简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: April Canada Jobs Report & USDCAD Price Forecast

Abstract:The April Canada jobs report (detailing the employment change and unemployment rate) is due on Friday, May 10 at 12:30 GMT.

Talking Points:

谈话要点:

- The April Canada jobs report (detailing the employment change and unemployment rate) is due on Friday, May 10 at 12:30 GMT.

- 4月加拿大就业报告(详细说明就业变化和失业率)将于5月10日星期五格林尼治标准时间12:30公布。

- Consensus forecasts have the Canadian labor market reasserting strength in April, due to post a gain of 11.6K jobs, the unemployment rate to stay on hold at 5.8%, and average hourly wages to have increased by 2.3% (y/y).

- 共识预测4月份加拿大劳动力市场重新走强,因为增加了11.6万个工作岗位,失业率保持在5.8%,平均每小时工资增长了2.3%(同比)。

- Retail traders have started buying the Canadian Dollar, with USDCAD net-short positioning rising in recent days.

- 零售交易商已经开始买入加元,最近几天美元兑加元净空头头寸有所上升。

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

周一美国东部夏令时间7:30 /格林尼治标准时间11点30分加入我的FX周向网络研讨会,在那里我们讨论未来几天的顶级事件风险以及围绕事件交易外汇市场的策略列出如下。

05/10 FRIDAY | 12:30 GMT | CAD Employment Change & Unemployment Rate (APR)

05/10周五| 12:30 GMT | CAD就业变化和失业率(APR)

After a surprisingly weak print in March, the Canadian labor market is looking for a modest rebound in April. Bloomberg News consensus forecasts call for the April Canada jobs report to show that the economy added 11.6K jobs after losing -7.2K in March. Even so, the six- and 12-month rates of jobs growth are 35.6K and 27.6K, respectively. The unemployment rate is due to stay on hold at 5.8% where it has since January 2019.

3月份出人意料地疲弱,加拿大劳动力市场正在寻求4月温和反弹。彭博新闻一致预测4月加拿大就业报告显示经济在3月份下跌-7.2万后增加了11.6万个就业岗位。即便如此,6个月和12个月的就业增长率分别为35.6K和27.6K。自2019年1月以来,失业率将维持在5.8%的水平。

The contraction in March was only the fourth month the Canadian economy has lost jobs since the start of 2017. Given that crude oil prices rebounded over the past several months, there may have been spillover into the Canadian energy sector (which accounts for roughly 11% of Canadian GDP), helping spur job creation and thus a rebound in the upcoming April Canada jobs report.

3月份的萎缩只是加拿大经济自开业以来失业的第四个月鉴于原油价格在过去几个月反弹,可能已经蔓延到加拿大能源部门(约占加拿大国内生产总值的11%),有助于刺激创造就业机会,从而促进即将到来的加拿大4月份的反弹工作报告。

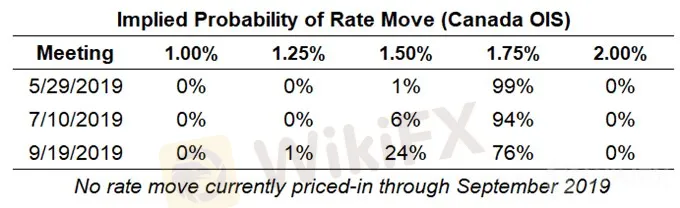

Overall, traders have had little reason one way or the other to change their expectations about the Bank of Canadas rate trajectory for 2019. At the start of April, overnight index swaps were pricing in a 21% chance of a 25-bps rate cut by the end of September; now, those odds are barely higher at 24% (despite the BOC saying that rate hikes were completely off the table at their recent policy meeting).

总体而言,交易者几乎没有理由改变他们对2019年加拿大银行利率轨迹的预期。一开始4月份,隔夜指数互换价格在一个截至9月底,降息25个基点的可能性为1%;现在,这些可能性仅略高于24%(尽管中行表示加息在他们最近的政策会议上完全不在考虑范围内)。

Pairs to Watch: CADJPY, EURCAD, USDCAD

需要关注的对象:CADJPY,EURCAD ,USDCAD

USDCAD Technical Analysis: Daily Price Chart (September 2018 to May 2019) (Chart 1)

美元兑加元技术分析:每日价格走势图(2018年9月至2019年5月)(图1)

USDCAD prices established a bearish outside engulfing bar on Friday, but the gap open higher at the start of the week has negated the potential bearish tone that might have otherwise been established. Putting price action in context of the symmetrical triangle forming going back to the yearly high, USDCADs recent pullback may have simply been a retest of former resistance turned support. As such, the path of least resistance may be the topside in the near-term.

美元兑加元价格在周五确定了看跌的外部吞没风险,但本周初开盘走高的空白已经否定了可能已经建立的潜在利空基调。将价格行动置于对称三角形形成可追溯至年度高点的背景下,美元兑加元最近的回调可能仅仅是对前阻力转向支撑的重新测试。因此,阻力最小的路径可能是近期的上行路径。

With another smaller triangle having formed over the past two weeks of trading following the breakout of the larger symmetrical triangle, USDCAD prices appear to be coiling again before their next move. Accordingly, traders may want for a break of the April high at 1.3521 or the May low at 1.3377 before the next directional move in USDCAD prices is forecast with more confidence.

在更大的突破之后,在过去两周的交易中形成了另一个较小的三角形对称三角形,美元兑加元价格在下一步走势之前似乎再次盘整。因此,交易者可能希望突破4月高点1.3521或5月低点1.3377,然后预测美元加元价格的下一个定向走势将更有信心。

IG Client Sentiment Index: USDCAD (May 6, 2019) (Chart 2)

IG客户情绪指数:美元兑加元(2019年5月6日)(图2)

USDCAD: Retail trader data shows 35.1% of traders are net-long with the ratio of traders short to long at 1.85 to 1. The number of traders net-long is 18.2% lower than yesterday and 18.7% lower from last week, while the number of traders net-short is 29.8% higher than yesterday and 22.5% lower from last week.

美元兑加元:零售交易者数据显示,35.1%的交易者是净持有者,其比率为交易商空头头寸为1.85比1.交易商净多头比昨天减少18.2%,比上周减少18.7%,而交易商净空头数比昨天增加29.8%,比去年减少22.5%一周。{/ p>

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias.

我们通常采取逆势观点为了挤压市场情绪,交易商净空头表明美元兑加元价格可能继续上涨。交易商进一步净空比昨天和上周,当前情绪和近期变化的结合使我们更加强烈的美元兑加元看涨逆势交易偏见。

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator