简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP Price Outlook: Brexit Fears Spike, British Pound Sinks

Abstract:The Sterling came under renewed selling pressure in response to the latest Brexit development with PM Boris Johnson aiming to strengthen his hand and steer the UK closer toward no-deal by suspending Parliament.

BREXIT LATEST – BRITISH POUND BLOODIED BY UK PARLIAMENT SUSPENSION

The British Pound took a plunge surrounding news that PM Boris Johnson received approval from the Queen to suspend UK Parliament

Spot GBPUSD prices dropped while implied volatility measures jumped as no-deal Brexit grows increasingly likely

Check out our Brexit Timeline for details on how Brexit negotiations have impacted the UK, Pound Sterling and financial markets

Spot GBPUSD sank over 100 pips from Wednesday‘s session high as the Sterling succumbed to the market’s resurfacing fears of no-deal Brexit. The British Pounds latest move to the downside was sparked by reports that Prime Minister Boris Johnson plans on suspending UK Parliament from early-mid September until October 14; a mere 17 calendar days away from the fast-approaching October 31 Brexit deadline. As things currently stand, no-deal Brexit is the default scenario if the October 31 deadline is reached prior to Parliament backing a new Brexit deal or approving another extension.

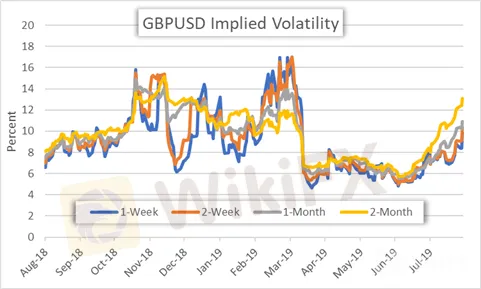

GBPUSD IMPLIED VOLATILITY SPIKES AS NO-DEAL BREXIT RISK RISES

GBPUSD implied volatility – largely quantifying the market‘s perception of Brexit uncertainty – depicts the rise of no-deal Brexit risk. That said, GBPUSD 2-month implied volatility, which nearly encompasses the October 31 Brexit departure date, unsurprisingly spiked to 13.09% and marks the highest reading since December 10 when former PM Theresa May canceled Parliament’s original Brexit vote. Also, given the generally strong inverse relationship between an underlyings implied volatility and its spot price, the British Pound could very well reembark on its steep slide lower as currency traders digest the growing probability that the UK will sever itself from the EU without a Brexit deal.

GBPUSD PRICE CHART: WEEKLY TIME FRAME (APRIL 2016 TO AUGUST 2019)

This relationship between the British Pound and its respective measures of implied volatility was last noted in our weekly GBP price forecast earlier this month when we correctly anticipated a technical retracement higher in the Sterling. In light of the latest Brexit developments, however, the prospect of GBPUSD continuing its recent rebound is unlikely. Yet, GBP bulls counter that PM Boris Johnson‘s latest move ups the pressure on the EU to make concessions to the Brexit Withdrawal Agreement – specifically regarding the Irish backstop. Nevertheless, spot GBPUSD is estimated to fluctuate between 1.1563-1.2859 with a 68% statistical probability as the Brexit clock ticks down judging by the currency pair’s 2-month implied volatility of 13.09%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator