简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/CAD Currency Volatility: Canadian Dollar Eyes BOC Rate Review

Abstract:The Bank of Canada threatens to jolt currency volatility with its July monetary policy update if the central bank fails to confirm the market's relatively hawkish expectations.

USD/CAD, EUR/CAD, CAD/JPY HIGHLIGHTED BY JULY BANK OF CANADA MEETING

Canadian Dollar (CAD) implied volatility measures appear muted headed into Wednesdays monetary policy update from the Bank of Canada (BOC) at 14:00 GMT

The BOC is largely expected to leave rates unchanged the rest of this year

Forex traders remain net-long spot USD/CAD according to IG Client Sentiment

Reserve your spot for free live webinar coverage of the Bank of Canada Rate Decision

Canadian Dollar price action could be stirred on Wednesday‘s trading session as currency traders react to the high-impact July BOC meeting. Although market participants are near-certain that Canada’s central bank will leave rates on hold tomorrow according to overnight index swaps, the BOCs updated monetary policy statement and follow-up commentary from Governor Stephen Poloz might jolt the loonie.

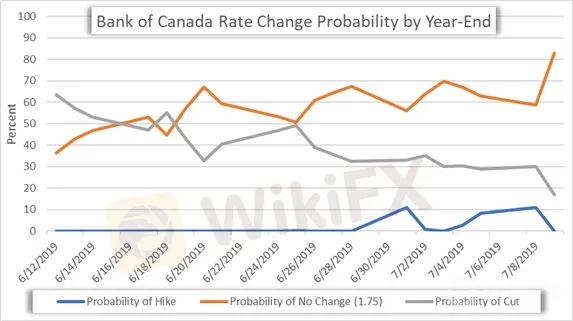

BANK OF CANADA RATE CHANGE PROBABILITY CHART: DAILY TIME FRAME (JUNE 12, 2019 TO JULY 09, 2019)

Over the last 20 trading days, rate traders more than halved their expectations that the Bank of Canada will lower its policy interest rate by at least 25 basis points before year-end. In fact, futures were pricing in a 63.6 percent probability that the BOC would cut rates by its December 4 meeting on June 12, but odds currently stand at 17.1 percent.

CANADA ECONOMIC SURPRISE INDEX (CITI): DAILY TIME FRAME (JANUARY 04, 2016 TO JULY 09, 2019)

The sharp shift in rate change expectations has been largely driven by improving fundamentals throughout the Canadian economy and is also reflected by the steep climb in the Citi Economic Surprise Index for Canada. The recent string of better-than-expected data since early May has kept the Canadian Dollar bid – particularly in response to the countrys latest inflation report and business outlook survey.

Although, it is expected that the overarching message from Canada‘s central bank will be echoed once again tomorrow and confirm the market’s expectation that rates will be left unchanged. The BOCs Governing Council most recently stated that future policy decisions “will remain data dependent and especially attentive to developments in household spending, oil markets and the global trade environment.” Yet, forward guidance hinted at by Governor Poloz on Wednesday risks stirring additional volatility in the best performing G10 currency.

USD/CAD PRICE CHART: DAILY TIME FRAME (MAY 15, 2019 TO JULY 09, 2019)

USD/CAD selling pressure has ebbed since the beginning of July as suggested by the currency pairs Relative Strength Index (RSI) rebounding off oversold territory, but the loonie threatens to strongarm price action lower if an upbeat message is revealed by the BOC tomorrow. Although, downside in spot USD/CAD could be limited by technical support from the 8-day EMA and psychologically-important 1.31 handle. Furthermore, the lower bound of the options-derived trading range of 1.3085, as calculated from USD/CAD overnight implied volatility of 5.60 percent, and the short-term bullish trendline both look to keep spot USD/CAD bid.

Looking to spot USD/CAD upside, technical resistance is posed by the negative sloping 34-day EMA. Upside might also be hindered by the 23.6 percent Fibonacci retracement of the currency pairs recent leg lower – a major level of confluence which happens to align almost perfectly with the 1-standard deviation implied upper bound of 1.3161 calculated from USD/CAD overnight implied volatility.

Correspondingly, it is worth mentioning that USD/CAD implied volatility could be underpriced by markets considering major event risk surrounding the US Dollar (namely Fed Chair Powells testimony to congress and the June FOMC minutes release both slated for tomorrow) threatens to exacerbate – or reverse – spot price swings.

EUR/CAD PRICE CHART: 4-HOUR TIME FRAME (JUNE 20, 2019 TO JULY 09, 2019)

The downtrend in spot EUR/CAD could easily continue if Poloz and the BOC reiterate a firm stance on monetary policy, which might inspire bears to target its year-to-date low of 1.4636 – the currency pairs lowest level since October 2017. Although, downside could be mired by the fact that the vast majority of bearish prospects regarding EUR/CAD appear largely priced in already.

That said, spot EUR/CAD is estimated to trade between 1.4669 and 1.4762 over the next 24-hours with a 68 percent statistical probability judging by EUR/CAD overnight implied volatility of 6.00 percent. Before targeting the upper bound of the options implied band around spot prices, EUR/CAD bulls will first have to overcome technical resistance stemming from the 23.6 percent Fibonacci retracement of the currency pairs trading range since June 24.

CAD/JPY PRICE CHART: DAILY TIME FRAME (FEBRUARY 18, 2019 TO JULY 09, 2019)

Spot CAD/JPY is estimated to fluctuate between 82.606-83.321 for Wednesday‘s trading session with a 68 percent statistical probability judging by CAD/JPY overnight implied volatility of 8.23 percent. Upside in CAD/JPY looks to be limited by technical resistance near the 23.6 percent Fib retracement of the currency pair’s year-to-date trading range whereas downside could be limited by the rising 8-day EMA and bullish uptrend support.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Japanese Yen Technical Analysis: EUR/JPY, CAD/JPY. What Happened to Momentum?

JAPANESE YEN, EUR/JPY, CAD/JPY - TALKING POINTS AND ANALYSIS

FX Week Ahead - Top 5 Events: August Canada Inflation Report & USD/CAD Rate Forecast

The August Canada inflation report (consumer price index) is due on Wednesday, September 18 at 12:30 GMT.

US Dollar Price Volatility Outlook: Data & Fed Cuts in Focus

US Dollar currency volatility eyes the barrage of high-impact economic data releases slated for Thursday and how it might sway Fed rate cut expectations.

USD/CAD: Canadian Dollar Ripe for Breakout but GDP Data Looms

The Canadian Dollar sits in currency trader's crosshairs with the loonie looking geared up for a technical breakout. Friday's GDP data could potentially serve as the catalyst that fuels CAD's next move.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator