简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: Q119 US GDP & EURUSD Price Forecast

Abstract:The initial Q119 US GDP report is due on Friday, April 26 at 12:30 GMT.

Talking Points:

谈话要点:

- The initial Q119 US GDP report is due on Friday, April 26 at 12:30 GMT.

- 最初的Q119美国GDP报告将于4月26日星期五格林尼治标准时间12:30公布。

{2}

- Retail traders are fading US Dollar gains, and the outlook for EURUSD has turned bearish.

- 零售交易商的美元涨幅正在逐渐消退,欧元兑美元的前景已经转为看跌。

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

周一7:30加入我EDT / 11:30 GMT为FX Week Ahead网络研讨会,我们将讨论未来几天的顶级事件风险以及围绕下列事件进行外汇市场交易的策略。

04/26 FRIDAY | 12:30 GMT | USD GROSS DOMESTIC PRODUCT (1Q A)

04 / 26周五| 12:30 GMT |美元国内生产总值(1Q A)

For much of the first quarter, there was great concern that the US government shutdown between December 23 and January 25 would have a significant negative impact on Q1‘19 US GDP. And while the Congressional Budget Office estimated that a net $3 billion in wages would be lost, ultimately, it appears that the underlying strength of the US economy will have prevailed past the government’s self-inflicted wounds.

在第一季度的大部分时间里,美国政府在12月23日至1月25日期间关闭的问题将引起严重的负面影响。美国第19季度GDP。虽然国会预算办公室估计将损失30亿美元的工资,但最终看来,美国经济的潜在优势将超过政府自身造成的伤害。

{7}

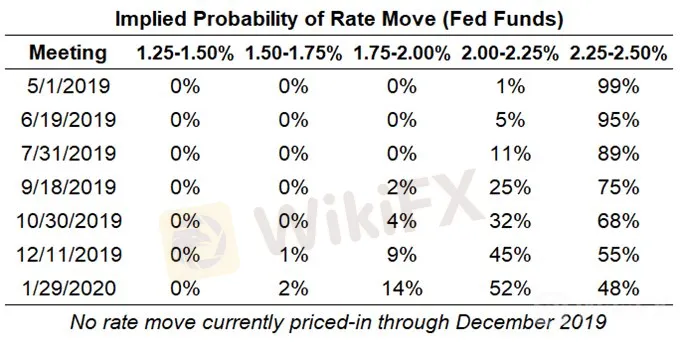

As such, rate expectations have evolved in a manner to suggest that market participants no longer feel the Federal Reserve will embark on a dovish policy course in the imminent future. In fact, at the end of March, Fed funds futures were pricing in greater than a 50% chance of a 25-bps rate cut by July 2019; now, markets are favoring the Federal Reserve to stay on hold for the rest of 2019.

因此,利率预期以某种方式发展建议市场参与者不再感到美联储将在即将来临的时候开始实施鸽派政策。事实上,截至3月底,联邦基金期货价格在2019年7月降息25个基点的可能性超过50%;现在,市场对美联储有利在2019年的剩余时间里保持不变。

Such a dramatic shift in expectations in just the span of a few weeks has proven helpful to the US Dollar as it tries to work off a six-month long consolidation (via the DXY Index), mirroring the multi-month consolidation seen in EURUSD.

在短短几周的时间内,这种戏剧性的预期转变已证明对美元有所帮助,因为它试图解决为期六个月的整合(通过DXY指数),反映了欧元兑美元的多月合并。

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

需要观察的对象:DXY指数,欧元兑美元,美元兑日元,黄金

EURUSD Technical Forecast: Daily Price Chart (January 2018 to April 2019) (Chart 1)

EURUSD技术预测:每日价格走势图(2018年1月至2019年4月)(图1)

EURUSD rates weakened meaningfully by the end of the week, with the uptrend from the April 2 low busted by the breakdown on April 18. Momentum has started to shift more to the downside, now that EURUSD price is below the daily 8-, 13-, and 21-EMA envelope. Similarly, daily Slow Stochastics have started to swing lower, while daily MACD has narrowed and nearly flipped to the downside.

EURUSD利率有意义地减弱在本周末,由于4月2日的崩溃导致4月2日的低点上行趋势受到打击。由于欧元兑美元的价格低于每日8,13和21-,因此动量开始向下移动。 EMA信封。同样,每日慢速随机指标开始走低,而日线MACD已经收窄并且几乎跌至下行。

Given rising European growth concerns, a strong Q119 US GDP report could reinvigorate US Dollar bulls and help breakout of the multi-month ranges trapping price action. After all, the last six-months of trading in EURUSD has been the tightest six-month range seen since the inception of the Euro on January 1, 1999.

鉴于欧洲经济增长担忧加剧,强劲的Q119美国GDP报告可能会重新焕发活力美元多头并帮助突破多个月区间诱捕价格行动。毕竟,自1999年1月1日欧元开始以来,欧元兑美元交易的最近六个月一直是最短的六个月范围。

IG Client Sentiment Index: EURUSD (April 19, 2019) (Chart 2)

IG客户情绪指数:EURUSD(2019年4月19日)(图2)

EURUSD: Retail trader data shows 60.2% of traders are net-long with the ratio of traders long to short at 1.52 to 1. The number of traders net-long is 10.8% higher than yesterday and 6.2% lower from last week, while the number of traders net-short is 22.7% lower than yesterday and 14.1% lower from last week.

EURUSD:零售交易者数据显示60.2%的交易者是净持有者与交易者的比率交易商净多头比昨天增加10.8%,比上周减少6.2%,而交易商净空头数比昨天减少22.7%,较上周减少14.1% 。{/ p>

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

我们通常采取逆向观点来看待情绪,事实上交易者是新的-long表明欧元兑美元价格可能继续下跌。交易商比昨天和上周进一步净多头,目前市场情绪和近期变化的结合使我们对欧元兑美元看跌的逆势交易偏见更加强烈。

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

Forex Economic Calendar Week Ahead: Fed Meeting, New Zealand GDP, Australia Jobs & More

Three central bank meetings are on the calendar over the coming week, including the Federal Reserve and the Bank of Japan.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator