简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US CPI Increases in July, Core CPI Now 17 Months Above 2%

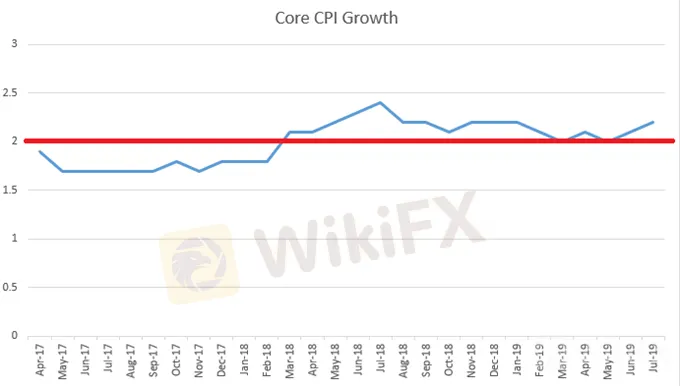

Abstract:Core CPI continues to show a streak of stability, printing at its highest level since January and continuing above the Fed's 2% target.

Talking Points:

US inflation rose last month, with headline CPI printing at 1.8% after last month‘s 1.6% print, and Core CPI printing at 2.2% after last month’s 2.1%.

The Fed cut rates last month for the first time in a decade even as Core CPI remained above target. Will this months pickup in inflation further hamper the Fed from a more aggressive dovish swing later this year?

This morning brought the release of CPI numbers for the month of July out of the Untied States. This release takes place amidst a backdrop of considerable concern as a recent fall in headline inflation has pushed the FOMC away from the hawkish pattern exhibited in 2018 and into a dovish position in 2019. The big question at this point is how dovish the Fed might get in the remainder of this year and markets have already built-in heavy expectations for another cut in September and, likely, another 25 basis points of softening in December.

At the core of this quandary is inflation in the United States. After coming very close to 3% in the summer of last year, headline inflation has experienced a brisk fall as last month produced a 1.6% print. Core inflation, however, stripping out food and energy, has been considerably more stable, with 16 consecutive months above the Feds 2% target. Last month produced a 2.1% print, and this creates a bit of difficulty for a Central Bank expected to move towards a more-aggressive stance of softening.

This morning brought another print above the Feds 2% target, extending the streak in Core CPI to now 17 months above 2%. July Core CPI printed at 2.2%, the highest level since January.

US Core CPI Since January, 2017

Chart prepared by James Stanley

Headline inflation, however, remains a bit less positive. Headline CPI spiked to 2.9% a year ago and this came despite the fact that the Fed was continuing to hike rates. But as the year progressed, inflation slowed and by the time we got to December, headline CPI had already pushed back below the 2% level. This year has so far been marked by more struggle, as February saw CPI fall down to 1.5% and this hasnt pushed back above 2% since.

This morning brought another below-2% print with headline CPI for the month of July coming in at 1.8%, rising from the 1.6% print from last month and beating the expectation for a 1.7% release.

US Headline CPI Since January, 2017

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FBS Joins Two Prestigious Financial Events by the End of 2024

FBS is thrilled to announce our participation in two major financial events in Asia – iFX Expo Asia 2024 and Traders Fair Davao!

FBS IB Program Named the Best Globally

The FBS Partnership Program earned the title of the Best Introducing Broker Programme 2024 from the World Finance Awards.

FBS Ranked Among Top 5 Best Brokers by FXStreet

FBS has been recognized as one of the best Forex brokers in 2024 by FXStreet!

FBS Increases Leverage on U.S. Indices to 1:500

FBS is excited to announce a significant update in trading conditions for our clients: starting from August 5th, 2024, the leverage on major U.S. indices, including US30, US100, and US500, is increased from 1:200 to 1:500.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator