简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Next Brexit Steps to Prove Pivotal for EURGBP, GBPJPY, GBPUSD Prices

Abstract:Brexit is out of the headlines for now. All of that will change next week.

Traders have been able to ignore the Brexit mess for the past few days, particularly as UK parliament is out of session until April 23 due to the Easter holiday. But as the end of the week comes into focus – tomorrow is effectively the last day for Europe, given the closure for Good Friday – traders should start thinking about what will come next in the Brexit process once markets resume full steam ahead after Easter Monday.

Next Steps in the Brexit Timeline: April

By the end of April: Now that the European council has agreed to extend the Brexit deadline to October 31, 2019 with a check-in at the end of June, UK Prime Minister Theresa May and Labour party leader Jeremy Corbyn have continued cross-party talks. The goal is to find enough common ground to whip the votes for the EU-UK Withdrawal Agreement to pass through UK parliament. Early indications from both Labour and Tory party officials suggest that the talks will result in very little.

If ‘no’ cross-party deal (most likely outcome): Tory party leader May could step down as prime minister. If so, this would trigger a new Tory party leadership election in May. If UK PM May does not resign, the Labour party would likely take other steps in May.

If ‘yes’ cross-party deal: A cross-party deal could take two different forms. On one hand, it could mean that there is enough cross-party support for a ‘soft Brexit,’ something that hasnt come together in any of the indicative votes put forth in parliament yet. On the other hand, a cross-party deal could be an agreement for a second referendum on the Brexit vote altogether.

Next Steps in the Brexit Timeline: May

If Theresa May Resigns: If May has resigned as PM, the Tory party would hold new leadership elections, very likely seeing a ‘hard Brexiteer’ come to power. In turn, moderate Tories could leave the party, leaving the Tories without enough support for a governing majority. Without a governing majority, a general election would need to be called.

If Theresa May Does Not Resign: If UK PM May does not resign, it is likely that the Labour party brings forward a no confidence vote forward. If the vote succeeds, then a general election would need to be called. If the vote fails, then odds are extremely high that no progress will be made by the end of June check-in with the EU.

By May 22: If there are enough votes to get the EU-UK Withdrawal Agreement passed through UK parliament, ensuring a ‘soft Brexit,’ UK parliament will need to ratify the EU-UK Withdrawal Agreement by May 22 to avoid European elections. If the UK parliament fails to ratify the EU-UK Withdrawal Agreement, then the UK will have to partake in European parliamentary elections.

British Pound Positioning Paints Mixed Picture

The lack of clarity about what could happen over the next few weeks has provided little relief for traders; that the British Pound hasnt rallied during a time when volatility readings have been depressed is a cause for concern. Recent changes in positioning across the GBP-crosses suggests that if prices do rally, the nature of the rally will be a short-term relief rally; more evidence is required to determine whether or not GBP-crosses are bottoming out in tandem.

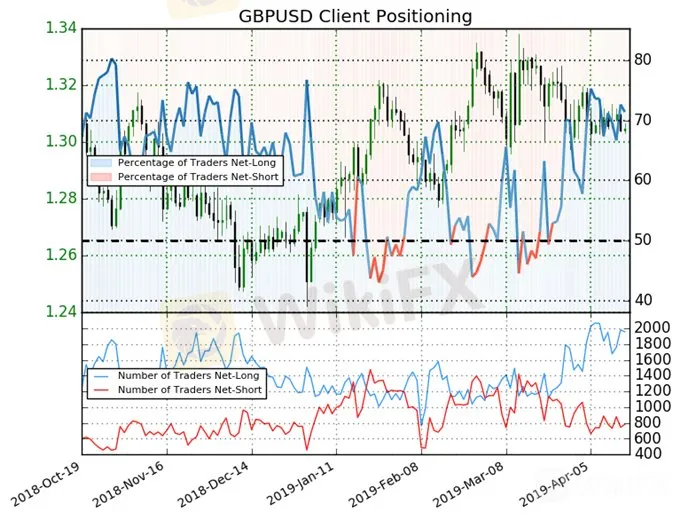

IG Client Sentiment Index: GBPUSD Price Forecast (April 17, 2019) (Chart 1)

GBPUSD: Retail trader data shows 71.4% of traders are net-long with the ratio of traders long to short at 2.5 to 1. In fact, traders have remained net-long since March 26 when GBPUSD traded near 1.32115; price has moved 1.2% lower since then. The number of traders net-long is 11.0% higher than yesterday and 6.6% lower from last week, while the number of traders net-short is 8.6% lower than yesterday and 6.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

IG Client Sentiment Index: GBPJPY Price Forecast (April 17, 2019) (Chart 2)

GBPJPY: Retail trader data shows 46.1% of traders are net-long with the ratio of traders short to long at 1.17 to 1. The number of traders net-long is 18.3% higher than yesterday and 4.0% lower from last week, while the number of traders net-short is 5.5% lower than yesterday and 29.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPJPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBPJPY trading bias.

IG Client Sentiment Index: EURGBP Price Forecast (April 17, 2019) (Chart 3)

EURGBP: Retail trader data shows 39.6% of traders are net-long with the ratio of traders short to long at 1.52 to 1. In fact, traders have remained net-short since April 5 when EURGBP traded near 0.86018; price has moved 0.8% higher since then. The number of traders net-long is 7.7% lower than yesterday and 4.4% lower from last week, while the number of traders net-short is 8.8% higher than yesterday and 2.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURGBP prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURGBP-bullish contrarian trading bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GBP/USD (CABLE) 4Hour Anticipation

Daily wise bearish structure, but as 4H shown shift in structure to the topside

British Pound Technical Analysis - GBP/USD, EUR/GBP

BRITISH POUND, GBP/USD, EUR/GBP - TALKING POINTS

Weekly British Pound Forecast: Inflation Report Due Ahead of BOE Meeting; Brexit Talks Ongoing

As Brexit talks persist, the BOE remains sidelined. And with the UK parliament prorogued, all attention is on UK PM Johnson's talks with his EU counterparts.

GBPUSD Price Rallies to a Six-Week High, Brexit Latest

GBPUSD has just hit its highest level since late-July and is eyeing further gains on a combination of a marginally stronger Sterling complex and a weak US dollar.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator