简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly British Pound Forecast: Inflation Report Due Ahead of BOE Meeting; Brexit Talks Ongoing

Abstract:As Brexit talks persist, the BOE remains sidelined. And with the UK parliament prorogued, all attention is on UK PM Johnson's talks with his EU counterparts.

Fundamental Forecast for the British Pound: Neutral

As Brexit talks persist, the BOE remains sidelined. And with the UK parliament prorogued, all attention is on UK PM Johnson's talks with his EU counterparts.

A further short covering rally is possible for the British Pound, as futures markets remain heavily net-short – even after a likely sharp

According to the IG Client Sentiment Index, traders have remained net-long since May 6 when GBPUSD traded near 1.3096; price has moved 4.6% lower since then.

See our long-term forecasts for the Euro and other major currencies with the DailyFX Trading Guides.

British Pound Rates Week in Review

Brexit breakthrough? Amid signs that UK Prime Minister Boris Johnson was seeking a new Irish border compromise with the support of Northern Ireland‘s DUP, the British Pound soared as a short covering rally propelled it to the top of the standings as the top performing major currency last week. It appears that UK parliament’s last minute efforts to derail a no deal, hard Brexit prior to being prorogued may have worked.

GBPJPY was the best performing GBP-cross, gaining 2.81%, while the other safe haven crosses, GBPCHF and GBPUSD, added 2.03% and 1.74%, respectively. Even as higher yielding and high beta assets proved strong thanks to falling interest rate cut odds among the G10 currencies central banks, the British Pound proved formidable versus the commodity currencies, with GBPCAD and GBPNZD adding 2.59% and 2.42%, respectively. Meanwhile, GBPAUD gained 1.27%, the worst performing GBP-cross.

Thanks in part to the Euros reaction around the September ECB meeting, EURGBP was the second-worst performing GBP-cross on the week, gaining 1.35%.

British Pound Economic Data Slowly Improving

The forex economic calendar should be watched closely midweek, as the docket is mostly quiet otherwise outside of Wednesday and Thursday. The August UK inflation report (consumer price index) on Wednesday and the September Bank of England meeting on Thursday will garner the bulk of attention outside of the ongoing Brexit talks between UK PM Johnson and his EU counterpart, European Commission President Jean-Claude Juncker.

In general, UK economic data has continued to improve over the past several months, at least when trying to look at economic data from an objective point of view. The Citi Economic Surprise Index for the UK, a gauge of economic data momentum, was up to 13.8 by the end of last week from -27.6, one-month ago on August 16; three-months ago on June 14, it was -26.

UK Inflation Expectations Remain Firm in Face of Rising British Pound

Ahead of the September BOE meeting on Thursday, the August UK inflation report (consumer price index) will likely generate some volatility among the GBP-crosses (although not too much; with the BOE still in neutral thanks to Brexit, markets are less sensitive to economic data that would otherwise guide BOE policymakers).

According to a Bloomberg News survey, the August UK inflation report will show that price pressures eased last month amid a rebound in Sterling rates; a strong domestic currency dampens import price pressures. Headline inflation is due to come in at 1.8% from 2.1%, while core inflation is due in at 1.8% from 1.9% (y/y).

UK Inflation Expectations versus Brent Oil Prices: Daily Timeframe (September 2018 to September 2019) (Chart 1)

There certainly has been a tug and pull between the British Pound and the impact of Brent oil prices on UK inflation expectations. On one hand, declining inflation expectations across developed economies have been in part driven by declining energy prices since early Q219. On the other hand, UK inflation expectations have been more stable than for other develop countries as the weakening British Pound throughout the second half of 2019 has raised input costs. On balance, UK inflation expectations have traded in a 20-bps range for the past five months.

September BOE Meeting Unlikely to Make Waves

There are two primary reasons why traders should keep expectations low for the September BOE meeting. The first reason is typical in nature, at least since the June 2016 Brexit: the BOE is doing everything it can to stay neutral so as to not appear political during the Brexit negotiations. The second reason is typical in nature, at least since the Global Financial Crisis in 2008: September policy meetings do not produce new growth, inflation, and unemployment forecasts, collectively known as the Quarterly Inflation Report (QIR).

Bank of England Interest Rate Expectations (September 13, 2019) (Table 1)

Now, overnight index swaps are pricing in a 1% chance of a 25-bps rate cut at the September BOE meeting, or, a 99% chance of a hold. Traders have been of the mindset that there wont be a change at the September BOE meeting for some time; six months ago, there was a 76% chance of a hold.

With the Brexit talks ongoing, the BOE isn‘t expected to move anytime soon; the BOE’s main rate is favored to stay at 0.75% through at least June 2020. But the moment clarity over Brexit begins to take shape, it seems highly likely that rate odds will evolve rapidly; the period of high volatility for the British Pound isnt going to dissipate anytime soon.

GBPUSD Rate versus COT Net Non-Commercial Positioning: Daily Timeframe (September 2018 to September 2019) (Chart 2)

Looking at positioning, according to the CFTC‘s COT report for the week ended September 10, speculators increased their net-short British Pound positions from 85K to 92.2K contracts. But the gains by the British Pound last week came after Tuesday’s reporting period ended. Traders should expect the data to show evidence of a short covering rally taking place in the forthcoming update on September 20.

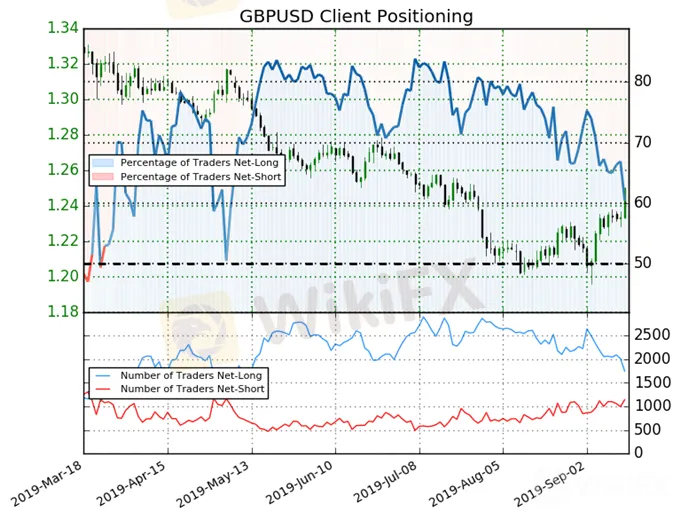

IG Client Sentiment Index: GBPUSD Rate Forecast (September 13, 2019) (Chart 3)

GBPUSD: Retail trader data shows 60.4% of traders are net-long with the ratio of traders long to short at 1.53 to 1. In fact, traders have remained net-long since May 6 when GBPUSD traded near 1.3096; price has moved 4.6% lower since then. The percentage of traders net-long is now its lowest since Apr 17 when GBPUSD traded near 1.30389. The number of traders net-long is 13.3% lower than yesterday and 17.0% lower from last week, while the number of traders net-short is 14.9% higher than yesterday and 8.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse higher despite the fact traders remain net-long.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GBPUSD Price Rallies to a Six-Week High, Brexit Latest

GBPUSD has just hit its highest level since late-July and is eyeing further gains on a combination of a marginally stronger Sterling complex and a weak US dollar.

EURGBP Price Outlook Tracks ECB Monetary Policy and Brexit News

Two weak currencies that are currently looking ahead to potentially defining moments that will provide a clear signal for both. How will they compare against each other?

Sterling (GBP) Price Drifts Lower on Brexit Uncertainty, Hard Data Flow Next

GBPUSD opens the week on the backfoot as Brexit rumours and news flow continue to keep traders on the sidelines. UK data on deck with a look at monthly GDP.

Sterling (GBP) Price Outlook Rattled by Brexit Confusion, PMI Weakness

Sterling remains under pressure with little scope for a sustained upside move as Brexit continues to weigh on market sentiment, while the latest batch of PMIs point to the UK economy contracting in Q3.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Currency Calculator