简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: Japanese Yen Eyes Upcoming BOJ Rate Decision

Abstract:With the Bank of Japan interest rate decision slated for Thursday's session, forex traders could experience increased price action in JPY currency crosses.

JPY CURRENCY VOLATILITY – TALKING POINTS:

Overnight volatility measures tick higher across JPY currency pairs in anticipation of tomorrows rate review and monetary policy update from the Bank of Japan

The BOJ will also release its latest outlook for economic activity and prices which looks to accompany a slew of data points such as industrial production and retail trade

Check out the free DailyFX Q2 JPY Forecast for comprehensive outlook on the Japanese Yen

USDJPY overnight implied volatility jumped to 5.61 percent, a multi-week high, as forex traders gear up for potential price swings in response to the Bank of Japan‘s interest rate decision expected during Thursday’s session.

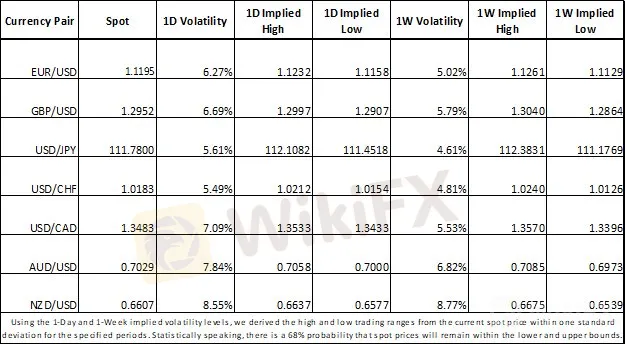

FOREX MARKET IMPLIED VOLATILITY AND TRADING RANGES

BOJ monetary policy is expected to remain unchanged after its April meeting, however, considering the central bank already announced a reduction to its bond purchase program by 20 billion Yen per month last week. That being said, commentary from BOJ Governor Kuroda – particularly on inflation – will likely be closely examined by markets.

FOREX ECONOMIC CALENDAR – JPY

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Aside from the BOJ taking the spotlight in Thursday‘s session, several economic data points may potentially weigh on the Yen’s performance. Forex traders could turn to Japans inflation and jobless rates in addition to year-over-year changes in industrial production and retail trade if no surprises come from the BOJ and Governor Kuroda.

USDJPY PRICE CHART: DAILY TIME FRAME (OCTOBER 31, 2018 TO APRIL 24, 2019)

USDJPY has formed an incredibly tight trading range which has largely contributed to the collapse in currency market volatility. Spot prices appear to have coiled between resistance at the 112.00 handle and support provided by the upward-sloping trendline formed from the low recorded during the Yen flash crash at the beginning of the year.

Tomorrows high-impact event risk could easily serve as a catalyst for overdue volatility and spark a sizeable move outside of current technical levels. That being said, the trading range derived from overnight implied volatility estimates that USDJPY will trade between 111.45 and 112.11 with a 68 percent statistical probability.

USDJPY TRADER SENTIMENT PRICE CHART: DAILY TIME FRAME (OCTOBER 26, 2018 TO APRIL 24, 2019)

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

According to client positioning data from IG, 38.8 percent of USDJPY traders are net-long resulting in a short to long ratio of -1.58 to 1. However, the number of traders net-long is 15.5 percent higher than yesterday and 10.2 percent higher than last week.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

BoJ Holds Firm on Tightening Path Fuels Yen

The Bank of Japan (BoJ) remains on course with its monetary tightening policy, according to the BoJ Chief, following his hearing at the Japan Lower House.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator