简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD Net Short Positions Totaled US$12.59 billion

Abstract:According to statistics released by Reuters and US Commodities and Futures Trading Commission(CFTC) last Friday(April 17th), speculative net short positions in USD grew from US$10.5 of the previous week to US$12.59 billion in the week ended April 14th.

According to statistics released by Reuters and US Commodities and Futures Trading Commission(CFTC) last Friday(April 17th), speculative net short positions in USD grew from US$10.5 of the previous week to US$12.59 billion in the week ended April 14th.

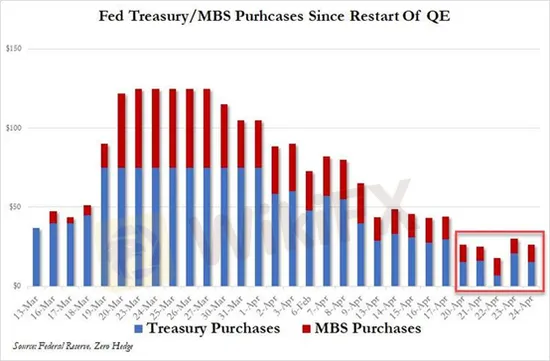

Since the Fed restarted QE, daily purchase of Treasury Bonds dropped from US$75 billion to US$60 billion, and then to US$50 billion.

As of last week (April 12th to 17th), US Treasury Bond purchase has decreased to US$30 billion per day, this implicates the US financial system has stabilized and the Federal Reserves countermeasures in combating the global pandemic are beginning to show their effects.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator