简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR Softer Ahead of ECB, IFO Figures Continue to Show Weakness

Abstract:EURUSD heads towards two-year lows as weakening data from Germany continues to fuel concerns about the growth of the Eurozone. ECB likely to restart QE cementing the case for a rate cut in September.

Talking Points:

Weaker IFO figures reinforce a slowing German economy suggested by weaker than expected PMIs

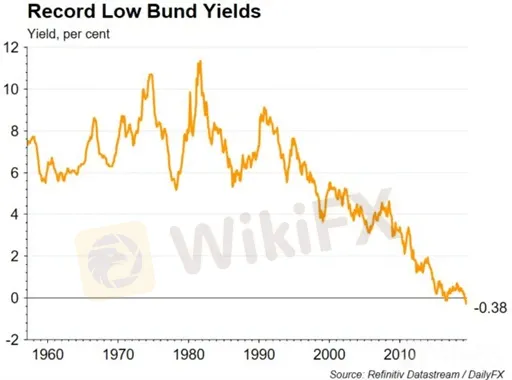

German bond yields at their lowest level on record as investor expectations worsen

EURUSD continues to head towards two-year lows of 1.1076 ahead of ECB rate decision meeting

Join our analyst Nick Cawley for live coverage of the ECB rate decision meeting at 1130 GMT

The Eurozone continues to show weakness as business confidence in Germany suffers another blow. The common currency was feeling the heat of the rate decision this morning as it traded lower against most G10 currencies.

EURUSD May Break Through Critical Support After ECB Rate Decision

EURUSD was trading mostly unchanged heading into the European open but the Euro bears managed to regain control and pushed the pair close to the 1.1128 support line in anticipation of German IFO figures to be released, ahead of the ECB rate decision meeting. EURGBP was losing some of the gains it had been steadily making since the beginning of May, but this was partly due to a rebound in sterling (GBP) as traders continue to digest the news about Boris Johnsons election as PM. The pair was trading at month-lows of 0.8920 at the start of the session.

Business climate in Germany for the month of July was 95.7 well below expectations of 97.0, and down from the previous months figure of 97.4. Current sentiment continues to show weakness in the Germany economy falling below 100 to 99.4, whilst future expectations were down to 95.7. These lacklustre figures come on the back of weakening PMI figures released yesterday, where manufacturing PMI continued to fall further below the 50 line, falling two points from 45.0 to 43.1, hitting an 84-month low amidst fears that slowing growth and trade disruption could push the country into a recession. The economic boom seen in the last ten years has come to an end leading into a sideways movement that could result in a downturn.

German Bund yields are trading at their lowest level ever, with the latest round of 10-year bonds offering a yield of minus 0.38%, down from minus 0.24% in June. The lowering yields come amid fears of a global economic slowdown which has been pushing prices of highly rated bonds higher, meaning that investors who purchase these bonds and hold them to maturity are likely to make a loss. Bond prices have been soaring in the last few months on the back of expectations that the ECB would reintroduce monetary stimulus coupled with a host of negative data from Germany, which has kept bond yields heading lower.

All four PMIs across the Eurozone failed to reach expectations, signalling one of the weakest expansions in recent years, and giving up the mild gains seen in the month of June. The case for a rate cut from the ECB is strengthening but it is unlikely that a cut will come in todays meeting, with expectations that Mario Draghi will announce the terms of a new round of QE, cementing the basis for a 10 bps cut to come in September if economic conditions do not improve.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GemForex - weekly analysis

The Week Ahead: Will the FED pivot to the emerging dynamics?

GemForex - weekly analysis

European Central Bank under enormous pressure ahead of Fed rates

GemForex - EUR/USD

EURUSD Forecast: Vulnerability ahead of fresh EZ economic data, FOMC

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator