简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

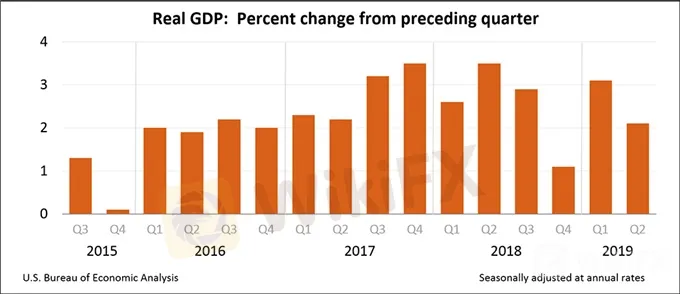

US Q2 GDP Stronger Than Expected, US Dollar Continues to Rally

Abstract:The first look at US Q2 GDP beat market expectations with ease and further boosted the US dollar ahead of next weeks highly anticipated FOMC rate decision.

US Q2 GDP and Dollar Price, Chart and Analysis:

美国第二季度GDP与美元价格,图表与分析:

{1}

US Q2 GDP beats to the upside.

{1}

Attention now turns to next weeks docket including the FOMC monetary policy meeting.

现在注意力转向包括FOMC货币政策会议在内的下周报告。

Q3 2019 USD Forecast andTop Trading Opportunities

Q3 2019年美元预测和顶部交易机会

The advanced US Q2 GDP (annualized) fell to 2.1% from 3.1% in Q1 2019 but beat market expectations of 1.8%. According to the Bureau of Economic Analysis (BEA),

美国第二季度GDP(年化)从2019年第一季度的3.1%降至2.1%,但高于市场预期的1.8%。根据经济分析局(BEA),

“The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, nonresidential fixed investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. The deceleration in real GDP in the second quarter reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.”

“第二季度实际国内生产总值的增长反映了个人消费支出(PCE),联邦政府支出和国家和地方政府支出部分被私人存货投资,出口,非住宅固定投资和住宅固定投资的负面贡献所抵消。进口是GDP计算的减法,增加了。第二季度实际GDP的减速反映了库存投资,出口和非住宅固定投资的下滑。这些经济衰退部分被PCE和联邦政府支出的加速所抵消。”

The US dollar basket (DXY) pushed marginally higher post-release, continuing its recent rally and taking it back towards its 27-month high of 97.86 made on May 23 this year.

美元篮子(DXY)后期小幅走高释放,继续其近期的反弹,并将其重新回到今年5月23日创下的27个月高点97.86。

US Dollar Daily Chart (December 2018 – July 26, 2019)

美元日报图表(2018年12月 - 2019年7月26日) )

Busy Week of Heavyweight US Data and Events Ahead

繁忙的美国重量级数据和活动周

A quick look at the economic calendar shows a raft of market-moving events and data releases next week which should keep US dollar traders busy. While Wednesdays FOMC meeting is the main course – with a 0.25% interest rate cut now fully priced-in - inflation data on Tuesday and the latest Labor market report (NFP) on Friday will also give traders a much better picture of the underlying health of the US economy.

快速浏览一下经济日历显示下周将有大量市场动向事件和数据公布,这将使美元交易商保持不变年。虽然周三FOMC会议是主要方向 - 周二通货膨胀率下降0.25%,周二通胀数据以及周五最新的劳动力市场报告(NFP)也将使交易者更好地了解其基本健康状况。美国经济。

{10}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 16 August: USD/JPY Forecast: Short-Term Bearish Trend Amid Dollar Consolidation

This year's arbitrage gains have been erased, with 65%-75% of these positions closed. The dollar's reaction has been as expected but slightly disappointing, with a significant 100 basis point rise in U.S. short-term interest rates impacting it. JPMorgan has reduced its dollar forecasts, now predicting USD/JPY at $146 in Q4 2024 and $144 in Q2 2025, down from $147. Despite a weakening job market, other economic data remains strong.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

Today's analysis: The Federal Reserve's interest rate decision is approaching, putting downward pressure on gold prices.

The Federal Reserve is expected to keep interest rates unchanged, which could support the US dollar and pressure gold prices if a hawkish stance is taken. Gold prices continue to decline after breaking an upward wedge pattern, with a key support level at $2250. The 14-day RSI indicates further potential decline unless prices recover above the 50-day and 21-day moving averages.

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator