简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: May RBNZ Meeting Preview & NZDUSD Price Forecast

Abstract:The Reserve Bank of New Zealand meets on Wednesday, May 8 at 02:00 GMT; rates markets are pricing in a 51% chance of a 25-bps rate cut.

Talking Points:

谈话要点:

- The Reserve Bank of New Zealand meets on Wednesday, May 8 at 02:00 GMT; rates markets are pricing in a 51% chance of a 25-bps rate cut.

- 新西兰储备银行于5月8日星期三格林威治标准时间02:00举行会议;利率市场定价降息25个基点的可能性为51%。

- NZDUSD prices reached fresh 2019 lows at the end of April, breaking the January 3 flash crash low in the process.

- 新西兰元兑美元价格在4月底达到新的2019点低点,打破了1月3日的闪电崩盘低点在此过程中。

- Retail traders are currently net-long NZDUSD and have remained net-long since April 2; during that timeframe, NZDUSD prices fell by -3%.

- 零售交易商目前是净多头新西兰元,自4月2日以来一直保持净多头;在此期间,新西兰元的价格下跌了3%。

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

周一美国东部时间7:30 /格林威治标准时间11:30参加FX周向前线网络研讨会,我们在此讨论未来几天的事件风险以及围绕下列事件进行外汇市场交易的策略。

05/08 WEDNESDAY | 02:00 GMT | NZD RESERVE BANK OF NEW ZEALAND RATE DECISION

05/08 WEDNESDAY | 02:00 GMT |新西兰储备银行新西兰汇率决定

The Reserve Bank of New Zealands overnight cash rate peaked at 3.50% in May 2015 and has been on a slow erosion over since; the most recent 25-bps rate cut was at the November 2016 meeting. Mounting concerns about a soft economy may have reached the tipping point in recent weeks, finally provoking the Reserve Bank of New Zealand into its first rate move in two and a half years.

新西兰储备银行隔夜现金利率在2015年5月达到峰值3.50%,并且自那以后一直缓慢下滑;最近25个基点的降息是在2016年11月的会议上。对经济疲软的担忧可能在最近几周达到临界点,最终导致新西兰储备银行在两年半内首次采取行动。

The Q1‘19 New Zealand GDP report showed that growth was weaker than anticipated, coming in at 2.3% annualized versus 2.5% expected, from 2.6% in Q4’18. Meanwhile, the Q119 New Zealand inflation report produced a similar disappointment, registering 1.5% versus 1.7% expected, from 1.9% (y/y). Overall, the Citi Economic Surprise Index for New Zealand, a gauge of economic data momentum, has fallen from -1.8 to -11.2 since the March RBNZ meeting.

2014年第19季度新西兰国内生产总值报告显示,增长率低于预期,年均增长2.3%,预期为2.5%,低于第四季度的2.6%。与此同时,Q119新西兰通胀报告也出现了类似的失望,从预期的1.9%(同比)下降1.5%至1.7%。总体而言,衡量经济数据动力的新西兰花旗经济惊喜指数自3月RBNZ会议以来已从-1.8降至-11.2。

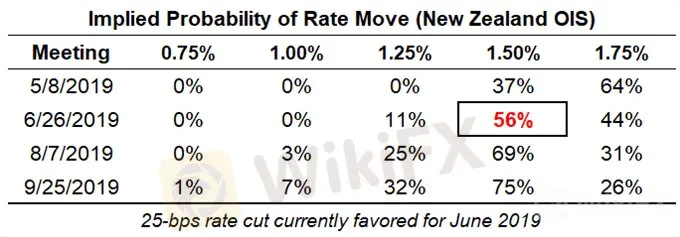

Since the last RBNZ meeting in March, traders had steadily pulled forward expectations of a 25-bps rate cut into the first half of 2019. Prior to the last RBNZ meeting there was a 7% chance of a cut at the May meeting; coming into this week, there was a 51% chance of a 25-bps cut on Wednesday.

自3月份上一轮新西兰央行会议以来,交易商已经稳步推进了对2019年上半年降息25个基点的预期。在上一轮新西兰央行会议之前,有7%的机会减持。五月见面;进入本周,周三有51%的机会减少25个基点。

{9}

But after the Reserve Bank of Australia opted to keep rates on hold rather than go the cut route, traders have taken a different perspective on the RBNZ. In the wake of the RBA's decision to punt its rate decision until June, traders are leaning into the same fate for the RBNZ: overnight index swaps now foresee a 36% chance of a rate cut at the May RBNZ meeting.

{9}

Pairs to Watch: AUDNZD, NZDJPY, NZDUSD

值得关注:澳元兑纽元,新西兰元,新西兰元

NZDUSD Technical Analysis: Daily Timeframe (April 2018 to May 2019) (Chart 1)

新西兰元技术分析:每日时间表(2018年4月至2019年5月)(图1)

The near-term price forecast for NZDUSD remains bearish as technical studies point to a weak momentum environment. Price remains below its daily 8-, 13-, and 21-EMA envelope, while both daily MACD and Slow Stochastics point lower in bearish territory.

由于技术研究显示动能环境疲弱,纽元兑美元的近期价格预测依然看跌。价格仍然低于其每日8,13和21-EMA信封,而日线MACD和慢速随机指标均在看跌区域内走低。

After breaking the early-2019 flash crash low set on January 3 at 0.6587, NZDUSD prices established a fresh 2019 low at 0.6580 in the final week of trading in April. As such, a move below the April low of 0.6580 would likely trigger an effort to return back to the November 1, 2018 low at 0.6514. The near-term bearish price forecast for NZDUSD would be negated were price to return above the April 30 high at 0.6685.

在突破2019年初的闪电之后1月3日创下0.6587的新低,新西兰元在4月交易的最后一周创下新的2019年低点0.6580。因此,跌破4月低点0.6580可能会触发回到2018年11月1日低点0.6514的努力。如果价格回到4月30日高点0.6685以上,则新西兰元兑美元的近期看跌价格将被否定。

IG Client Sentiment Index: NZDUSD Price Forecast (May 7, 2019) (Chart 2)

IG客户情绪指数:新西兰元兑美元价格预测(2019年5月7日) )(图2)

NZDUSD: Retail trader data shows 71.9% of traders are net-long with the ratio of traders long to short at 2.56 to 1. In fact, traders have remained net-long since April 2 when NZDUSD traded near 0.68032; price has moved 3.0% lower since then. The number of traders net-long is 8.0% higher than yesterday and 22.4% higher from last week, while the number of traders net-short is 8.4% lower than yesterday and 23.9% lower from last week.

NZDUSD:零售交易者数据显示,71.9%的交易者为净多头,交易者持股多头做空事实上,自4月2日以来,当纽元兑美元汇率在0.68032附近交易时,交易商仍维持净多头;此后价格已下跌3.0%。交易者净多头数为8比昨天增加0%,比上周增加22.4%,而交易商净空头数比昨天减少8.4%,比上周减少23.9%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZDUSD-bearish contrarian trading bias.

我们通常采取逆向观点来看待人群情绪,而且交易商净多头表明纽元兑美元价格可能继续下跌。交易商比昨天和上周进一步净多头,目前的情绪和最近的变化相结合,使我们对新西兰元兑美元看跌的逆势交易偏见更加强烈。

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Economic Calendar Week Ahead: Fed Meeting, New Zealand GDP, Australia Jobs & More

Three central bank meetings are on the calendar over the coming week, including the Federal Reserve and the Bank of Japan.

EUR/USD, EUR/JPY Rates Rebound Off Lows after September ECB Meeting

Euro rates have seen volatility around the September ECB meeting as outgoing President Draghi's alter ego “Super Mario” made an appearance.

FX Week Ahead - Top 5 Events: August RBA Meeting Minutes & AUD/USD Rate Forecast

The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

Gold Price Rise May Extend But Signs of Exhaustion Are Emerging

Gold prices may continue inching upward but technical cues pointing to ebbing momentum are warning of a possible pullback before the broader rise resumes.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator