简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Support Held on Negative BoC Business Outlook, AUD Eyes RBA

Abstract:The Canadian Dollar fell as BoC business outlook resulted negative, fueling interest rate cut expectations as USD/CAD support held. Ahead, AUD/USD may fall to support on RBA minutes.

Asia Pacific Market Open Talking Points

Canadian Dollar drops with crude oil prices as BoC fuels rate cut bets

Wall Street swings as US earnings season begins with mixed results

Australian Dollar at risk if RBA minutes build on global growth risks

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in theDailyFX Webinars. Wed love to have you along.

FX News Monday

The Canadian Dollar underperformed on Monday alongside volatility in crude oil prices. It began with downside gaps which may have been as a result of growing concerns about a provincial election in Alberta that may create uncertainty for a portion of Canadas energy sector. This was then followed by a slew of disappointing Canadian economic data.

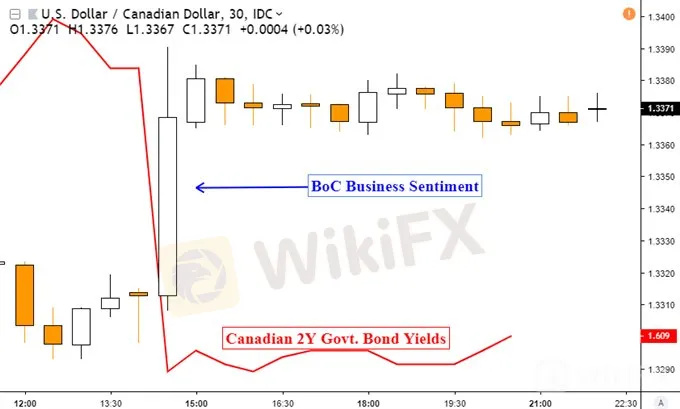

Bank of Canadas overall business outlook survey contracted 0.6 in the first quarter of 2019 which was the first negative outcome since 2016. Accompanying this was growing concerns about inflation expectations from the central bank. On the chart below, you can see Canadian front-end government bond yields falling as USD/CAD rose. This reflected increased BoC rate cut expectations.

Check out the DailyFX Economic Calendarfor critical currency event risk!

USD/CAD Rises on BoC Business Outlook Survey

Chart Created in TradingView

{12}

USD/CAD Technical Analysis

{12}

USD/CAD still remains in a well-defined range between 1.3251 and 1.3469 after support held over the past 24 hours yet again. This may signal that perhaps it could be readying up to test resistance next. On the other hand, the daily chart below shows that if there is a downside breakout, that requires overcoming more psychological barriers than a turn higher. These include former resistance from early 2019 and rising support from late January.

USD/CAD Daily Chart

Chart Created in TradingView

Tuesdays Asia Pacific Trading Session

Sentiment-oriented currencies such as the Australian and New Zealand Dollars could be looking to a mixed start as Tuesday gets underway. A mixed beginning to the US earnings season, with Goldman Sachs and Citigroup having just passed, saw Wall Street swing as the S&P 500 ended more-or-less little changed at -0.06%. As such, Asia equities may be heading for consolidation.

AUD/USD could be vulnerable to monetary policy fundamental themes, with the RBA minutes from the April meeting on the docket. This is because the central bank has been slowing hinting that it is watching certain risks to their outlook such as slowing global growth. If the document echoes and builds on growing concerns from policymakers, the Aussie may weaken.

FX Trading Resources

See how equities are viewed by the trading community at the DailyFX Sentiment Page

Join a free Q&A webinar and have your trading questions answered

See our free guide to learn what are the long-term forces driving US Dollar prices

See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

{25}

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

{25}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

Canadian Dollar Technical Analysis: Short-term CAD Weakness Anticipated–Setups for CAD/JPY, USD/CAD

While the BOC has turned more hawkish, other fundamental factors are working against the Canadian Dollar in the near-term. Volatility and weakness in oil prices coupled with a stretch of disappointing Canadian economic data are weighing on the Loonie. According to the IG Client Sentiment Index, USD/CAD rates have a bullish bias in the near-term.

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator