简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Q2 GDP Preview: Slowest Growth Since 2017

Abstract:Growth in the second quarter is expected to have slowed to 1.8%, its lowest figure in two years, as continued trade wars weigh on domestic output, providing the Fed signals it needs for rate cuts.

Talking Points:

谈话要点:

US Q2 GDP is expected to show that the economy is growing at its slowest pace in two years

美国第二季度GDP预计将显示经济增长两年来最慢的步伐

Business demand growth may be a signal of third quarter strength

业务需求增长可能是第三季度实力的信号

Likelihood of Fed cutting rates remains high, even if GDP is better than expected

即使国内生产总值好于预期,美联储降息的可能性仍然很高

Q2 GDP forecasts show that the US economy is likely to have experienced slower growth in the second quarter of the year on the back of continued trade tensions despite consumer spending being firm. It is expected that GDP grew 1.8% in the second quarter, which would be slowest rate of growth since 2017. Despite the figure being in line with periods when growth is slowing, it would be a sharp decline from the 3.1% growth seen at the beginning of 2019 and the worst figure since Donald Trump took office.

第二季度GDP预测显示,尽管消费者支出坚挺,但由于持续的贸易紧张局势,美国经济可能在今年第二季度出现较慢增长。预计第二季度国内生产总值增长1.8%,这将是2017年以来增长最慢的增长率。尽管这一数字与经济增长放缓的时期一致,但仍将从增长率3.1%的增长率大幅下降。自从唐纳德特朗普上任以来,这是自2019年初以来最糟糕的数字。

The period from April to June is likely to have seen an unwinding of stockpiles in response to the various tariff deadlines imposed during that period, bringing down the number of exports and weighing heavily on domestic output.

4月至6月期间可能会出现库存减少以应对各期间征收的各种关税期限。那个时期,减少出口数量,严重影响国内产出。

But figures released on Thursday showed that demand for business equipment increased in the month of June by the biggest amount since early 2018. Orders place in US factories for business equipment jumped 1.9% in June showing that despite trade disruption and tariffs business investment is regaining momentum.

但周四公布的数据显示,6月份商用设备需求增幅最大自2018年初以来,美国工厂的商业设备订单增加了1.9%,显示尽管贸易中断和关税,商业投资正在重新获得动力。

{9}

This carries the potential that the performance in June might have safeguarded growth more than expected, which could see GDP being slightly above expectations. This would see USD regain strength pushing GBPUSD and EURGBP back close to 2017 lows.

{9}

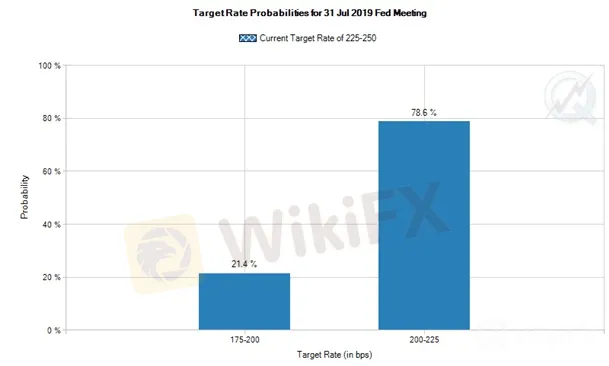

The fall in growth is unlikely to have an impact on the anticipation of a rate cut by the Federal Reserve in the meeting next week, but it will help gauge the health of the US economy and will provide policy makers with the tools to decide on whether more cuts are needed in the future. Despite the likelihood of the Fed cutting rates being high, if Q2 GDP is confirmed to be in line with, or below, expectations we may see a retracement in US equities as they react to a weakening economy, but that would quickly be corrected as a lower growth rate increases the likelihood of a rate cut, a positive sign for equity markets.

增长的下降不太可能对美联储降息的预期产生影响在下周的会议上,它将有助于衡量美国经济的健康状况,并将为政策制定者提供工具,以决定未来是否需要进一步减产。尽管有可能美联储降息率很高,如果确认第二季度国内生产总值符合或低于预期,我们可能会看到美国股市的回撤,因为它们对经济疲软做出反应,但随着经济增长率下降,这种情况很快就会得到纠正降息的可能性,股市的正面信号。

Source: CME Group

来源:CME Group

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

Today's analysis: USDJPY Poised for Decline Despite Recent Upsurge; Mixed BOJ Signals

Bank of Japan board members are divided on rate hikes due to high living costs and price risks. Some urge caution, while others push for early action. The BoJ will closely monitor data ahead of potential interest rate adjustments. USD/JPY rallied past 158.40 to 159.00, maintaining a bullish trend towards the next target of 160.20.

US GDP slumped 4.8% in the first quarter, ending the longest economic expansion on record - Business Insider

The sharp contraction in gross domestic product reflects the swift impact of the coronavirus pandemic on the US economy.

Silver Price Breakout Begins as US Treasury Yields Drop to Multi-year Lows

An environment defined by plummeting US Treasury yields and a weak US Dollar has historically been very bullish for silver prices.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

Currency Calculator