简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

3 Scenarios to Consider for the S&P 500 Ahead of US GDP

Abstract:The initial print of first quarter GDP from the world‘s largest economy will cross the wires Friday as equity bulls hope for a strong figure, the implications for the Fed’s policy path may dictate conviction.

S&P 500 Talking Points:

Strong earnings were able to control early weakness in the S&P 500 and the Nasdaq, driving them into the green at Thursdays close

The initial release of 1Q US GDP is due Friday, April 26 at 12:30 GMT

See how IG Clients are positioned on the S&P 500 ahead of US GDP with Retail Sentiment Data

3 Scenarios to Consider for the S&P 500 Ahead of US GDP

On the heels of stellar earnings from Facebook and Microsoft, the S&P 500 saw a mixed trading day, briefly slipping into the red before climbing into positive territory ahead of the close. Volatility has been lacking in the recent melt up but the release of US GDP on Friday could buck that trend.

Check out our Second Quarter forecasts for the S&P 500, Dow Jones, Gold and more.

While GDP estimates range from 1.4% to as high as 2.8%, Bloomberg‘s aggregate measure projects a 2.2% print tomorrow. As always, markets will judge the data in three ways – a hit, miss or beat. However, with the recent capitulation from the Federal Reserve and the subsequent rebound in US equities, a typically bullish print could be undone by the implications for the central bank’s policy path.

US GDP Shatters Estimates

In the event that Fridays GDP release is above expectations, markets will likely look to the degree of outperformance. It could be argued anything above 2.5% - within the upper bound of projections – would significantly increase the chances of a rate hike from the Federal Reserve and consequently pressure the S&P 500.

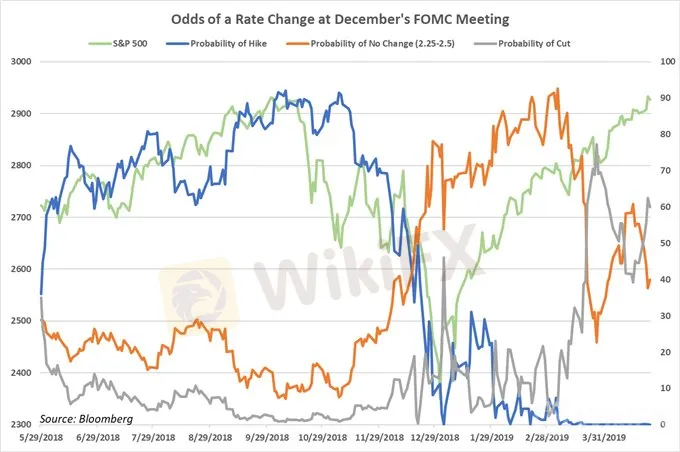

While strong growth is indicative of a healthy economy, the Feds outlook on interest rates has proven a more dominant concern in recent months as the S&P 500 has climbed alongside the falling chance of a rate hike at upcoming Fed meetings.

US GDP Lands Near Expectations

With the Federal Reserve in mind, a Goldilocks data print may be the best-case scenario for the S&P 500. A release at the expected 2.2% or thereabouts, would likely offer support for the current monetary policy outlook. In turn, analysts may look to earnings and corporate forecasts to drive price but if the impact from trade wars and a partial government shutdown are discounted, a miss may be in store. A miss would further the recent trend in the Citi Economic Surprise Index which has seen US data consistently miss expectations in the latter half of the first quarter and April.

US GDP Misses Substantially

Data considerably beneath market expectations could also see the initial reaction lack conviction as the greater implications on monetary policy are considered. The market already sees the odds of a rate cut at Julys FOMC meeting above 60%, just two months after they were effectively zero. An abysmal growth figure could see these odds skyrocket – potentially spurring the S&P 500 higher. Looking at 30-day Fed Funds interest rate futures, the market is currently pricing the effective interest rate in December 2019 at 2.24%.

S&P 500 Price Chart: Daily Time Frame (August 2018 – April 2019)

S&P 500 overlaid with Fed Funds interest rate futures

For live webinar coverage of the release, join Analyst David Song at 12:15 GMT Friday. Outside of equities, explore potential trades in the US Dollar, Gold and more with analyst James Stanleys Price Action Setups video.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator