简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

Abstract:European trading is subdued due to the U.S. holiday, with the euro benefiting from weak U.S. data. The pound rises ahead of the UK election, supported by market sentiment. ECB President Christine Lagarde's comments on interest rates support the euro. Overall, mixed sentiment prevails with cautious trading expected. Key economic events include Eurozone retail sales, Germany's industrial production, and UK services PMI.

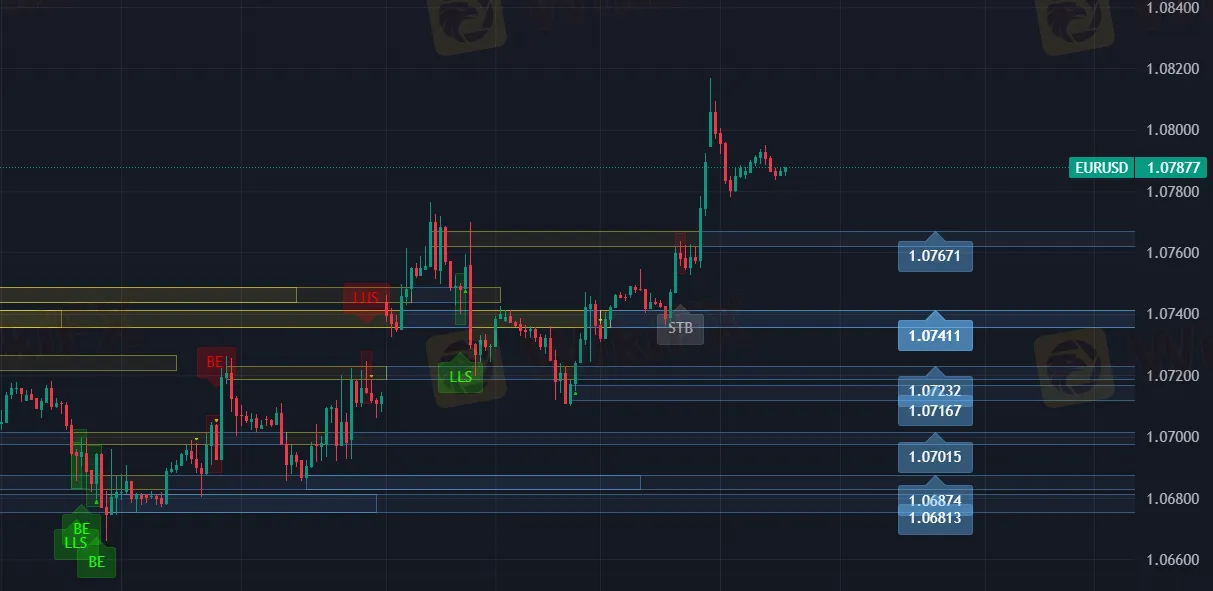

EUR/USD 1H Chart

GBP/USD 1H Chart

EUR/GBP 1H Chart

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

Key Support Levels:

EUR/USD:1.07671

GBP/USD:1.27362

EUR/GBP:0.84956

Key Resistance Levels:

EUR/USD:1.08320

GBP/USD:1.28027

EUR/GBP:0.84403

Summary:

Trading activity in the European session is expected to be dampened due to the U.S. holiday, leading to subdued market movements. The euro has capitalized on the dollar's weakness, driven by underwhelming U.S. data. In the UK, the pound has reached a 3-week high, bolstered by positive sentiment and market positioning ahead of the upcoming UK election. ECB President Christine Lagarde's comments suggest that near-zero interest rates are unlikely to return, providing a supportive backdrop for the euro. However, FX options indicate cautious market outlooks amid geopolitical and economic uncertainties.

Overall Sentiment:

Mixed, with the euro gaining on dollar weakness and the pound supported by election optimism, while geopolitical and economic concerns introduce caution.

Key Influences:

U.S. Data:Weak economic data from the U.S. weakening the dollar, benefiting the euro.

UK Election:Positive sentiment and positioning ahead of the UK election supporting the pound.

ECB Stance:Christine Lagarde's comments on interest rates providing support for the euro.

Geopolitical Factors:Ongoing uncertainties impacting market sentiment.

Potential Movement:

EUR/USD, GBP/USD, and EUR/GBP are expected to see cautious trading with potential upside for the euro and the pound, contingent on further economic data and geopolitical developments.

Important Economic Calendar Events for Europe

Eurozone Retail Sales (YoY) (May)– July 5, 2024: Measures the change in the total value of inflation-adjusted sales at the retail level.

Impact:Higher-than-expected sales could strengthen EUR as it indicates consumer spending strength. Lower-than-expected sales could weaken EUR due to concerns about consumer confidence.

Germany Industrial Production (MoM) (May)– July 5, 2024: Measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

Impact:Higher-than-expected production could strengthen EUR as it indicates industrial growth. Lower-than-expected production could weaken EUR due to concerns about industrial activity.

UK Services PMI (Jun)– July 5, 2024: Reflects the activity level of purchasing managers in the services sector.

Impact:Higher-than-expected PMI could strengthen GBP as it indicates strong services activity. Lower-than-expected PMI could weaken GBP due to concerns about services sector slowdown.

Eurozone Sentix Investor Confidence (Jul)– July 7, 2024: Measures the level of investor confidence in the Eurozone.

Impact:Higher-than-expected confidence could strengthen EUR as it indicates positive investor sentiment. Lower-than-expected confidence could weaken EUR due to concerns about economic outlook.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator