简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast Remains Bullish as RSI Approaches Overbought Zone

Abstract:The price of gold may continue to exhibit a bullish behavior as the Relative Strength Index (RSI) approaches overbought territory.

Gold Price Talking Points

The price of gold remains bid even though China looks to negotiate with the US “in a calm manner,” and the precious metal may continue to exhibit a bullish behavior as the Relative Strength Index (RSI) approaches overbought territory.

Gold Price Forecast Remains Bullish as RSI Approaches Overbought Zone

Current market conditions are likely to keep gold prices afloat as there appears to be a flight to safety, and little indications of a looming US-China trade deal may push market participants to find an alternative to fiat currencies amid the threat of a policy error.

It seems as though the Federal Reserve will come under increased pressure to insulate the US economy as President Donald Trump tweets that the “Fed has been calling it wrong for too long,” and the central bank may continue to alter the forward guidance for monetary policy as “participants were mindful that trade tensions were far from settled and that trade uncertainties could intensify again.”

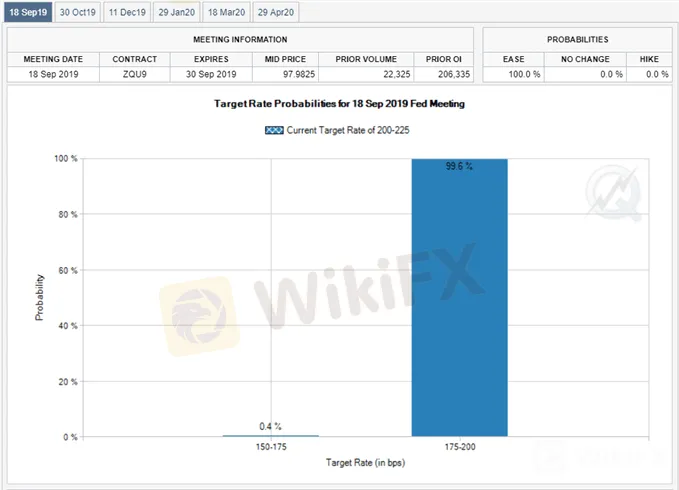

Keep in mind, Fed Fund futures continue to show overwhelming expectations for at least a 25bp reduction on September 21, but it remains to be seen if the central bank will reverse the four rate hikes from 2018 as Chairman Jerome Powell argues that monetary policy “cannot provide a settled rulebook for international trade.”

In turn, the shift in US trade policy may spur a greater rift within the Federal Open Market Committee (FOMC), and a growing number of Fed officials may resist calls to implement a rate easing cycle as the economy shows little signs of an imminent recession.

In fact, the update to Atlanta Fed GDPNow model shows the US economy expanding 2.3% in the third quarter of 2019 compared to 2.2% on August 16, and the FOMC may find it increasingly difficult to justify back-to-back rate cuts as “participants generally judged that downside risks to the outlook for economic activity had diminished somewhat since their June meeting.”

With that said,the risk of a policy error may push market participants to hedge against fiat currencies, and falling US Treasury yields along with the inverting yield curve are likely to keep gold prices afloat as there appears to be a flight to safety.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Gold Price Daily Chart

Source: Trading View

The broader outlook for gold prices remain constructive as both price and the Relative Strength Index (RSI) clear the bearish trends from earlier this year.

Moreover, gold has broken out of a near-term holding pattern following the failed attempt to close below the $1402 (78.6% expansion) region, with the RSI still tracking the bullish formation from April.

Will keep a close eye on the RSI as it approaches overbought territory, with a break above 70 likely to be accompanied by higher gold prices as the bullish momentum gathers pace.

Need a break/close above $1554 (100% expansion) to open up the Fibonacci overlap around $1629 (23.6% retracement) to $1634 (78.6% retracement).

For more in-depth analysis, check out the 3Q 2019 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Gold Analysis: Steady Prices Amid Key Economic Data

Gold prices remain steady as investors anticipate Federal Reserve Chairman Jerome Powell’s upcoming speech and the U.S. Non-Farm Payrolls data. Geopolitical tensions and economic uncertainties continue to support safe-haven demand for gold, while higher U.S. yields exert downward pressure. Key economic events this week include JOLTs Job Openings, ADP Employment Change, and the Non-Farm Payrolls report.

Gold Supported by Weak U.S. Data and Inflation Concerns

Gold prices are buoyed by weak U.S. economic data, reduced Fed rate hike expectations, and ongoing geopolitical tensions. The precious metal is set for its third consecutive quarterly gain, with upcoming U.S. inflation data being closely monitored.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator