简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD: July Fed Meeting to Spark US Dollar Currency Volatility

Abstract:A major move in USD following the Federal Reserves updated monetary policy stance on Wednesday risks sparking volatility across the currency market.

USD PRICE ACTION TURNS TO JULY FED MEETING

The US Dollar is primed for volatility and will likely be sparked by Wednesdays July Fed meeting

EURUSD and USDJPY 1-week implied volatility readings, although muted, suggest a looming breakout from technical confluence

Register for live webinar coverage of the July Fed Rate Decision hosted by DailyFX Chief Currency Strategist John Kicklighter

The US Dollar looks to take the spotlight as currency traders anxiously await the outcome of the July Fed meeting slated for release Wednesday at 18:00 GMT. A reduction in the federal funds rate has been long priced in, but the size of the expected Fed rate cut remains ambiguous. As such, the July Fed meeting poses a major threat to the US Dollar and stands to spark currency volatility.

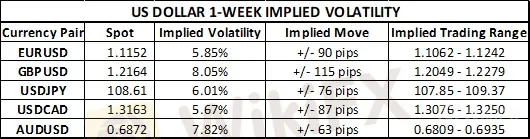

US DOLLAR 1-WEEK IMPLIED VOLATILITY & TRADING RANGE CHART

Interestingly, USD implied volatility measures appear relatively suppressed given the high-impact event risk surrounding the FOMC rate decision. Looking at tenors further out, however, we see that the implied volatility curve is inverted for the major USD pairs and indicates that currency option traders are placing greater emphasizing on the near-term. That said, a major move in USD tomorrow following the Federal Reserves updated monetary policy stance risks sparking volatility across the currency market.

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (OCTOBER 29, 2018 TO JULY 30, 2019)

A violent repricing in lofty Fed rate cut bets (which currently stand at around 75 basis points of easing by year-end) could serve as the catalyst – particularly if Chair Powell communicates a firm outlook and conveys that the move to lower rates at the July Fed meeting was a ‘one-and-done insurance cut.’ This scenario, if confirmed, will likely see the US Dollar extend its stretch of gains and push onward to test year-to-date highs measured via the DXY Index. The potential for a breakout – or breakdown – in the US Dollar is also suggested by the 1-week implied volatility measures for major pairs like EURUSD and USDJPY.

EURUSD PRICE CHART: DAILY TIME FRAME (DECEMBER 21, 2018 TO JULY 30, 2019)

EURUSD 1-week implied volatility of 5.85% results in a 1-standard deviation trading range between 1.1062 and 1.1242. These option-implied upper and lower bounds are outside of the major technical confluence at the 1.11 and 1.12 handles. As such, a major move in spot EURUSD that smashes through these key technical levels could provide evidence of the US Dollars resurgence or a looming reversal in the greenback. In turn, currency volatility stands to rise off the currently subdued readings.

Read more on EURUSD implied volatility here.

USDJPY PRICE CHART: DAILY TIME FRAME (APRIL 22, 2019 TO JULY 30, 2019)

According to USDJPY 1-week implied volatility of 6.01%, the currency pair is calculated to trade between 107.85 and 109.37 with a 68% statistical probability. Similar to the setup in EURUSD, the options-implied trading range in spot USDJPY aligns outside the key levels of technical support and resistance at the 108.00 and 109.00 handles respectively. If spot USDJPY makes a move outside these closely watched levels, currency price action could be exacerbated and stoke additional forex volatility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator