简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Drops as Italy Risks Snap Elections, USDCAD Spikes - US Market Open

Abstract:EURUSD Drops as Italy Risks Snap Elections, USDCAD Spikes - US Market Open

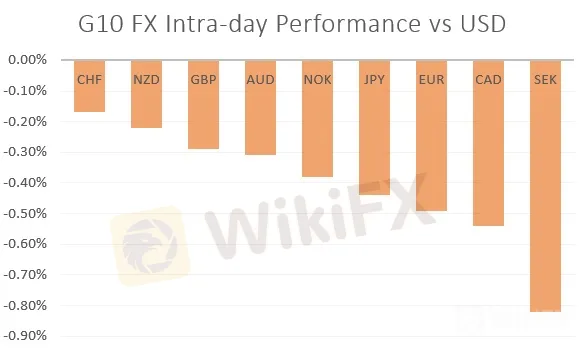

MARKET DEVELOPMENT – EURUSD Drops as Italy Risks Facing Snap Elections, USDCAD Spikes

市场发展 - 随着意大利风险面临快攻选举,美元兑美元下跌,美元兑加元飙升

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

EUR: A recovery in the US Dollar after Fed‘s Williams faux pas had been clarified, has weighed on the Euro, which is once again back towards the low 1.12s. Overnight, comments from Fed’s Williams had led to a surge in bets for a 50bps rate cut, however, this had later been clarified by a spokesperson, noting that this was not in relation to the upcoming meeting, thus sparking a pullback in 50bps cut expectations. Keep in mind as well that the most dovish FOMC member, Bullard, had previously stated that a 50bps cut would be somewhat overdone.

欧元:在美联储威廉姆斯失败后,美元出现回升,已经打压欧元,再次回到1.12的低位。一夜之间,美联储威廉姆斯的言论引发了降息50个基点的赌注激增,但后来发言人澄清了这一点,并指出这与即将举行的会议无关,因此引发了50个基点削减预期的回落。请记住,最温和的联邦公开市场委员会成员布拉德此前曾表示,50比特的削减幅度有点过头了。

Aside from the communication error at the Fed, Italian risks are once again plaguing the market with the FTSE MIB notably underperforming as tensions rise between the League and 5 Star Party. Yesterday, both parties had stated that the coalition were at risk of breaking, consequently raising the prospect of a snap election. Bund-BTP spreads are modestly wider this morning, keeping the Euro on the backfoot, most notably against the Swiss Franc.

除了美联储的沟通错误,意大利风险由于联盟和五星党之间的紧张局势升级,富时MIB再次困扰市场。昨天,双方都表示联盟有破裂的风险,从而提高了大选的可能性。 Bund-BTP利差在今天上午略微扩大,使欧元保持在后脚,最显着的是兑瑞士法郎。

CAD: The Canadian Dollar fell to fresh weekly lows following soft retail sales (-0.1% vs. Exp. 0.3%), which had also coincided with soft oil prices. However, the Loonie has since pulled off worse levels amid offers at 1.31.

加元:加元在软零售后跌至新的每周低点销售额(-0.1%对比实际增长0.3%),这也与油价疲软同时发生。然而,Loonie在1.31的报价中已经下挫。

{7}

Source: DailyFX, Thomson Reuters

{7}

IG Client Sentiment

IG客户端情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GemForex - weekly analysis

The Week Ahead: Will the FED pivot to the emerging dynamics?

GemForex - weekly analysis

European Central Bank under enormous pressure ahead of Fed rates

GemForex - EUR/USD

EURUSD Forecast: Vulnerability ahead of fresh EZ economic data, FOMC

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator