简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

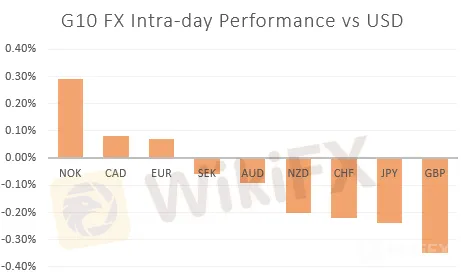

GBPUSD Dips, EURUSD Steady, SNB Intervening in Swiss Franc (CHF) - US Market Open

Abstract:GBPUSD Dips, EURUSD Steady, SNB Intervening in Swiss Franc (CHF) - US Market Open

MARKET DEVELOPMENT – GBPUSD Dips, EURUSD Steady, Eyes on Italy No-Confidence Vote

DailyFX 2019 FX Trading Forecasts

EUR: A relatively muted start to the week for the Euro, which hovers around the 1.1100 handle. Eurozone inflation figures showed a slight dip to 1% from 1.1%, while the core reading remained at 0.9%, further emphasising the need for ECB stimulus. That said, calls for German fiscal stimulus are also growing louder as the Bundesbank sees a risk that the German economy may fall into a technical by Q3. A fiscal stimulus package is touted to be around EUR 50bln, however, the bar is relatively high for this, given that the lower parliament would have to confirm that there is a crisis, while fiscal stimulus is unlikely to take place before monetary stimulus. Nonetheless, equity markets have been supported with the DAX rising some 1.6%, while German yields have also ticked up.

Elsewhere, focus will be on Italy, in which a no-confidence vote is scheduled to take place on Tuesday. Therefore, the passing of the no-confidence vote could add further downside risks to the Euro going forward, particularly if a snap-election is called.

GBP: Last weeks mild recovery in the Pound has stalled as the corrective move in EURGBP eases. Reports continue to highlight that the UK is preparing to leave the EU on October 31st. Eyes will be on PM Johnson who is scheduled to meet French President Macron on the 22nd. Sentiment remains bearish on the Pound; however, the psychological 1.2100 handle has held thus far.

JPY / CHF: The reprieve in risk sentiment has seen safe-havens ease slightly following reports that the US will grant Huawei another 90 days to do business with US firms. Although, given that uncertainties remain, risks remain tilted to safe-haven upside. Elsewhere, the latest SNB Sight Deposits continued to show active intervention from the central bank to stem the upside in the Swiss Franc.

Source: DailyFX

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Canadian Dollar Price Forecast: USD/CAD Rise at Risk of Failing” by Paul Robinson, Currency Strategist

“Gold Price Rally Primed For a Fed Boost, Silver Price Struggling” by Nick Cawley, Market Analyst

“CAD Longs Cut, GBP Remains Bearish, JPY Longs Extended - COT Report” by Justin McQueen, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GBP/USD (CABLE) 4Hour Anticipation

Daily wise bearish structure, but as 4H shown shift in structure to the topside

Sterling (GBP) Turnaround on Data Beat and Brexit Commentary - Webinar

After opening the session in negative territory, GBPUSD performed a quick U-turn after UK manufacturing, industrial production and monthly GDP data all beat expectations. And over in Ireland, UK PM Boris Johnson was in a more conciliatory mood.

US Dollar Reversal Continues: EUR/USD, GBP/USD, USD/CAD

The US Dollar came into the holiday-shortened week with a full head of steam. But that's been soundly reversed. Tomorrow brings NFP and Canadian employment.

US Dollar Price Outlook: EUR/USD, GBP/USD, AUD/USD, USD/CAD

It's going to be a big week for the US Dollar and likely US equities as the Jackson Hole Economic Symposium kicks off on Wednesday.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator