简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

India delivers surprise corporate tax cuts to boost economy

Abstract:Media playback is unsupported on your device Media captionWhat cars and underwear say about India's

Media playback is unsupported on your device

Media captionWhat cars and underwear say about India's slowdown

India has cut its corporate tax rates in an effort to spur investment and boost growth in the country's faltering economy.

Finance Minister Nirmala Sitharaman said the base corporate tax rate would be lowered to 22% from 30%.

The surprise move triggered a stock market rally, with the Sensex index jumping 4.5%.

The tax cuts are the latest measures to boost spending and shore up investment in India.

Under the slate of reforms announced on Friday, India will lower its corporate tax rate to 22% from 30% for companies that don't seek exemptions.

Firms that do receive incentives or exemptions will see their tax rate cut to 25% from 35%.

In addition, some new manufacturing firms will see their corporate tax rate lowered to 15% from 25%.

A Prasanna, head of research at ICICI in Mumbai, said the move would boost investment and employment.

“This is a long overdue and hugely positive move by the finance minister. The new rates simplify the tax architecture and it will give a fillip to investments and jobs,” he told Reuters.

Viewpoint: How serious is India's economic slowdown?

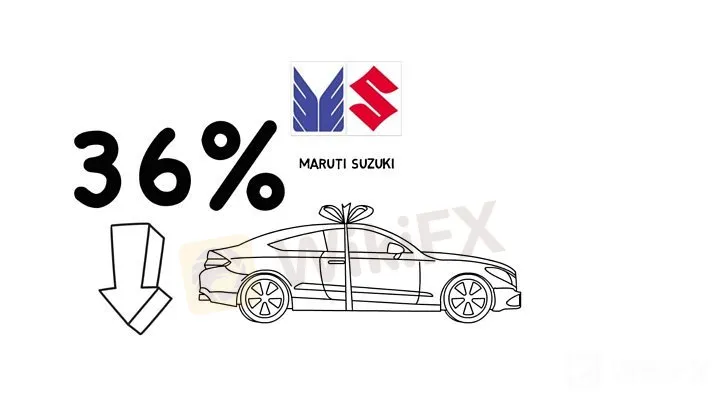

India's economic growth is sitting at a six-year low and the government has taken a series of steps to boost the economy.

So far this year, India's central bank has cut rates four times and the benchmark rate currently sits at a near-decade low.

The country has relied on domestic consumption to fuel growth but spending has slowed sharply.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator