简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Outlook: Volatility Begins to Awaken as Brexit Risks are Priced In

Abstract:GBPUSD Outlook: Volatility Begins to Awaken as Brexit Risks are Priced In

Currency Volatility GBP Talking Point

货币波动英镑谈话点

GBP Volatility is Coming Back

英镑波动性正在回升

GBP is the Clearest Way to Trade Brexit Risks

英镑是交易英国脱欧风险最清晰的方式

GBP Volatility Will Come Back, Options Beginning to Price in Brexit Risks

波动性将回归,英国退欧风险选择开始降价

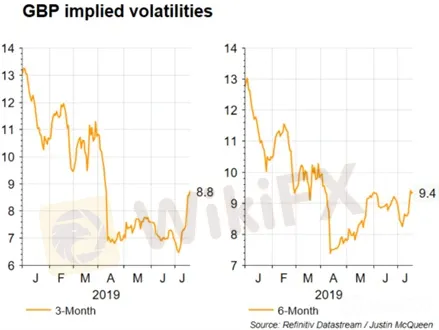

Since the Brexit extension from the end of March to October 31st, implied volatility in the Pound had crashed to near 5-yr lows. However, with Boris Johnson likely to be announced as Prime Minister next, expectations are now for a tougher Brexit stance between the UK and EU. In turn, demand for options is beginning to rise as investors begin to price in Brexit risks ahead of the October deadline. This has been observed in the rise in premium for 3-month options, which suggests that the market is expecting the Pound to be increasingly volatile in the run up to the October deadline and will likely continue to increase as the tenor covers the exit date. Since the lows in July, implied vols have jumped over 2 vols from 6.475 to 8.85, which marks a 36% increase in the price in 11-days. However, this does remain heavily below highs of 15 vols ahead of the first deadline.

自3月底至10月31日英国脱欧延期以来,英镑的隐含波动已经崩溃至接近5年的低点。然而,由于鲍里斯·约翰逊可能会被宣布为下一任总理,现在对英国和欧盟之间更加严格的英国脱欧立场抱有期望。反过来,随着投资者在10月截止日期前开始对英国脱欧风险定价,对期权的需求开始上升。 3个月期权的溢价上升已经观察到这一点,这表明市场预期英镑在10月截止日期前会变得越来越不稳定,并且随着期限涵盖退出日期,可能会继续增加。自7月份的低点以来,隐含的价格已从6.475上涨至8.85,从而在11天内价格上涨了36%。但是,在第一个截止日期之前,这仍然远远低于15个高点。

Source: Thomson Reuters, DailyFX: Sterling (GBP) 3-6-month option implied volatility.

来源:汤森路透,DailyFX:英镑(英镑) )3-6个月期权隐含波动率。

GBPUSD Has Been the Cleanest Way to Trade Brexit Risks

英镑兑美元一直是交易英国退欧风险最清洁的方式

Since the UK referendum sentiment regarding Brexit has been expressed most clearly through trading GBP, which since the peak in May has been dropped over 5%. Of course, this has not solely been down to Brexit, factors have included a dovish shift from BoE Governor Carney, alongside weak economic data, prompting GBPUSD to fall to a fresh 27month low having briefly dipped below 1.24.

} 由于英国对英国脱欧的公投情绪表达最明显gh交易英镑,自5月份的峰值以来已下跌超过5%。当然,这并不仅仅取决于英国脱欧,其中包括英国央行行长卡尼的温和转变以及疲弱的经济数据,促使英镑兑美元跌至新的27个月低位,短暂跌破1.24。

How are Markets Positioned for GBP?

市场如何定位英镑?

Given the factors mentioned above and with the Brexit noise beginning to increase once Boris Johnson is announced as the next Prime Minister, risks continue to remain tilted to the downside for GBP. This has also been reflected in speculative positioning, which shows that markets hold sizeable net shorts in GBPUSD (-29.5%). However, while shorts maybe at 2019 highs, this is still some way off highs in 2018 (-34.5%) and the record high in 2017 (-43.4%), suggesting that current levels are not extreme, thus there is room for speculators to add to their bearish positions.

考虑到上述因素和一旦鲍里斯·约翰逊被宣布为下一任首相,英国退欧噪音开始增加,风险继续倾向于英镑下行。这也反映在投机性定位中,这表明市场在英镑兑美元(-29.5%)中持有相当大的净空头。然而,虽然空头可能在2019年的高点,但仍然有点偏离2018年的高位(-34.5%)和2017年的历史高点(-43.4%),这表明目前的水平并非极端,因此投机者有空间增加他们看跌的头寸。

Source: Thomson Reuters, DailyFX

来源:汤森路透,DailyFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

British Pound Technical Analysis - GBP/USD, EUR/GBP

BRITISH POUND, GBP/USD, EUR/GBP - TALKING POINTS

US Dollar Flexes Against British Pound Ahead of the Fed and BoE. Where to for GBP/USD?

US DOLLAR, BRITISH POUND, GBP/USD, BOE, FED,CHINA, AUD/USD - TALKING POINTS

British Pound (GBP) Price Outlook: GBP/USD Falling Ahead of BoE, Fed Meetings

GBP/USD PRICE, NEWS AND ANALYSIS:

GBP/USD Under Pressure as USD Outperforms - Fed, BOE and Brexit Loom

TALKING POINTS:

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator