简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sterling (GBP) Price Outlook Rattled by Brexit Confusion, PMI Weakness

Abstract:Sterling remains under pressure with little scope for a sustained upside move as Brexit continues to weigh on market sentiment, while the latest batch of PMIs point to the UK economy contracting in Q3.

Brexit, UK PMIs, Sterling (GBP) Price, Chart and Analysis

英国退欧,英国采购经理人指数,英镑(英镑)价格,图表与分析

UK PM Boris Johnson under pressure as Parliament takes control of Brexit.

英国首相由于议会控制了英国退欧,鲍里斯·约翰逊面临压力。

{2}

UK Services PMI disappoints, economy expected to contract in the third quarter.

{2}

Q3 2019 GBP Forecast and Top Trading Opportunities

2019年第3季度英镑预测和最佳交易机会

{5}

The UK Economy is Likely to Contract as Brexit Confusion Continues

{5}{6}

UK PM Boris Johnson‘s defeat in the House of Commons late Tuesday has left his Brexit plans in disarray with Parliament now more likely to lead the way forward. A cross-party Remainer motion to delay the UK’s departure from the EU until January 31, 2020 was passed and is now expected to be legislated later today before going to the House of Lords. PM Johnson who now wants to call a General Election will need support from across the House to get the 2/3 majority necessary and this will prove difficult until the Remainers bill is passed.

{6}

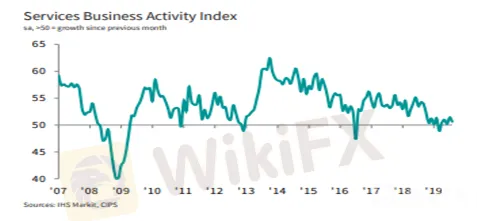

The latest Markit IHS PMIs highlight the effect that Brexit is having on the UK economy with the dominant services sector this year reporting ‘its worst performance since 2008, with worrying weakness seen across sectors such as transport, financial services, hotels and restaurants and business-to-business services’, according to Chris Williamson, chief business economist at IHS Markit. The index fell to 50.6 in August from 51.4 in July, signaling only marginal expansion with Markit suggesting that UK Q3 GDP will contract by 0.1%.

最新的Markit IHS采购经理人指数突显了英国脱欧对英国经济的影响,今年主导服务业表现出“自2008年以来表现最差”,运输,金融服务,酒店,餐馆和商业等行业出现了令人担忧的疲软。 IHS Markit的首席商业经济学家克里斯威廉姆森表示,“商业服务”。该指数从7月份的51.4降至8月份的50.6,表明只有边际扩张,Markit表示英国第三季度GDP将收缩0.1%。

‘While the current downturn remains only mild overall, the summer’s malaise could intensify as we move into autumn. Companies have grown increasingly gloomy about the outlook due to the political situation and uncertainty surrounding Brexit, adding to downside risks in coming months. With the exception of the slump in sentiment after the 2016 referendum, August saw service sector firms at their gloomiest since the height of the global financial crisis in early 2009, according to Williamson.

What is the Brexit Backstop and How Does it Impact the British Pound?

什么是英国退欧支持以及它如何影响英镑?

Against this backdrop, Sterling (GBP) remains volatile with political headlines driving price action. GBPUSD trades around 1.2180, in part due to today‘s weakness in the US dollar, while investors are now starting to, at the margin, price out a hard Brexit, giving Sterling a small uplift. While the pair have recovered from Tuesday’s 1.1959 low print, the bear trend from early-March remains intact and will only be convincingly broken when there is clarity on Brexit.

在这种背景下,英镑(英镑)仍然不稳定头条新闻推动价格行动。英镑兑美元汇率在1.2180附近交易,部分原因是由于今天美元疲软,而投资者现在正开始以一定的利润率对英国脱欧进行定价,使英镑小幅上扬。虽然该货币对从周二的1.1959低位回升,但3月初的熊市趋势仍然完好无损,只有在英国脱欧清晰时才能令人信服地打破。

GBPUSD Daily Price Chart (November 2018 – September 4, 2019)

GBPUSD每日价格走势图(2018年11月 - 2019年9月4日)

IG Client Sentiment data show that 73.7% of retail traders are net-long of GBPUSD, a bearish contrarian indicator. However, recent daily and weekly positional changes give us a mixed trading bias.

IG Client Sentiment数据显示73.7%的零售交易商是英镑兑美元的净多头,是看跌的逆势指标。然而,最近的每日和每周位置变化给我们带来了混合的交易偏见。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly British Pound Forecast: Inflation Report Due Ahead of BOE Meeting; Brexit Talks Ongoing

As Brexit talks persist, the BOE remains sidelined. And with the UK parliament prorogued, all attention is on UK PM Johnson's talks with his EU counterparts.

GBPUSD Price Rallies to a Six-Week High, Brexit Latest

GBPUSD has just hit its highest level since late-July and is eyeing further gains on a combination of a marginally stronger Sterling complex and a weak US dollar.

EURGBP Price Outlook Tracks ECB Monetary Policy and Brexit News

Two weak currencies that are currently looking ahead to potentially defining moments that will provide a clear signal for both. How will they compare against each other?

Sterling (GBP) Turnaround on Data Beat and Brexit Commentary - Webinar

After opening the session in negative territory, GBPUSD performed a quick U-turn after UK manufacturing, industrial production and monthly GDP data all beat expectations. And over in Ireland, UK PM Boris Johnson was in a more conciliatory mood.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator