简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Will US GDP Stoke Currency Volatility Across USD Forex Pairs Tomorrow?

Abstract:The highly anticipated first quarter US GDP report is due for release during Friday's session. What might tomorrow's numbers mean for the US Dollar and currency volatility?

USD CURRENCY VOLATILITY – TALKING POINTS:

Overnight implied volatility metrics for major USD currency pairs leaps ahead of Fridays US GDP data release which may potentially stoke a sizable market reaction

The DXY US Dollar Index recently surged above technical resistance to its highest level since May 2017 and could suggest USD traders are expecting tomorrows GDP numbers to beat estimates

Take a look at this article for information on How to Trade the Top 10 Most Volatile Currency Pairs or download the free DailyFX Q2 USD Forecastfor comprehensive fundamental and technical insight on the US Dollar over the second quarter

Forex traders are starting to see signs that currency volatility could be ticking higher, led by the latest surge in the US Dollar. In fact, recent USD gains has pushed the DXY US Dollar Index above key resistance at the 98.00 price level which is its highest reading in nearly 2 years.

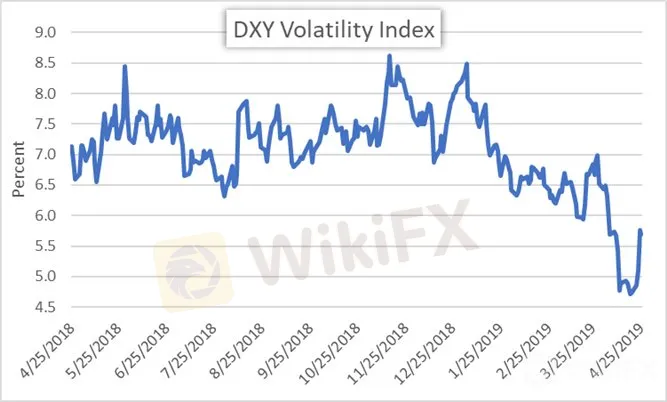

DXY US DOLLAR INDEX 1-MONTH IMPLIED VOLATILITY PRICE CHART: DAILY TIME FRAME (APRIL 24, 2018 TO APRIL 25, 2019)

Prior to the greenback‘s latest advance, forex market volatility was seemingly evaporating. But, price action looks to be picking up again judging by rising implied volatility which interestingly aligns with tomorrow’s potentially market-moving economic data.

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Performance in the major USD crosses tomorrow will largely depend on how closely actual Q1 US GDP is reported to consensus. Fed funds futures are currently pricing a 45 percent probability that the Fed will cut interest rates by its December 11 FOMC meeting.

If economic growth comes in above the 2.2 percent estimate, the odds that the Fed lowers its benchmark interest rate will likely drop which usually lifts the US Dollar. On the other hand, if GDP crosses the wires below forecast, markets could begin pricing in a higher likelihood that the Fed cuts rates this year.

FOREX ECONOMIC CALENDAR – USD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Currency pairs of interest highlights EURUSD, USDJPY and AUDUSD. Greenback gains could be limited against the Euro if GDP surprises to the upside considering recent EURUSD price action. On the other hand, there could be more room for the USD to run against the Aussie considering weak inflation out of Australia likely sets up the RBA for a rate cut.

Also, a US GDP beat would likely enhance risk appetite and send traders flocking out of anti-risk currencies like the Japanese Yen, especially given the BOJ‘s reiterated dovishness. That being said, JPY could see a boost from US GDP coming in below estimates, particularly if the report is bleak enough to reignite market pessimism and flight to ’safe-haven securities.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator