简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: AUDUSD Price at Risk Ahead of Aussie Jobs Data

Abstract:AUDUSD overnight implied volatility soars to a multi-month high following the latest monetary policy minutes from the RBA which labeled future weakness in Australia's labor as a potential trigger to cut interest rates.

AUDUSD CURRENCY VOLATILITY – TALKING POINTS:

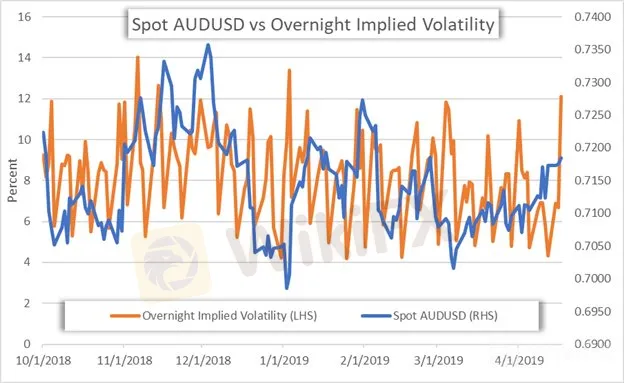

AUDUSD overnight implied volatility skyrockets to 12.1 percent, the metrics highest reading since the Currency Market Flash-Crash on January 3

Australian employment numbers in addition to a slew of economic indicators out of the United States will be closely watched during Thursdays session seeing that the data will likely dictate AUDUSDs next direction

Lack of market liquidity due to the upcoming Good Friday and Easter Sunday holidays threaten possible breakouts from recent narrow trading ranges which could exacerbate price movements

Check out this free educational guide covering an Introduction to Forex News Trading

AUDUSD could experience a volatile session tomorrow considering overnight forex options contracts are pricing in the largest expected move for spot prices since the flash-crash witnessed by markets on January 3. Uncertainty surrounding Thursdays high-impact economic data out of Australia and the US has likely bid up AUDUSD 1-day implied volatility to its second highest reading of the year.

AUDUSD OVERNIGHT IMPLIED VOLATILITY

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Australia‘s economic data is expected to cross the wires at 1:30 GMT during Thursday’s session. Markets are expected to closely scrutinize the Aussie employment numbers for potential insight into the country‘s labor market, especially considering tepid language found in the Reserve Bank of Australia’s March meeting minutes published yesterday.

The RBAs remarks unsurprisingly weighted negatively on AUDUSD seeing that the central bank stated a decrease in the overnight cash rate would likely be appropriate if inflation fails to firm and unemployment trends higher.

FOREX ECONOMIC CALENDAR – AUDUSD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Although Australian employment numbers will likely take the spotlight for AUDUSD traders during Thursday‘s session, a slew of economic data out of the US could weigh on the currency pair later in the day. It’s worth mentioning that the Citi US Economic Surprise Index shows a sizeable drop-off since January, indicating that Americas economic data has broadly surprised to the downside as of late.

That being said, a data-dependent Fed could adopt a dovish tilt following suit from central banks around the world if leading indicators like the Markit Services and Manufacturing PMIs disappoint. On the contrary, better than expected economic reports out of the US will likely bolster the greenback.

AUDUSD PRICE CHART: DAILY TIME FRAME (NOVEMBER 12, 2018 TO APRIL 17, 2019)

According to AUDUSD overnight implied volatility, the currency pair is calculated to trade between 0.7139 and 0.7231 with a 68 percent statistical probability. Spot AUDUSD currently trades at 0.71659 with prices forming a rising channel since the beginning of the month. Recent gains have pushed the Aussie above near-side resistance from the downtrend line formed by the tops printed on December 4, 2018 and January 31, 2019. Yesterdays advance also helped reclaim the 23.6 Fibonacci retracement line drawn from the flash-crash low on January 3 this year to its 2019 high – a level that now looks to serve as technical support.

However, if Australian economic data falters tomorrow, AUDUSD fundamentals could quickly weaken considering the RBA has a previously stated that a deteriorating jobs market would likely put a rate cut on the table. That being said, an increase in the unemployment rate has potential to send spot AUDUSD plunging. With overnight implied volatility suggesting a mere 46 pip move, the possibility of a risk-reversal could be underpriced. On the contrary, a robust employment report could drive AUDUSD to fresh month-to-date high.

AUDUSD TRADER SENTIMENT PRICE CHART: DAILY TIME FRAME (OCTOBER 19, 2018 TO APRIL 17, 2019)

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

The latest AUDUSD trader sentiment data from IG shows that 43.4 percent of traders are net-long resulting in a ratio of traders short to long at -1.31 to 1. Moreover, the number of traders net-long is 7.3 percent lower than yesterday and 10.9 percent lower relative to last week.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

S&P 500 Outlook: Fed Rate Cut Speculation & Market Volatility | March 20, 2024

Navigating Uncertainty: Insights for Traders & Investors

How to Capitalize on Currency Volatility and Uncertainty in 2023?

The forex market is typically known for its instability, but in 2022, currency volatility was particularly high, surpassing the usual levels. This increased volatility, which more than doubled throughout the year, significantly impacted investment portfolios. The Covid-19 pandemic, along with the war in Europe, probably impacted the world economy severely. With these factors in mind, it is crucial to explore strategies for taking advantage of currency volatility and uncertainty in 2023.

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator