简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bridgewater Made €4 Billion Via Bearish Bets Amid Outbreak

Abstract:According to the report of data analyzing group Breakout Point on March 25th, the world’s largest hedge fund Bridgewater Associates, LP has closed its previous short positions of European Stock market, gaining at least €4 billion(equivalence of 30 billion RMB).

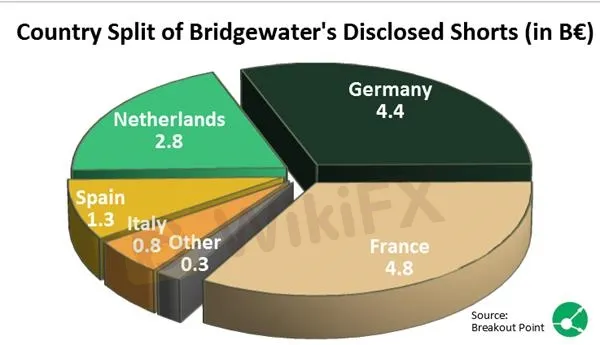

According to the report of data analyzing group Breakout Point on March 25th, the world’s largest hedge fund Bridgewater Associates, LP has closed its previous short positions of European Stock market, gaining at least €4 billion(equivalence of 30 billion RMB). Bridgewater made bearish bets on several European countries including France, Germany, the Netherlands, Spain and Italy, all of which are heavily affected by the coronavirus outbreak.

Bridgewater which has been considered a long-winning company manages over US$160 billion of global assets. Its flagship fund Pure Alpha once achieved a 9.4% return during 2008’s global financial crisis through strategic investment, while gaining remarkable returns of 45% and 25% in 2010 and 2011 respectively.

Meanwhile, the company was subject to “blow-up” rumors that went wild among the financial circle last week.

During a recent interview with CNBC, founder of Bridgewater Ray Dalio admitted that the coronavirus outbreak’s shock on the market had caught him off-guard. He estimated that the pandemic will inflict US$4 trillion losses on US companies, while global corporate loss due to the crisis can reach US$12 trillion, more than half of United States’ GDP last year.

Datuk Michael Kang, the Chair of SME Association of Malaysia, said the spreading coronavirus pandemic will further exasperate the economy. A shutdown of just 10% of small medium enterprises in Malaysia can make a million Malaysians lose their jobs.

As Mr. Dalio mentioned, the coronavirus is a crisis that “has not happened in our lifetime before”, leading to an equally unprecedented global recession that revealed potential risks of US and European markets as well as vulnerability of Southeast Asian Economies. In such a time, forex investors need to keep a close eye on market updates, while remaining alert to scams and potential risks to ensure the safety of your assets.

As a leading forex media, WikiFX will continue to bring you the latest forex updates round the clock, including reports on economic events that affect the market, forex economic data, live trend of currencies, and changes in forex indicators. Click here to download. www.wikifx.com/my_en/

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Spain plans 100% tax for homes bought by non-EU residents

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Singapore Blocks Polymarket Access, Following U.S. and France

OneZero Collaborates with Ladies Professional Golf Association (LPGA)

Housewives Scammed of Over RM1 Million in Gold Investment Fraud

Currency Calculator