简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Braces for German ZEW Survey, Commentary from ECB and Draghi

Abstract:EURUSD may fall if German ZEW data underperforms and commentary from ECB officials continues to underscore a need to introduce more Eurozone stimulus.

TALKING POINTS – GERMAN ZEW SUREVEY, ECB, MARIO DRAGHI, BOE, MARK CARNEY

谈话要点 - 德语ZEW SUREVEY,ECB,MARIO DRAGHI,BOE,MARK CARNEY

ECB officials consider more Eurozone stimulus if outlook worsens

如果前景恶化,欧洲央行官员会考虑更多的欧元区刺激措施

EURUSD may suffer if commentary carries pessimistic undertones

如果评论带有悲观的影响,欧元兑美元可能会受到影响

The German ZEW survey will be closely watched as growth slows

德国ZEW调查将受到密切关注,因为增长放缓

EURUSD may suffer if ECB officials continue to strike pessimistic undertones regarding future growth and inflationary prospects in the Eurozone. Central Bank President Mario Draghi will be speaking at the annual symposium in Sintra, Portugal shortly before German ZEW survey data is released. Following the publication, BoE Governor Mark Carney and Draghi will both be speaking on a policy panel.

如果欧洲央行官员继续对欧元区未来增长和通胀前景持悲观态度,欧元兑美元可能会受到影响。在德国ZEW调查数据公布之前不久,央行行长马里奥·德拉吉将在葡萄牙辛特拉举行的年度研讨会上发言。在出版之后,英国央行行长马克卡尼和德拉吉都将在政策小组发言。

The previous day‘s comments alluded to the ECB’s willingness to step in if necessary to provide stimulatory measures to boost inflation and local economic activity. These policies could include cutting rates even further and even the possibility of re-introducing Quantitative Easing. This comes as trade tensions continue to escalate while the probability of a hard Brexit is looking increasingly likely.

前一天的评论暗示欧洲央行愿意在必要时提供促进通胀和当地经济活动的刺激措施。这些政策可能包括进一步降低利率,甚至可能重新引入量化宽松。这是因为贸易紧张局势继续升级,而英国退欧的可能性越来越大。

Feeling lost on Brexit?See our infographic timeline!

英国脱欧感到失落?我们的信息图表时间表!

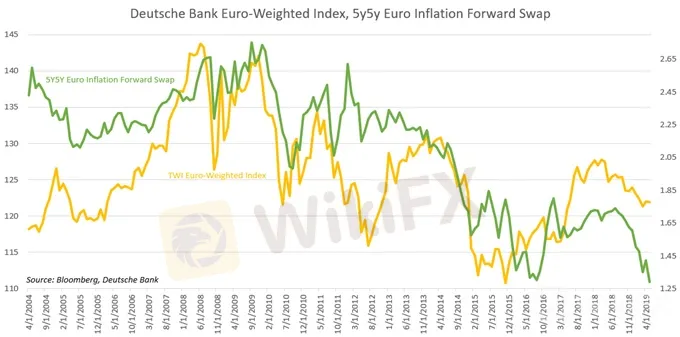

The outcome of the German ZEW survey may amplify pessimistic undertones from monetary authorities if the data falls in-line with policymakers fundamental assessment. The current expectations are for a reading of -5.6 which is significantly lower than the previous -2.1 publication. Eurozone inflation expectations are looking grim, with the 5Y5Y Euro inflation swap forward reaching an all-time low at 1.2910.

德国ZEW调查的结果可能会放大货币当局的悲观情绪,如果数据符合政策制定者的基本评估。目前预期的读数为-5.6,远低于之前的-2.1出版物。欧元区通胀预期看起来严峻,5Y5Y欧元通胀掉期达到历史最低点1.2910。

The EU is also in the midst of negotiating a trade deal with Brazil, which if passed will be the largest trade deal ever negotiated by the EU in regard to the number of tariff reductions. As the US deviates from its role as the chief broker in global trade, Europe is taking up the mantle and is negotiating a trade deal with Latin Americas largest economy. As Brazil slowly opens its economy to the world, the US practices protectionism.

欧盟也正在与巴西达成贸易协议谈判如果通过,将是欧盟就关税削减数量谈判达成的最大贸易协议。由于美国偏离其作为首席经纪人的角色在全球贸易方面,欧洲正在与拉丁美洲最大经济体达成贸易协议。随着巴西向世界缓慢开放经济,美国实行保护主义。

Furthermore, escalating tensions in Iran may translate to cross-Atlantic hostility between the Washington and Brussels. The divergence in policy toward Iran continues to be a lingering risk that could end up becoming part of the terms in reaching an EU-US trade agreement. Compromise – or what some might see as capitulation – from either side is not likely, leading to greater fears of a revived trade war in a slowing global economy.

此外,伊朗紧张局势升级可能转化为华盛顿与布鲁塞尔之间的跨大西洋敌意。对伊朗政策的分歧仍然是一种挥之不去的风险,最终可能成为达成欧盟 - 美国贸易协定条款的一部分。在任何一方都不可能妥协 - 或者有些人可能认为是投降 - 导致对全球经济放缓的复苏贸易战的担忧。

CHART OF THE DAY: EURO 5Y5Y INFLATION FORWARD SWAP PLUNGES ALONGSIDE EURO-WEIGHTED INDEX

一天的情节: EURO 5Y5Y在欧元加权指数附近的通货膨胀转发

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

EUR/USD is mixed to bearish, influenced by resistance levels and upcoming data. GBP/USD is bullish with the pound at four-month highs on positive UK data and hawkish BoE comments. EUR/GBP remains volatile, reflecting diverging economic conditions in the Eurozone and the UK.

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

European trading is subdued due to the U.S. holiday, with the euro benefiting from weak U.S. data. The pound rises ahead of the UK election, supported by market sentiment. ECB President Christine Lagarde's comments on interest rates support the euro. Overall, mixed sentiment prevails with cautious trading expected. Key economic events include Eurozone retail sales, Germany's industrial production, and UK services PMI.

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator