简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility Could Ignite with EZ GDP, FOMC, US NFP Next Week

Abstract:Next week is chalk-full of potential risks surrounding major economic events and data releases that could easily stoke market volatility. What risks and forex pairs should traders keep an eye out for?

CURRENCY VOLATILITY – TALKING POINTS:

货币波动率 - 谈话要点:

Following today‘s US GDP report, traders will turn their attention to the slew of economic events and data releases on tap next week for further clarity on the market’s next direction

继今日美国GDP报告后,交易者将会将注意力转向下周的大量经济事件和数据发布,以进一步明确市场的下一个方向

Although 1-week implied volatility metrics across the major currency pairs remains subdued, forex market price action is beginning to show signs that volatility could soon turn higher

虽然1周的隐含波动率主要货币对的指标仍然低迷,外汇市场价格行动开始显示波动可能很快转高的迹象

Take a look at this article for information on How to Trade the Top 10 Most Volatile Currency Pairs

看一下这篇文章有关如何交易十大最易变货币对的信息

The latest stretch of gains in the US Dollar appears to have stoked forex market volatility over the last few days of trading. However, price action looks to have been in anticipation of Q1 US GDP which was released earlier today. With this data now in the rearview mirror, what risks have potential to propel further currency volatility next week?

美元的最新涨幅交易的最后几天似乎引发了外汇市场的波动。然而,价格走势似乎一直在预期今天早些时候公布的第一季度美国GDP。现在这些数据位于后视镜中,下周有哪些风险有可能推动货币进一步波动?

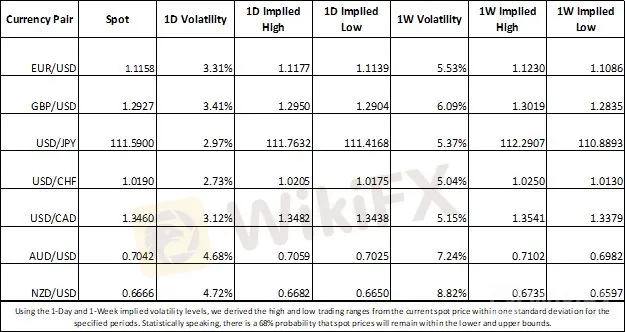

FOREX MARKET IMPLIED VOLATILY AND TRADING RANGES

外汇市场暗示波动和交易范围

{7}

{7}

Consequently, AUDJPY will be an interesting currency pair to keep an eye on next week. According to 1-week implied volatility measures, AUDJPY traders might expect spot prices to fluctuate between 77.940 and 79.238 with a 68 percent statistical probability. The 1-week implied high and low aligns well with Fibonacci support and resistance which have contributed to the narrow trading range observed since the January 3 flash-crash.

因此,澳元兑日元将成为一种有趣的货币配对,以留意下周。根据1周的隐含波动率澳元兑日元交易者可能预期现货价格在77.940和79.238之间波动,统计概率为68%。 1周隐含的高点和低点与斐波那契支撑和阻力位良好对齐,这导致自1月3日闪电崩盘以来观察到的交易区间狭窄。

AUDJPY PRICE CHART: DAILY TIME FRAME (NOVEMBER 27, 2018 TO APRIL 26, 2019)

澳元兑日元价格表:每日时间框架(2018年11月27日至2019年4月26日)

Shifting to hard economic data, the Eurozone is slated to release its Q1 GDP report during Tuesday‘s session. If the numbers show an improvement in the Eurozone’s economic growth and surprise to the EURUSD could attempt to rebound from its recent selloff. On the contrary, if the report fails to provide reasons for optimism, the Euro could continue to come under pressure. The 1-week EURUSD trading range derived from implied volatility priced into forex option contracts estimates that the currency pair will trade between 1.1086 and 1.1230 with a 68 percent statistical probability.

转向艰难的经济数据,欧元区将于周二发布第一季度GDP报告会议。如果数据显示欧元区经济增长有所改善,欧元兑美元的意外可能会从最近的抛售中反弹。相反,如果报告未能提供乐观的理由,欧元可能会继续承受压力。 1周的欧元兑美元交易区间来自外汇期权合约的隐含波动率,估计货币对将在1.1086和1.1230之间交易,统计概率为68%。

EURUSD PRICE CHART: DAILY TIME FRAME (DECEMBER 26, 2018 TO APRIL 26, 2019)

EURUSD PRICE CHART :每日时间框架(2018年12月26日至2019年4月26日)

Later on Tuesday, Canada will also release its GDP numbers and could draw a reaction in USDCAD. Last week, the Bank of Canada rate decision weighed negatively on the Canadian Dollar given dovish language found in the Governing Council‘s press statement and follow up commentary from Stephen Poloz. If Canada’s GDP report echoes timid economic activity in the country, more pain could be expected for the loonie. Also worth noting is the recent downside in oil which might pose as another headwind to CAD upside.

周二晚些时候,加拿大也将公布其GDP数据,并可能在美元兑加元。上周,由于理事会的新闻声明和Stephen Poloz的评论,后加拿大央行的利率决定对加元造成负面影响。如果加拿大的国内生产总值报告与该国经济活动的怯懦相呼应,那么加元可能会产生更多的痛苦。另外值得注意的是近期油价下跌可能成为CAD上行的另一个逆风。

USDCAD PRICE CHART: DAILY TIME FRAME (NOVEMBER 15, 2018 TO APRIL 26, 2019)

美元兑加元价格图表:每日时间框架(11月1日),2018年至2019年4月26日)

{14}

{15}

DXY US DOLLAR INDEX 1-WEEK IMPLIED VOLATILITY PRICE CHART: DAILY TIME FRAME (APRIL 25, 2018 TO APRIL 26, 2019)

美元兑美元汇率指数1周趋势波动率价格图表:每日时间框架(2018年4月25日至周五) 2019年4月26日)

To cap off the week, US Nonfarm Payroll data will be released in addition to the ISM Services Index for April. Further improvement in US economic data will likely reduce market expectations for a rate cut from the Fed this year and could boost the greenback. On the contrary, weakness in Americas job market could give markets the jitters if this cornerstone of the US economy shows signs of deterioration.

除了4月份的ISM服务指数外,美国非农就业数据将会发布。美国经济数据的进一步改善可能会降低市场对美联储今年降息的预期,并可能提振美元。相反,如果美国经济的基石显示出恶化的迹象,美国就业市场的疲软可能会让市场感到紧张。

- Written by Rich Dvorak, Junior Analyst for DailyFX

- 由DailyFX的初级分析师Rich Dvorak撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

S&P 500 Outlook: Fed Rate Cut Speculation & Market Volatility | March 20, 2024

Navigating Uncertainty: Insights for Traders & Investors

How to Capitalize on Currency Volatility and Uncertainty in 2023?

The forex market is typically known for its instability, but in 2022, currency volatility was particularly high, surpassing the usual levels. This increased volatility, which more than doubled throughout the year, significantly impacted investment portfolios. The Covid-19 pandemic, along with the war in Europe, probably impacted the world economy severely. With these factors in mind, it is crucial to explore strategies for taking advantage of currency volatility and uncertainty in 2023.

Currency Volatility: Japanese Yen Eyes Upcoming BOJ Rate Decision

With the Bank of Japan interest rate decision slated for Thursday's session, forex traders could experience increased price action in JPY currency crosses.

Currency Volatility: AUDUSD Price at Risk Ahead of Aussie Jobs Data

AUDUSD overnight implied volatility soars to a multi-month high following the latest monetary policy minutes from the RBA which labeled future weakness in Australia's labor as a potential trigger to cut interest rates.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Dr. Sandip Ghosh, Ex-RG Kar Principal, Involved in Multi-Crore Scam

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

Terra Founder Do Kwon Denies Fraud Allegations in U.S. Court

Currency Calculator