative price is still an exception rather than the norm in the global crude oil market.

Recently, some countries have seen crude oil price fallen to negative range. However, we believe that in light of the US crude oil futures contracts for June, the negative price is still an exception rather than the norm in the global crude oil market.

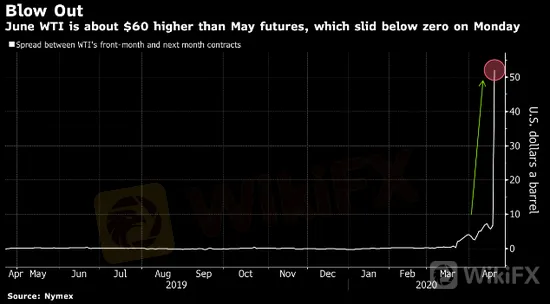

The West Texas Intermediate(WTI) Futures June contract is currently among the most traded assets on the New York market, trading at a price of more than US$20 per barrel. WTI futures for May fell more than 300%, and finally settled at -37.63 US dollars per barrel. The contract expired on Tuesday and the transaction volume and open positions were lower than the contracts in June.

The difference between the two contracts prices is nearly US$60, indicating that there is growing concern that people who need to make physical delivery of the contract recently may have difficulties finding a place to store the crude oil because of oil refinery production cuts. The slumping demand caused by prevention measures against the coronavirus has strained the US oil storage capacity.

This is simply because financial pricing has to be close to the actual market price of the underlying asset when the contract expires. In other words, when the asset is ready to be delivered, the price of an financial instrument will converge upon spot price of the underlying asset.

The Brent crude oil market also shows the same situation, with London Brent crude oil futures trading at near US$ 26 per barrel. The Brent May contract has expired, and the current price reflects the price of the June contract.

The violent fluctuation of prices in May has been due to the shock of a sluggish spot market resulting from unprecedented production cuts of oil refineries.

In a time of sluggish spot market, the unprecedented production cut of oil refineries has weighed on pricing of oil futures, lead to its violent fluctuation in May.

To be clear, this situation, which could largely be attributed to the limitation of oil storage capacity in North America,is not a global phenomenon. It is currently estimated that the world still has a 1.5 trillion barrels storage capacity.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator