简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Contactless payments drive almost as many transactions as cash in Canada - Business Insider

Abstract:Contactless transactions are a major part of Canada's payments landscape – making up 19.5% of the country's 21.1 billion transactions in 2018.

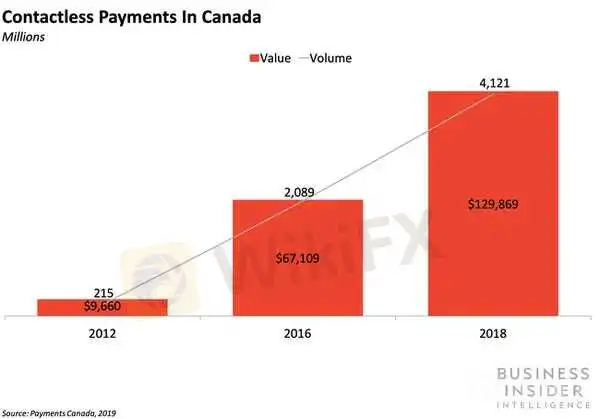

This story was delivered to Business Insider Intelligence Payments & Commerce subscribers earlier this morning. To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Contactless payment volume surged to 4.1 billion in 2018, growing 97.2% compared with 2016, per a report from Payments Canada. The country also saw nearly $129.9 billion in contactless transaction value last year, which was up 93.5% from its 2016 total. Contactless transactions have come a long way in Canada considering that just 215 million transactions were conducted for a total of less than $9.7 billion in 2012.

Business Insider Intelligence

Contactless transactions have established themselves as a major part of Canada's payments landscape. They accounted for 19.5% of the country's 21.1 billion transactions in 2018, which nearly matches cash's 21% share. Contactless payments' share of Canada's $9.9 trillion in transaction value was minuscule in comparison at just 1.3%, but their high level of volume still makes them a key part of the country's payments ecosystem.Mobile payments are already a fairly popular channel for contactless payments in Canada, but financial institutions (FIs) may have the opportunity to use them to capture more volume.Almost 35% of Canadian consumers used their mobile devices to make contactless payments regularly in 2018, but security concerns persist. Having more than one-third of consumers use mobile devices for contactless payments is a good start to adoption, but the report states that its uptake has been slower than that of contactless cards.This is likely due to consumers' concerns about mobile payments services' security, as less than one-third reported believing that mobile payments services are safe and secure, according to data cited by the report, which is similar to US consumers' concerns about mobile wallet safety.FIs are Canadian consumers' most trusted source for mobile payments, so they may be best positioned to popularize contactless payments via devices. Nearly half (48%) of Canadian consumers said their own FI or bank was their most trusted source for mobile payments, which is far ahead of the 7% who selected payment networks or the 5% who chose mobile device manufacturers, per a report from TSYS.This may mean that FIs in Canada can find success pushing their own mobile payments services rather than working with third-party wallets, which would help them capture more volume and capitalize on Canadian consumers' interest in contactless payments. FIs that would rather work with a third-party wallet like Apple Pay could consider promoting their relationship with other wallets to try to inspire trust from consumers in other mobile payment providers as well.Want to read more stories like this one? Here's how to get access: Sign up for Payments & Commerce Pro, Business Insider Intelligence's expert product suite keeping you up-to-date on the people, technologies, trends, and companies shaping the future of consumerism, delivered to your inbox 6x a week. /> /> Get StartedJoin thousands of top companies worldwide who trust Business Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

Understanding the Impact of Interest Rate Changes on Forex Markets

Currency Calculator