简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ZAR Plummets on Shocking Q1 GDP, Mexican Peso Rises, RBA Cuts Rates - US Market Open

Abstract:ZAR Plummets on Shocking Q1 GDP, Mexican Peso Rises, RBA Cuts Rates - US Market Open

MARKET DEVELOPMENT – ZAR Plummets on Shocking GDP, while MXN Gains on Trade Optimism

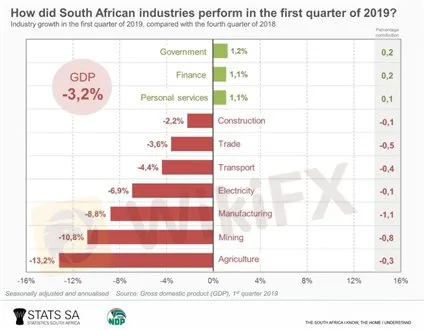

DailyFX Q2 2019 FX Trading ForecastsZAR: The South African Rand under significant pressure this morning after Q1 GDP showed the largest contraction since 2009, falling 3.2% vs Exp. -1.7%. In turn, this has raised the likelihood that South Africa is heading back into a recession. Alongside this, the ZAR saw another round of selling as the ANC stated that the party executive had agreed to expand the central banks mandate to include growth and employment, while also directing the government to consider constituting a task team to explore QE measures. As such, with the unemployment rate near 15yr highs and with GDP seeing the biggest contraction in a decade, interest rates appear to be heading lower. USDZAR eyes a test of resistance at 14.80.

AUD: RBA cut rates to 1.25% as expected, while RBA Governor Lowe had also signalled that rates could go lower, which had also been priced by money markets. As such, the Aussie saw a slight short squeeze, given that market pricing for the RBA had been very dovish with markets looking for a many as three rate cuts by the year-end (COT shows AUD Shorts highest since 2015). Elsewhere, eyes will be on tonights GDP report, whereby risks are tilted to the downside.

MXN: The Mexican Peso is on the front foot following optimistic comments from the Mexican President in which he stated there could be a deal before June 10th (the start date for Mexican tariffs). However, it remains to be seen whether the US also share this optimism.

GBP: The Pound has been holding up relatively well this morning as EURGBP fails to make a convincing break above 0.89. However, GBP remains fragile given the political environment, while UK data has also been heading south with the latest Construction PMI moving back into contractionary territory. Focus on tomorrows Services PMI, in which a move below 50 could see GBP on the backfoot.

Source: DailyFX, Thomson Reuters

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

{12}

“Sterling (GBP) Week Ahead: Risk, Brexit, NFPs and Flashing Signals” by Nick Cawley, Market Analyst

{12}{13}

“Crude Oil Bulls Exit, Copper and Silver Downtrend Persist - COT Report” by Justin McQueen, Market Analyst

{13}

“S&P 500 and Dow Jones Weakness Failing to Result In a VIX ‘Event’” by Paul Robinson, Currency Strategist

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

{18}

Follow Justin on Twitter @JMcQueenFX

{18}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Currency Calculator