Score

OANDA Japan

Japan|5-10 years|

Japan|5-10 years| https://www.oanda.jp

Website

Rating Index

Influence

Influence

A

Influence index NO.1

Japan 9.32

Japan 9.32Contact

Licenses

Licenses

Licensed Institution:OANDA Japan Inc

License No.:関東財務局長(金商)第2137号

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Japan

JapanUsers who viewed OANDA Japan also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Company Summary

| OANDA Japan Review Summary | |

| Registered Country/Region | Japan |

| Regulation | FSA (Suspicious Clone) |

| Market Instruments | Forex, stocks indices CFDs, commodities CFDs |

| Demo Account | Available |

| Trading Platforms | MT4, MT5, API, TradingView, OANDA Fx Trade |

| Minimum Deposit | 10,000 yen |

| Customer Support | Telephone, online messaging |

What is OANDA Japan?

OANDA Japan offers a diverse range of market instruments, including forex, stocks indices CFDs, and commodities CFDs. With a minimum deposit requirement of 10,000 yen, OANDA Japan provides a user-friendly trading experience through various platforms such as MT4, MT5, API, TradingView, and OANDA Fx Trade. They also offer a demo account for users to practice their trading strategies. Though OANDA Japan implements robust security measures, their license FSA is suspected to be clone.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

- Multiple Trading Platforms: OANDA Japan offers multiple trading platforms, including MT4, MT5, API, TradingView, and OANDA Fx Trade, giving traders the flexibility to choose their preferred platform.

- Demo Account: OANDA Japan provides a demo account option, allowing users to practice trading strategies and get familiar with the platform without risking real money.

- Fraud Protection Measures: OANDA Japan claims to have implemented fraud protection measures, such as encrypting customer accounts and transaction information using SSL 128-bit, to prevent information leakage and unauthorized access.

Cons:

- FSA (Suspicious Clone): The license FSA is suspected to be clone, which means that there are doubts or suspicions regarding its authenticity or legitimacy. In the context of brokerage firms, a clone license refers to a fraudulent or counterfeit license that is created to deceive individuals or misrepresent the regulatory status of a company.

- Minimum Deposit Requirement: OANDA Japan requires a minimum deposit of 10,000 yen, which may be relatively high for some traders, especially beginners or those with limited funds.

- Reports of Issues: There have been reports of issues with OANDA Japan, including difficulties with account withdrawals and potential scams. It is important to be aware of these reports and consider them as part of your decision-making process.

- Limited Communication Channels: According to the information provided, OANDA Japan has limited communication channels, specifically mentioning telephone and online messaging as the primary means of customer support. This might be a drawback for traders who prefer more immediate or direct communication options.

Is OANDA Japan Safe or Scam?

OANDA Japan claims to have protection measures in place, such as encrypting customer accounts and transaction information using SSL 128-bit to prevent information leakage. They also strive to prevent unauthorized access and computer virus infection. They have a system management company that operates with a 24-hour monitoring system and has backup systems to ensure service continuity in the event of equipment or line failures.

OANDA Japan is currently suspected to be a clone of another broker and does not have valid regulation or oversight from government or financial authorities. The Financial Services Agency (FSA) (License Type: Retail Forex License, No: 関東財務局長(金商)第2137号) claimed by this broker is suspected to be clone. Investing with them carries risks, as there may be no one to hold them accountable for any fraudulent actions. They could potentially disappear without notice, taking your funds with them.

Market Instruments

OANDA Japan offers a range of trading instruments for its clients.

- Forex: OANDA Japan allows trading in the foreign exchange market, providing access to numerous currency pairs. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

- Stocks Indices CFDs: OANDA Japan offers Contracts for Difference (CFDs) on various stock indices. These indices represent a basket of stocks from a specific region or country, allowing traders to speculate on the overall performance of the stock market. Examples of indices that may be available include the S&P 500, Nikkei 225, and FTSE 100.

- Commodity CFDs: OANDA Japan also offers CFDs on commodities. This allows traders to speculate on the price movements of commodities without owning the physical asset. Commonly traded commodities include gold, silver, oil, natural gas, and agricultural products.

Account Types

OANDA Japan offers a range of trading accounts to suit different trading needs.

- OANDA Securities Account for FX: This account is designed for trading foreign exchange (FX) instruments. You can create sub-accounts within this account to trade different currency pairs, and you have the flexibility to choose the trading platform (MT4 or MT5) and trading conditions that suit your needs.

- OANDA Securities Account for CFDs: This account is specifically for trading Contracts for Difference (CFDs). You can create sub-accounts within this account to trade stock indices or commodity CFDs. Similar to the FX account, you can choose between the MT4 or MT5 trading platforms.

Additionally, OANDA Japan provides different server options, such as the Tokyo server or NY server, depending on your geographical location and preferences.

OANDA Japan also offers demo accounts. Demo accounts allow traders to practice trading using virtual funds in a simulated market environment. This is a great way to gain experience and familiarize yourself with the platform before trading with real funds.

For more detailed information about the specific features and conditions of each account type, you can visit the OANDA Japan website or contact their customer support for accurate and up-to-date information.

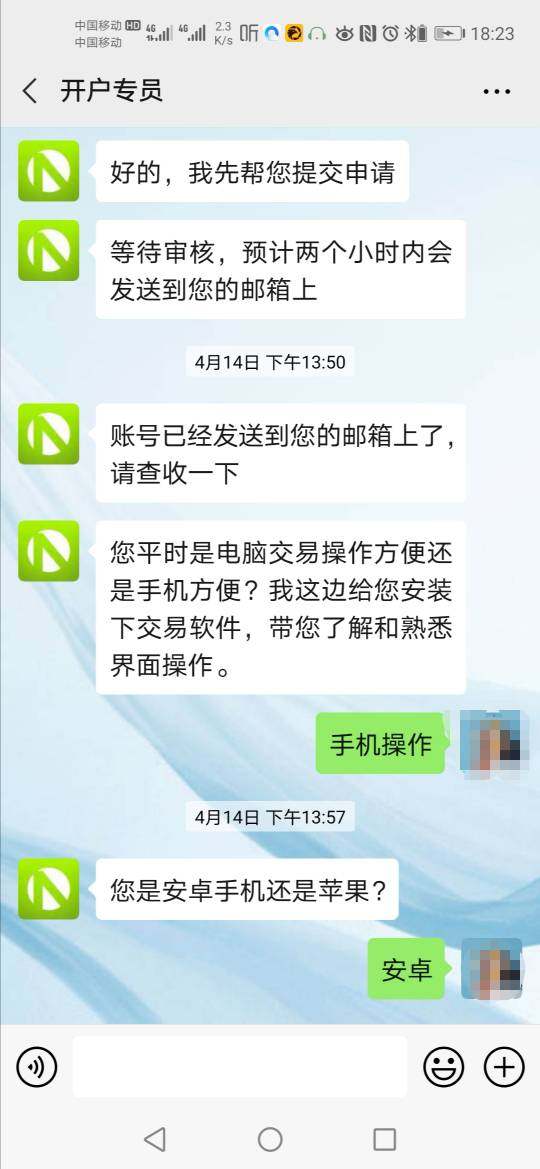

How to Open an Account?

To open an account with OANDA Japan, please follow these steps:

| Step | |

| 1 | Go to the OANDA Japan website. |

| 2 | Click on the “Open an Account” button or link. |

| 3 | Fill in the required information, including your email address. |

| 4 | Submit the form. |

| 5 | Check your email for a message from OANDA Japan. |

| 6 | Click on the link provided in the email to access the registration form. |

Trading Platforms

OANDA Japan provides its clients with a range of trading platforms to suit different trading styles and preferences.

OANDA FxTrade:

This is OANDA's proprietary trading platform, designed to offer a user-friendly and intuitive trading experience. It provides access to a wide range of financial instruments, including forex, CFDs, and commodities. FxTrade is web-based, meaning you can access it from any web browser without needing to download or install additional software. The platform offers advanced charting tools, risk management features, and real-time market data.

MetaTrader 4 (MT4):

OANDA Japan also supports the popular MetaTrader 4 platform, which is widely used by traders worldwide. MT4 is known for its comprehensive functionality, including advanced charting tools, automated trading capabilities through Expert Advisors (EAs), and a wide range of technical indicators. It allows traders to execute trades in forex, as well as CFDs and other financial instruments. MT4 is available in both desktop and mobile versions, enabling traders to access the markets on-the-go.

MetaTrader 5 (MT5):

OANDA Japan also offers the MetaTrader 5 platform, which is an upgraded version of MT4. MT5 builds upon the features of MT4 and offers a more sophisticated trading environment. It includes advanced technical analysis tools, enhanced charting capabilities, and improved order execution. MT5 is also available on desktop and mobile devices, allowing traders to trade across various markets and instruments.

API:

For traders who prefer custom solutions and automated trading strategies, OANDA Japan provides an Application Programming Interface (API). This allows traders to build their own trading systems or integrate third-party platforms with OANDA's infrastructure. The API provides access to real-time market data, order placement, and account management functionalities.

TradingView:

OANDA Japan also offers integration with TradingView, a popular cloud-based charting and social trading platform. TradingView provides advanced charting tools, a wide range of technical indicators, and the ability to share and discover trading ideas within a community of traders. With OANDA's integration, clients can execute trades directly from the TradingView platform.

Deposits & Withdrawals

For Deposits:

OANDA Japan offers two payment methods for deposits: direct deposit and regular deposit.

Direct deposit is a convenient and free method that allows for immediate reflection of the deposit on the transaction screen. It can be used 24 hours a day and can be accessed through internet banking at seven banks: MUFG Bank, Mizuho Bank, Sumitomo Mitsui Banking Corporation, Rakuten Bank, PayPay Bank, Japan Post Bank, and SBI Sumishin Net Bank. However, please note that direct deposits must be 10,000 yen or more.

On the other hand, regular deposits are a transfer method that can be made from financial institutions or ATMs nationwide. The transfer fee will be borne by the customer. Normally, deposits can be made to MUFG Bank, Mizuho Bank, Sumitomo Mitsui Banking Corporation, and Japan Post Bank. The account information for the bank to deposit money from can be found in the documents provided when opening the account or on the screen after logging in.

For Withdrawals:

For withdrawals, you can initiate the process by logging into your account and selecting “Withdrawal Request” in the My Page section. If the withdrawal procedure is completed by 11 a.m. on weekdays, it usually takes until 3 p.m. on the same day for the withdrawal to be processed, except during Christmas and New Year holidays. The withdrawal fees will be covered by OANDA Japan. It's important to note that, according to OANDA Japan's transaction manual, withdrawals are generally processed within 3 business days.

Withdrawals can be made once a day, and if you wish to change the withdrawal amount, you will need to cancel the initial withdrawal request and submit a new request for the desired amount. The minimum withdrawal request amount at one time is 10,000 yen or more, excluding full withdrawals.

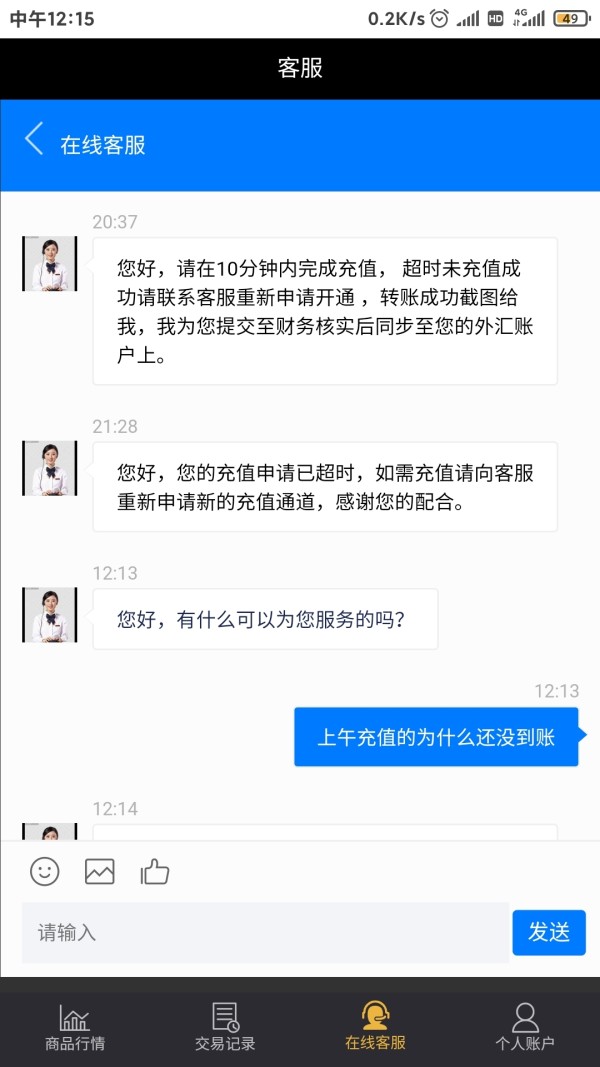

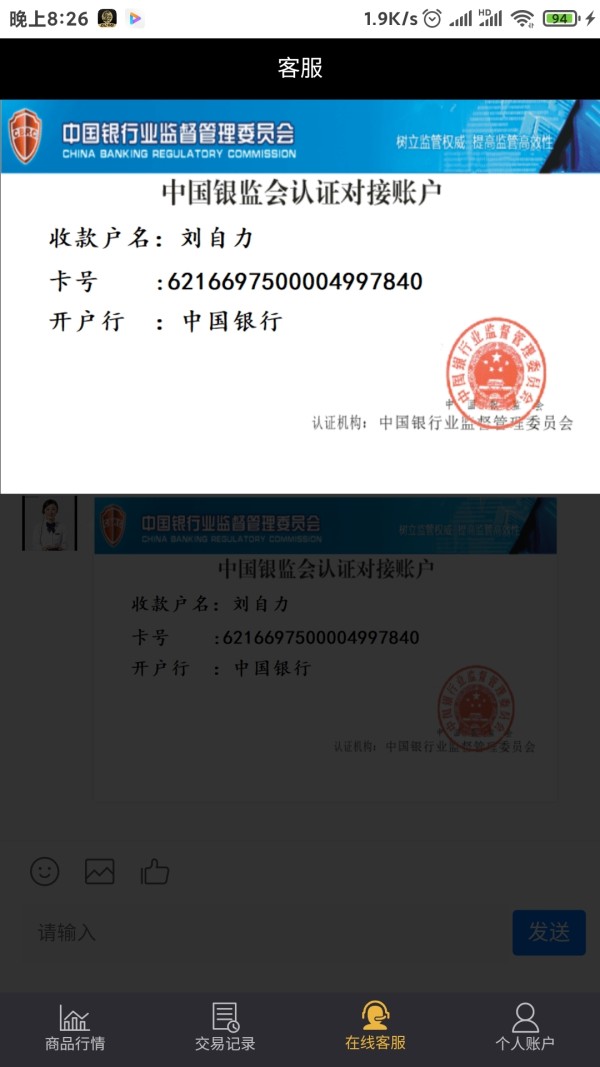

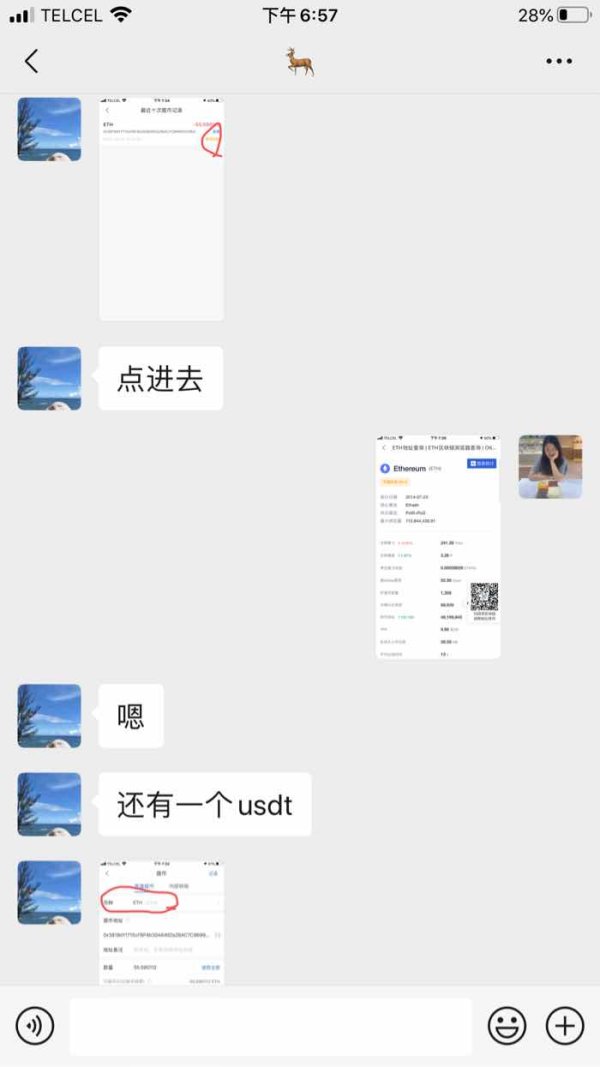

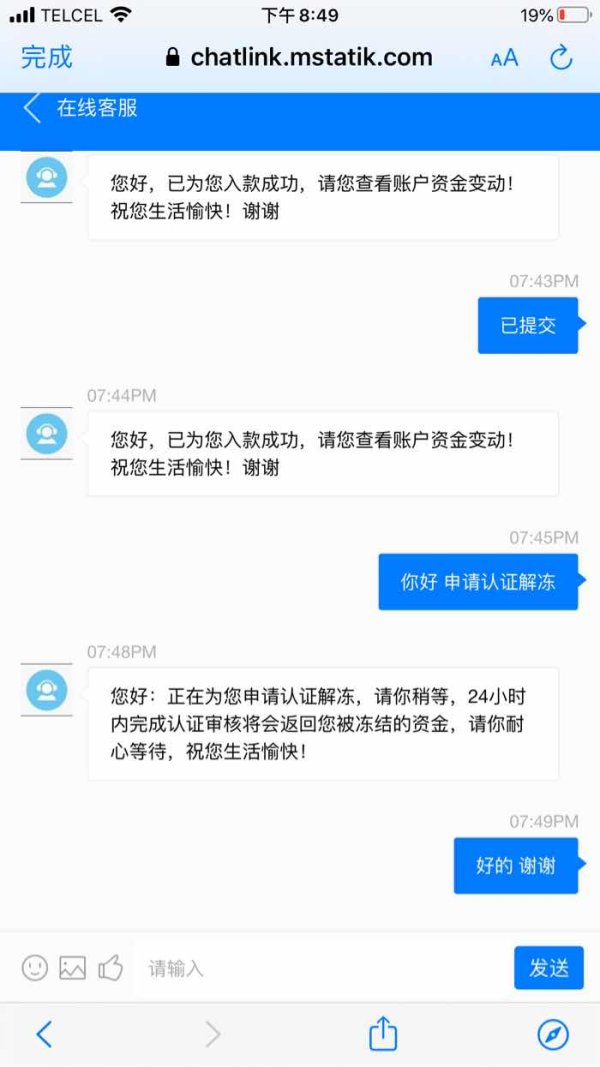

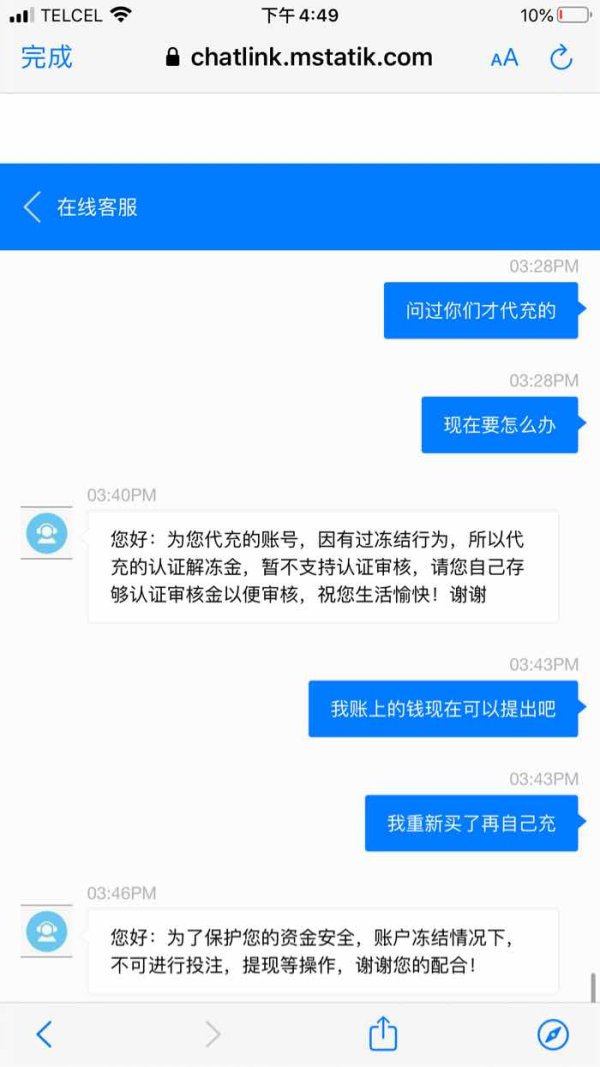

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: 0120-923-213

Whats more, OANDA Japan provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information.

OANDA Japan offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

OANDA Japan is a brokerage firm that offers a range of products and services for traders. Some of its major products include multiple trading platforms. It also provides customized account solutions and a demo account for practice trading.

While OANDA Japan claims to have implemented fraud protection measures, there have been reports of issues and its FSA license is suspicious clone. These reports should not be ignored and should be taken into account when assessing the overall safety and reliability of the broker.

Frequently Asked Questions (FAQs)

| Q 1: | Is OANDA Japan regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at OANDA Japan? |

| A 2: | You can contact via phone: 0120-923-213 and online messaging. |

| Q 3: | Does OANDA Japan offer demo accounts? |

| A 3: | Yes. |

| Q 4: | What platform does OANDA Japan offer? |

| A 4: | It offers MT4, MT5, API, TradingView, OANDA Fx Trade. |

| Q 5: | What is the minimum deposit for OANDA Japan? |

| A 5: | The minimum initial deposit to open an account is 10,000 yen. |

| Q 6: | What services and products OANDA Japan provides? |

| A 6: | It provides forex, stocks indices CFDs, commodities CFDs. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility fo r the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now