简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Q3 Forecast: Gold Outlook Bullish on Imminent Fed Rate Cut

Abstract:Gold took out the 2014 high ($1392) after the Federal Reserve altered the forward guidance for monetary policy.

Gold took out the 2014 high ($1392) after the Federal Reserve altered the forward guidance for monetary policy, and the price for bullion may continue to benefit from the current environment as the central bank appears to be on track to switch gears over the coming months.

在美联储改变货币政策的远期指引后,黄金拿走了2014年的高点(1392美元),黄金的价格可能继续受益于当前环境因为中央银行似乎有望在未来几个月内转向。

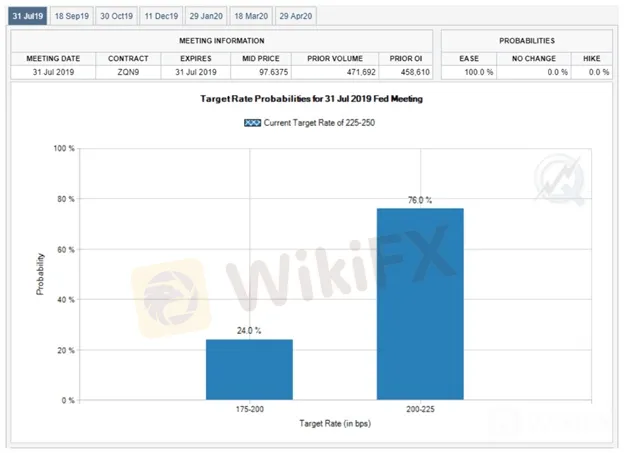

July Fed Meeting Interest Rate Probabilities

7月美联储会议利率概率

In fact, Fed Fund futures now highlight 100% probability for at least a 25bp rate cut at the next rate decision on July 31. The central bank may show a greater willingness to establish a rate easing cycle as the dot-plot shows the benchmark interest rate narrowing to 1.75% to 2.00% by the end of 2019.

事实上,美联储基金期货现在强调在7月31日的下一次利率决定中至少降息25个基点的概率为100%。央行可能表现出更大的意愿来建立利率宽松政策周期点图显示到2019年底基准利率收窄至1.75%至2.00%。

Gold prices are testing big resistance into the final week of June trade and while the broader focus is higher in XAU/USD, look for a larger pullback early next quarter to offer more favorable entries while above 1319. Ultimately, were targeting fresh yearly highs above 1400 in the second quarter before a larger correction.

黄金价格正在测试6月交易最后一周的大阻力,而XAU / USD的更广泛关注点更高下个季度初期会有更大的回调,在1319以上时提供更多有利的参与。最终,在更大的修正之前,第二季度将目标定位在1400以上的年度新高。

To read the full Gold Price Forecast, download the free guide from the DailyFX Trading Guides page

Gold Price Weekly Chart

黄金价格每周图表

Chart prepared by Michael Boutros

由Michael Boutros编写的图表

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The U.S. dollar index and U.S. Treasury yields rebounded at the same time; gold fell by more than 1%!

The initial value of the US S&P Global Manufacturing PMI in August was 48, which was lower than expected and the lowest in 8 months; the service PMI was 55.2, which exceeded the expected 54. The number of initial jobless claims in the week ending August 17 was 232,000, slightly higher than expected, and the previous value was revised from 227,000 to 228,000. Existing home sales in July increased for the first time in five months. The PMI data was lower than expected, which was bad for the US eco

The U.S. dollar index returned to the 103 mark; gold once plunged nearly $40 from its intraday high!

The monthly rate of retail sales in the United States in July was 1%, far exceeding expectations; the number of initial claims last week was slightly lower than expected, falling to the lowest level since July; traders cut their expectations of a rate cut by the Federal Reserve, and interest rate futures priced that the Federal Reserve would reduce the rate cut to 93 basis points this year. The probability of a 50 basis point rate cut in September fell to 27%. The data broke the expectation of a

Gold Price Stimulates by Geopolitical Tension

Gold prices experienced their largest gain in three weeks, driven by escalating tensions in the Middle East and the easing of the U.S. dollar as markets await the crucial CPI reading due on Wednesday. Gold has surged to an all-time high above $2,460, as uncertainties surrounding developments in both the Middle East and Eastern Europe persist push the demand for safe-haven assets higher.

KVB Today's Analysis: USD/JPY Eyes Volatility Ahead of BoJ Policy Meeting and US Data

The USD/JPY pair rises to 154.35 during the Asian session as the Yen strengthens against the Dollar for the fourth consecutive session, nearing a 12-week high. This is due to traders unwinding carry trades ahead of the Bank of Japan's expected rate hike and bond purchase tapering. Recent strong US PMI data supports the Federal Reserve's restrictive policy. Investors await US GDP and PCE inflation data, indicating potential volatility ahead of key central bank events.

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator