简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/SGD May Rise on Fed as Crude Oil Weakness Stems USD/PHP Rise

Abstract:The US Dollar may rise versus the Singapore Dollar on the Fed as a cooldown in crude oil prices supports the Philippine Peso. China Manufacturing PMI may surprise higher, boosting MYR.

ASEAN Fundamental Outlook

东盟基本面观

Indonesian Rupiah, Philippine Peso weakened as the US Dollar rose

印尼盾,菲律宾比索因美元上涨而走弱

China manufacturing PMI may surprise higher, sinking USD/MYR

中国制造业采购经理人指数可能出人意料地走高,美元兑马币下跌

Fed may sour sentiment, lifting USD/SGD as oil fall upholds PHP

美联储随着石油价格持续上涨,美元/新加坡元可能会出现疲软情绪

Trade all the major global economic data live and interactive at the DailyFX Webinars. Wed love to have you along.

在DailyFX网络研讨会上实时交互所有主要全球经济数据。我很高兴能帮助你。

US Dollar and ASEAN FX Recap

美元和东盟外汇回顾

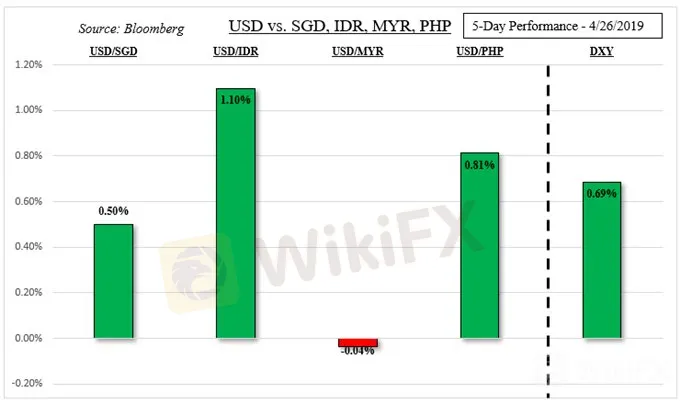

The US Dollar had its best week in two months, guided higher on multiple accounts of risk aversion which fueled demand for the highly liquid currency. This ended up pressuring its ASEAN counterparts with the Indonesian Rupiah one of the worst-performing ones. This past week, the Bank of Indonesia left rates unchanged while expanding measures to boost liquidity. Expectations of a cut have been increasing.

美元在两个月内表现最佳,在风险规避的多个账户中引导走高,这推动了对高流动性货币的需求。这最终迫使其东盟同行对印尼卢比表现最差的一个。上周,印度尼西亚央行维持利率不变,同时扩大措施以提振流动性。对减产的预期一直在增加。

As crude oil prices initially climbed this week on Iranian supply disruption concerns, the Philippine Peso continued to depreciate before leveling off on Friday. Meanwhile, the Malaysian Ringgit ended mostly little changed after pronounced declines. USD/MYR, amidst general Greenback gains, hovered as the FTSE Bursa Malaysia KLCI Index rose. Capital outflows fears seemed to have subsided for the time being

由于本周原油价格因伊朗供应中断问题而上涨,菲律宾比索继续贬值,然后在周五趋于平稳。与此同时,马来西亚令吉在明显下跌后几乎没有变化。美元/马来西亚林吉特综合指数上涨,美元/马来西亚林吉特综合指数大幅升值。目前资本外流担忧似乎已经消退

Regional ASEAN Docket

区域ASEAN Docket

Regionally, ASEAN currencies will have Chinese manufacturing PMI data to potentially look forward to. According to the Citi Economic Surprise Index for China, data has been tending to increasingly outperform relative to economists‘ expectations as of late. An upside surprise may bolster PHP and MYR given how the Philippines and Malaysia have key trading relationships with the world’s second-largest economy.

从地区来看,东盟货币将会中国制造业采购经理人指数数据可能值得期待。根据中国花旗经济惊喜指数,数据相对于经济学家的预期最近趋于突出。考虑到菲律宾和马来西亚与世界第二大经济体之间存在重要贸易关系,上行意外可能会增加PHP和MYR。

For the Indonesian Rupiah, the week ahead contains domestic inflation data. Indonesia CPI is expected to clock in at 2.6% y/y in April from 2.5% in March. The nation has been experiencing disinflation since the Bank of Indonesia took on rate hikes last year to help stabilize the Rupiah. Supportive inflation data may boost IDR as it may lessen the haste for the central bank to consider cutting rates.

对于印尼盾,未来一周包含domesti通胀数据。预计4月印度尼西亚CPI同比增长2.6%,而3月为2.5%。自印度尼西亚央行去年加息以帮助稳定印尼盾以来,该国一直在经历通货紧缩。支持性通胀数据可能会提高IDR,因为它可能会减少中央银行考虑降息的速度。

External Risks

外部风险

A key event that can have major implications for general risk trends is the Fed rate decision. If the central bank shows hesitation in wanting to favor a cut or does not drop hints that one may come in the near-term, dovish expectations may be disappointed. This is a weakness for equities and by extension sentiment-linked crude oil prices. While such an outcome may boost USD, PHP may stabilize if oil prices keep weakening.

A可能对一般风险趋势产生重大影响的关键事件是美联储利率决定。如果中央银行表示犹豫是否希望支持减产,或者没有暗示可能会在短期内出现这种暗示,那么鸽派的期望可能会令人失望。这是股市和原油价格相关的弱势因素。虽然这样的结果可能会提振美元,但如果油价继续疲软,PHP可能会稳定下来。

But that is not all, the US economic calendar docket is quite dense. Items such as the latest jobs report and the core PCE deflator, which is a favored measure of inflation by the Fed, are up. Unlike in China, outcomes relative to expectations have been tending to disappoint. While this may fuel Fed rate cut bets, it also risks denting sentiment and the S&P 500. That may in-turn boost the US Dollar and USD/SGD which tends to closely trace DXY.

但并非全部,美国经济日历的报道非常密集。诸如最新就业报告和核心PCE平减指数等项目正在上升,这是美联储对通胀的一种有利措施。与中国不同,与预期相关的结果一直令人失望。虽然这可能推动美联储降息,但也有可能降低情绪和标准普尔500指数。这可能反过来提振美元和美元/新元,这往往会密切跟踪DXY。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

NFP Hammers Dollar to 4 Months Low

The aftermath of the Japanese yen's strengthening has manifested in significant dips across multiple markets, including equities, commodities, and various currencies. The yen has erased all its 2024 losses against the dollar, moving towards the 145.00 mark. The dollar index (DXY) has fallen to its lowest level since March, hovering above the $103 mark.

KVB Today's Analysis: Gold Bullion Gains Strength Amid Fed's Dovish Stance on Interest Rates

Fed officials have indicated they are prepared to cut interest rates if necessary, though there is no immediate need. This dovish stance has been viewed positively by the markets, leading to increased buying pressure on gold. Despite ongoing inflationary risks, market expectations of a rate cut in June have risen to 66.3% (up 3% since the PCE release). Lower interest rates could enhance the appeal of non-yielding gold.

Yen Resurgence! Will Next BoJ Week Sustain the Rally?

The U.S. Conference Board reported a slight decline in the US Consumer Confidence Index (CCI) for June 2024, dropping to 100.4 from 101.3 in May. The Bank of Japan (BoJ) opted to keep its key short-term interest rate steady at 0.10% for June 2024, in line with market expectations. At its June 2024 meeting, the Federal Reserve decided to keep the federal funds rate unchanged at 5.50%. In June 2024, the Bank of England (BoE) decided to keep the interest rate at 5.25% unchanged. This decision...

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator