简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Why stock market "super cycle" could extend rally for another 10 years - Business Insider

Abstract:The next decade in stocks might look pretty similar to the last one, according to Jim Paulsen: strong, steady gains with low overall volatility.

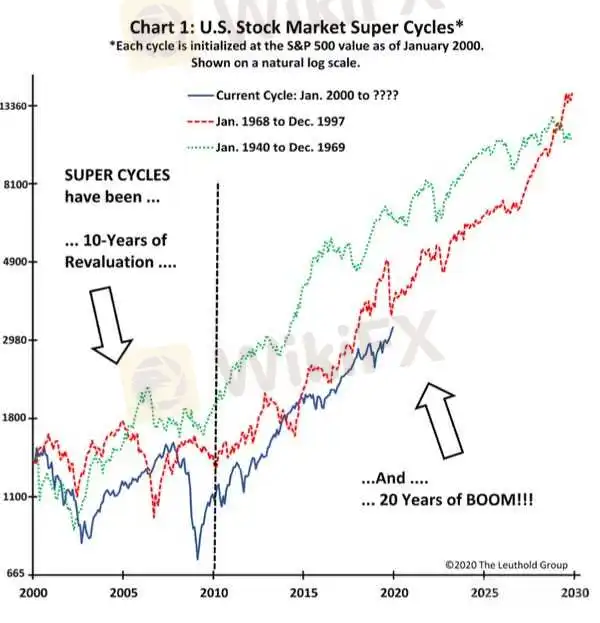

The current bull market is almost 11 years old, but Jim Paulsen of Leuthold Group says the next decade for stocks might be about as good as the last one was.Paulsen says that since 1940, stocks have gone through 30-year “super cycles” consisting of a decade of high volatility and weak returns and 20 years of great returns and low volatility.He's not guaranteeing this will happen, but Paulsen says there are good reasons for investors to stay in the stock market instead of assuming returns will weaken or disappoint in the years ahead.Click here for more BI Prime stories.Don't lower your expectations too quickly.There is almost unanimous agreement on Wall Street that the incredible 11-year bull market for stocks is going to give way to something closer to normal and kind of disappointing, or even a decade of minimal returns. After all, the good times can't last forever. Right?Jim Paulsen — the chief investment officer at Leuthold Group — isn't saying the bull market will last forever, but he says there is evidence it's a very long way from ending. That means those predictions of weak returns, sensible though they are, may turn out to be premature.“Post-war history of the U.S. stock market tells a potentially very different and more optimistic story about what the next decade could produce for investors,” he said in a recent client note.Paulsen says that over the past 80 years, the stock market gone through “super cycles” that last about 30 years each. The first decade is painful for investors, with meager returns and very high volatility as price-to-earnings ratios plunge from high levels to low ones. In the present scenario, that would be the early 2000s, when the stock market saw two severe downturns.Those roughly decade-long periods then transition into huge, two-decade rallies. And according to Paulsen's methodology, we're only halfway done with the expansion phase.Read more: GOLDMAN SACHS: Wall Street is asleep on these 11 stocks, which will all explode 30% higher in 2020“Super Cycles have been three-decade events comprised by ten years of revaluation followed by about a 20-year period of Boom!” he wrote. “The first cycle was roughly between 1940 and 1970, the second cycle unfolded between the late 1960s to the late 1990s, and the contemporary cycle began around the year 2000.”This chart shows how those cycles have looked. The black dotted line divides the tumultuous first decade from the two-decade rally. Note that there is some overlap at the end of the first cycle and the beginning of the second.

Jim Paulsen says this could be evidence of market “super cycles” where a decade of mediocre returns is followed by two decades of big gains.

Leuthold Group

According to Paulsen, over the first 10 boom years, the S&P 500 has returned 12.9% per year with low volatility. And the next 10 have been nearly as good, with an average annual return of 10.6% a year with even lower volatility.One obvious objection to this is that stock market valuations are high, which would seem to leave less room for growth. Paulsen acknowledges the point, but says it hasn't been a problem at this stage in previous cycles.“At this point in the last two Super Cycles, even though valuations were equally as extended as they are today, the coming ten-year risk/reward profile for ”buy & hold“ stock investors proved to be more than satisfying,” he said.It's worth noting, however, that Paulsen isn't say the current bull market will make it to year 20. He says multiple bear markets and recessions are probable, but investors who are patient are likely to be rewarded for the rest of the cycle.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

February 23, 2024- US Stocks Hit Record Highs, Tech Sector Fuels Rally

Nvidia Soars, European Markets Gain, and Key Forex Trends

Market Resurgence: Stocks Rally, Cryptos Surge, and Forex Fluctuations - February 15, 2024 Update

Key Insights into Today's Market Dynamics and Profitable Trading Strategies

EBC Research Institute Hotspot Analysis | China Unleashes Major Moves, Stock Market Brews a Violent Reversal

The Chinese government has taken measures to boost the stock market, yet the market still faces challenges, and investors should proceed with caution.

Market Wrap: Stocks, Bonds, Commodities

U.S. Stocks Rebound, Yen Surges on BoJ Policy Hints

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator