简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD Whipsaws Despite Q1 GDP Smashing Expectations - US Market Open

Abstract:USD Whipsaws Despite Q1 GDP Smashing Expectations - US Market Open

MARKET DEVELOPMENT – USD Whipsaw Despite Q1 GDP Surge

DailyFX Q2 2019 FX Trading ForecastsUSD: The US Dollar saw a relatively choppy reaction to the Q1 GDP report. While headline surprised to the upside by quite some margin at 3.2% vs. Exp. 2.3%. The details however, were somewhat less convincing, particularly the PCE figures, meaning that while growth is running hot, inflation is not. Consequently, this places the Fed in a rather tricky situation. Within the GDP report temporary factors had been behind the surge with government spending and inventory accounting for 65% of the growth, while personal consumption had been soft.

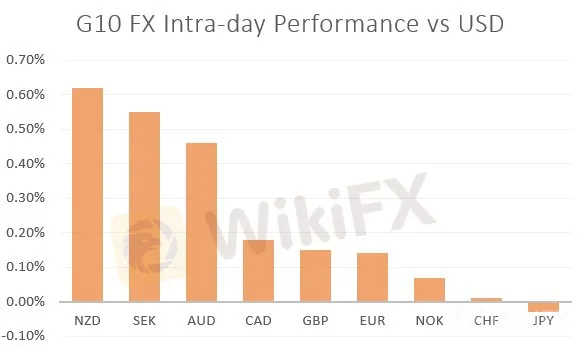

As such, in light of the softer inflation metrics and the surge in temporary factors, the USD had pared its initial gain, losing out to its major counterparts with both the EUR and AUD jumping to session highs, while US 10yr yields broke below 2.5%. Nonetheless, when comparing US growth to the RoW, the situation is much more supportive.

Source: Thomson Reuters, DailyFX

{5}

DailyFX Economic Calendar: – North American Releases

{5}

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator