简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SEK, NOK Forecast: European GDP, US Data May Pressure Nordics

Abstract:The Swedish Krona and Norwegian Krone may find themselves under pressure as key growth data out of the US and EU cross the wires.

NORDIC FX, NOK, SEK WEEKLY OUTLOOK

NORDIC FX,NOK,SEK每周展望

NOK, SEK bite nails before European GDP

NOK,SEK在欧洲GDP之前咬指甲

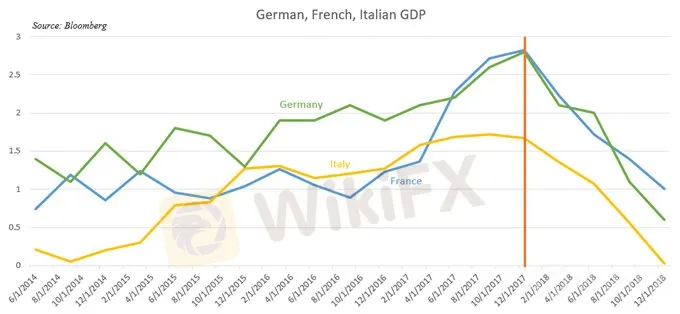

German growth is a major point of concern

德国的成长是一个主要关注点

Why does EU demand matter for NOK, SEK?

为什么欧盟要求挪威克朗,SEK?

The Swedish Krona and Norwegian Krone may find themselves feeling tense in today‘s trading session as Eurozone, French and Italian GDP are released along with a slew of key growth indicators out of Germany. Economic reports have been broadly falling short of expectations, indicating that perhaps analysts are too optimistic about the Continent’s growth – or there lack of.

瑞典克朗和挪威克朗在今天的交易时段可能会感到紧张,因为欧元区,法国和意大利的国内生产总值以及一系列关键增长指标已经公布德国经济报告大致未达到预期,表明分析师可能对欧洲大陆的增长过于乐观 - 或者缺乏。

70 percent of Swedens exports head to Europe, of which 11 percent is consumed by Germany. This might help explain why Riksbank Deputy Governor Martin Floden expressed concern about slower growth from the “steam engine of Europe”. Deceleration in the largest Eurozone economy has broader regional implications. It inevitably spills over into other Eurozone member states that rely on strong demand out of Germany.

70%的瑞典出口前往欧洲,其中11%被德国消费。这可能有助于解释为什么瑞典央行副行长马丁·弗洛登对“欧洲蒸汽机”的增长放缓表示担忧。欧元区最大经济体的减速具有更广泛的区域影响。它不可避免地蔓延到依赖德国强劲需求的其他欧元区成员国。

The nature of inter-European demand is also a point of concern for Norway. 80 percent of Norway‘s exports have Europe as their destination. 52 percent of those goods are linked to petroleum-based products. This leaves the Norwegian economy sensitive to changes in European demand due to the country’s reliance on a cycle-sensitive commodity. This explains why Nordic policymakers are so concerned with European growth.

欧洲需求的性质也是挪威关注的一个问题。挪威80%的出口以欧洲为目的地。这些商品中有52%与石油类产品有关。由于该国依赖对周期敏感的商品,这使得挪威经济对欧洲需求的变化敏感。这就解释了为什么北欧政策制定者如此关注欧洲经济增长。

For this reason, today‘s release of key growth indicators – and the potential volatility it may stoke – is a point of concern for Swedish Krona and Norwegian Krone traders. The outlook for European demand could impact the central bank’s monetary policy out of Sweden and Norway if inflationary pressure in the EU continues to cool and sends a chilly breeze into the Nordic economies.

出于这个原因,今天发布的关键增长指标 - 以及它可能引发的潜在波动 - 是瑞典克朗和挪威克朗交易员关注的一个问题。如果欧盟的通胀压力继续降温并发送,欧洲需求的前景可能会影响央行对瑞典和挪威的货币政策北欧经济中充斥着微风。

US economic data will also heavily eyed by Nordic traders because of the global impact US economic activity has on the world economy. Swedish Krona and Norwegian Krone traders with exposure to a US-Dollar cross will be particularly mindful, given that the source of the event risk is emanating from the base currencys home. Looking to trade NOK, SEK? Sign up for my Nordic trading webinar here!

由于美国经济活动对世界经济的全球影响,美国经济数据也将受到北欧贸易商的极大关注。瑞典克朗和挪威克朗的交易者将面临美元交叉,特别注意事件风险来源于基本货币之家。想要交易NOK,SEK?在这里注册我的北欧交易网络研讨会!

CHART OF THE DAY: GDP FROM TOP THREE EUROZONE ECONOMIES

每日图表:来自前三个欧元区经济体的GDP

KRONA, NORWEGIAN KRONE TRADING RESOURCES

KRONA,NORWEGIAN KRONE TRADING RESOURCES

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

---由Dimitri Zabelin撰写,Jr Currency DailyFX.com分析师

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

Euro May Extend Gains vs NOK and Aim to Re-Test 11-Year High

The Euro may rise vs the Norwegian Krone this week and push EURNOK to retest the 11-year high at 10.0972, a level not reached since the 2008 financial crash.

Crude Oil Prices, NOK May Fall on Norway Sovereign Wealth Fund Data

Crude oil prices and the Norwegian Krone may fall if the world‘s largest petroleum-linked sovereign wealth fund’s earnings amplify global recession fears.

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

WikiFX Broker

Latest News

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

OFX: Is It Good to Go? Broker Review

Financial Educator “Spark Liang” Involved in an Investment Scam?!

Currency Calculator