简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NOK Traders Eye Norway GDP, Crude Oil Prices, Trade War Talks

Abstract:NOK traders will be eagerly awaiting the release of first-quarter GDP data, though optimism over the outcome may be overshadowed by shaky US-China trade relations and outlook the for crude oil prices.

NOK TALKING POINTS – NORWAY GDP, CRUDE OIL PRICES, NORGES BANK

Norwegian QoQ GDP: expecting a 0.2 percent rise

Trade wars and global sentiment weigh on crude oil

Risk out of EU to increase pressure on central bank?

See our free guide to learn how to use economic news in your trading strategy!

Norwegian Krone traders will be closely watching Norway‘s upcoming GDP data, a 0.2 percent quarter-on-quarter rise expected. That is lower than the previous 0.5 percent increase. Relative to developed countries, Norway’s economy has been faring well; So much so that its central bank remains one of the most hawkish monetary authorities in the world. But for how long?

The source of Norway‘s economic strength is also its weakness. The economy’s export-driven nature and heavy reliance on the petroleum sector leaves it exposed to abrupt changes in global sentiment. The most recent crack in US-China trade relations illustrates how crude oil prices can be notoriously sensitive to shifts in market mood. The Norwegian Krone also found itself under pressure as US-China trade tensions escalated.

There is also growing political and economic risk emanating out of Europe, Norways biggest client. Brexit still remains a headline risk for European markets while the rise of Eurosceptics is making for an unsettling political landscape. To learn more about how politics affect markets, you may follow me on Twitter @ZabelinDimitri.

If regional and global fundamental themes continue to decay, it could pressure the Norwegian economy and force the central bank to adjust its rate hike cycle. The Krone would almost certainly suffer in this environment, particularly against the US Dollar because of how these risks may generate a demand for the Greenbacks unparalleled liquidity.

Looking ahead, the continuation of the US-China trade war drama will likely continue to be a global headline risk alongside Brexit as the clock for both runs out. Regional and domestic growth indicators will likely continue to impact the Krone, though international themes may overshadow the potential volatility-inducing results of some peripheral Norwegian data.

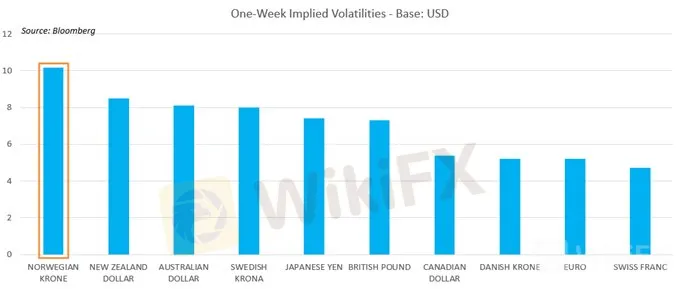

CHART OF THE DAY: ONE-WEEK IMPLIED VOLATILITY MAY 8, 2019

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

Euro May Extend Gains vs NOK and Aim to Re-Test 11-Year High

The Euro may rise vs the Norwegian Krone this week and push EURNOK to retest the 11-year high at 10.0972, a level not reached since the 2008 financial crash.

US Dollar May Rise vs NOK if Norges Bank Trims Hawkish Outlook

The US Dollar may rise vs the Norwegian Krone if the Norges Bank scales back its hawkish outlook against the backdrop of slower regional and global growth.

SEK, NOK Brace for Turbulence Ahead of FOMC and Sweden GDP

The Swedish Krona and Norwegian Krone will likely experience unusually high volatility with Swedish GDP, the FOMC rate decision and other high-event risk in the week ahead.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator