简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Rate Outlook: PMI Data Eyed by EUR/USD, EUR/GBP, EUR/JPY

Abstract:The Euro could be at risk judging by the rise in overnight implied volatility measures ahead of Eurozone PMI data slated for release during early Thursday trade.

EURO CURRENCY VOLATILITY IN FOCUS AHEAD OF EUROZONE PMI DATA

Euro price action will likely turn to August Eurozone PMI numbers from Markit on Thursday as forex traders weigh their potential impact on future ECB monetary policy decisions

EURUSD, EURGBP, EURJPY, EURAUD and EURCAD overnight implied volatility measures all tick higher ahead of the Eurozone PMI and consumer confidence data dump

Fiending for volatility? Check out this article on How to Trade the Most Volatile Currency Pairs

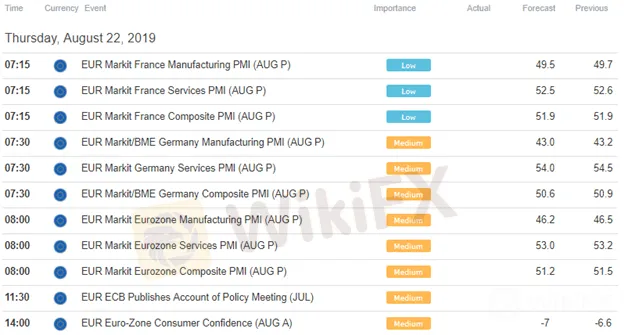

While markets speculate over possible dovish remarks from global central bankers at the highly-anticipated Jackson Hole Economic Symposium, forex traders will be provided with hard economic data which could set the tone for monetary policy expectations. Turning to the DailyFX Economic Calendar, we find that Thursdays data dump out of the EU will kick off with Markit releasing August PMI numbers on France at 7:15 GMT followed by Germany PMI readings at 7:30 GMT.

Also, the headline composite Eurozone PMI figure, which keeps edging closer toward contraction territory (a reading below 50.0), is slated to cross wires at 8:30 GMT. July ECB minutes and the Eurozone consumer confidence report for August will be published during Thursdays trading session as well which are expected at 11:30 GMT and 14:00 GMT respectively.

EURO – FOREX ECONOMIC CALENDAR – 22 AUGUST 2019

A sharp deterioration across the Euro economy – most recently evidenced by plunging ZEW sentiment readings and Germany‘s GDP contracting by -0.1% in Q2 – has steered Citi’s Eurozone Economic Surprise Index to its lowest level since March. In turn, calls for the European Central Bank (ECB) to step up its stimulus efforts have grown louder and has kept the Euro under pressure as dovish ECB bets rise.

EUROZONE ECONOMIC SURPRISE INDEX

Consequently, currency price action across EUR pairs could heat up in the event August Eurozone PMI data catches the market off-guard with better (or worse) than expected economic readings. The July ECB minutes also have potential to swing the Euro – particularly if details on forthcoming monetary policy accommodation measures are revealed. As such, it should come as no surprise that overnight implied volatility measures for EURUSD, EURJPY, EURGBP, EURAUD and EURCAD all ticked higher ahead of Thursday trade.

EURO PRICE IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT)

EURUSD overnight implied volatility increased from 4.22% on Tuesday to 5.30% to day but remains slightly below its average of 5.99% over the last 12-months. EURGBP, largely watched by forex traders to gauge the latest Brexit developments, is expected to be the most volatile Euro currency pair with an overnight implied volatility reading of 9.43%. Also, EURJPY overnight implied volatility of 7.83% could be priced a bit low by forex option traders in light of Japans consumer price index release due Thursday as well.

EUR/USD PRICE CHART: DAILY TIME FRAME (APRIL 2019 TO AUGUST 2019)

Despite the closely watched Eurozone PMI data having serious potential to move the market‘s needle, spot EURUSD could have a limited reaction to Thursday’s economic indicators considering the currency pair will largely by driven by Jackson Hole and US Dollar Price Action. That said, spot EURUSD has potential to eclipse the 1.1100 price level again even if Eurozone PMI data disappoints with the prospect of a dovish Fed looming. EURUSD upside could run out of steam prior to hitting the ceiling of the option-implied trading range, however, if technical resistance from the 8-day EMA or 23.6% Fibonacci retracement level come into play.

EUR/JPY PRICE CHART: DAILY TIME FRAME (JUNE 2019 TO AUGUST 2019)

EURJPY price action in response to Thursday‘s Eurozone PMI data could be a better measure of the market’s and Euro‘s reaction. The Euro likely stands to sink against the sentiment-driven Japanese Yen if the PMI data fails to inspire risk taking and prompts a move toward safe-havens. In this scenario, EURJPY bears could push for a retest of August’s lows slightly above the 117.50 handle. Conversely, EURJPY upside might be limited by the 23.6% Fib around 119.00 in addition to the currency pairs 20-day SMA as well as its option-implied upper barrier of 118.61.

EUR/GBP PRICE CHART: DAILY TIME FRAME (APRIL 2019 TO AUGUST 2019)

EURGBP price action remains largely dominated by Brexit drama, but further deterioration in EU fundamentals potentially revealed by Thursday‘s PMI data release could cause forex traders to focus less on Brexit and more on forthcoming ECB stimulus. On the contrary, upbeat PMI readings out of the Eurozone could keep spot EURGBP fixated on Brexit. That said, if EURGBP drifts below technical confluence stemming from the 23.6% Fib of the pair’s steep climb since May, it could open up the door for Euro to give back some more of its gains as bullish momentum wanes.

EUR/CAD PRICE CHART: WEEKLY TIME FRAME (JANUARY 2017 TO AUGUST 2019)

Albeit a less popular currency pair, EURCAD appears to be gearing up for a breakout and may very well be worth putting on the watchlist. We recently pointed to the Canadian Dollar strengthening in response to hotter-than-expected CPI data published early Wednesday, which is a trend that has potential of continuing if Eurozone economic readings disappoint and strongarm price action lower – particularly if spot prices fail to catch bid around the bullish trendline or EURCAD sinks below confluent support from the 61.8% Fibonacci retracement of the currency pairs trading range since 2017.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

Euro Technical Analysis - EUR/USD, EUR/JPY. Levels to Watch

The Euro has established some range environments against the US Dollar and the Japanese Yen. Will the single currency break-out to establish a trend?

Euro Overview

Euro Jumps to 1-Month High as ECB's Lagarde Fails to Calm Rate Hike Bets.

Euro Technical Analysis: EUR/USD, EUR/JPY Eyeing Push to Higher Highs

Euro Technical Analysis: EUR/USD, EUR/JPY Eyeing Push to Higher Highs

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator