简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Rebound from April-Low Stalls Following FOMC Minutes

Abstract:The recent advance in the price for gold appears to have stalled following the FOMC Minutes as it snaps the series of higher highs and lows from earlier this week.

Gold Price Talking Points

Gold pulls back from a fresh weekly high ($1311) following the Federal Open Market Committee (FOMC) Minutes, and the recent advance in the price for bullion appears to have stalled ahead of weekend as it snaps the series of higher highs and lows from earlier this week.

Gold struggles to retain the rebound from the monthly-low ($1281) as the FOMC Minutes suggest the central bank has yet to abandon the hiking-cycle, and the committee may continue to endorse a wait-and-see approach at the next interest rate decision on May 1 as ‘participants generally agreed that a patient approach to determining future adjustments to the target range for the federal funds rate remained appropriate.’

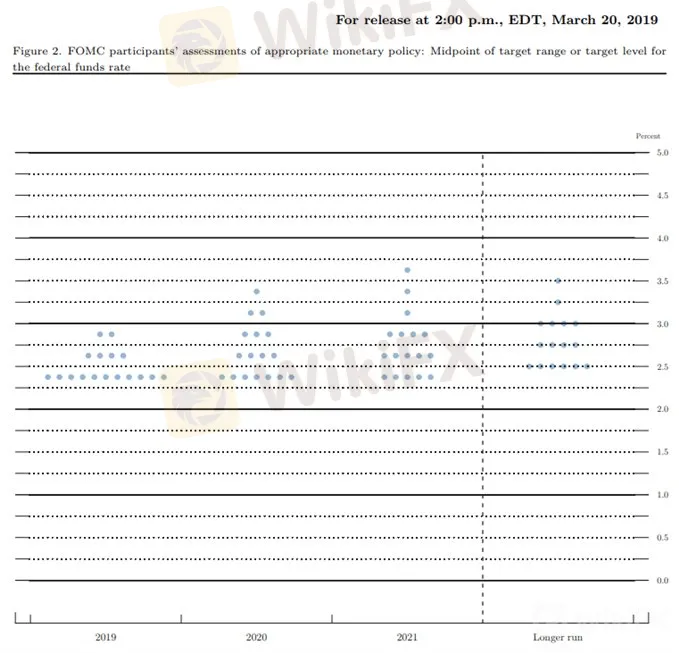

It seems as though Fed officials are no in rush to further adjust the forward-guidance for monetary policy as the central bank plans to wind down the $50B/month in quantitative tightening (QT) by the end of September, and Chairman Jerome Powell & Co. may continue to project a longer-run interest rate of 2.50% to 2.75% as ‘some participants indicated that if the economy evolved as they currently expected, with economic growth above its longer-run trend rate, they would likely judge it appropriate to raise the target range for the federal funds rate modestly later this year.’

It remains to be seen if Fed officials will make additional changes to the Summary of Economic Projections (SEP) as ‘a majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year,’ and the central bank may continue to endorse a ‘patient’ approach over the coming months as ‘participants continued to view a sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective as the most likely outcomes over the next few years.’

However, market participants appear to be unconvinced, with Fed Fund Futures still highlighting bets for a rate-cut in December, and the inversion in the U.S. Treasury yield curve may fuel concerns of a policy error as it warns of a looming recession. In turn, gold may continue to benefit from the current environment as market participants look for an alternative to fiat-currencies, but recent price action instills a mixed outlook for the precious metal as it snaps the series of higher highs and lows from earlier this week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Gold Price Daily Chart

Keep in mind, the broader outlook for gold remains mired by the threat of a head-and-shoulders formation, with the Relative Strength Index (RSI) highlighting a similar dynamic as it continues to track the bearish trend from earlier this year.

Nevertheless, the opening range for April instills a constructive view for gold amid the lack of momentum to test the 2019-low ($1277), with the $1279 (38.2% retracement) area still offering support.

However, lack of momentum to push back above the Fibonacci overlap around $1315 (23.6% retracement) to $1316 (38.2% expansion) raises the risk for range-bound prices.

Need a break above the overlap to bring the $1328 (50% expansion) to $1329 (50% expansion) region on the radar, which sits just above the March-high ($1324).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Gold Analysis: Steady Prices Amid Key Economic Data

Gold prices remain steady as investors anticipate Federal Reserve Chairman Jerome Powell’s upcoming speech and the U.S. Non-Farm Payrolls data. Geopolitical tensions and economic uncertainties continue to support safe-haven demand for gold, while higher U.S. yields exert downward pressure. Key economic events this week include JOLTs Job Openings, ADP Employment Change, and the Non-Farm Payrolls report.

Gold Supported by Weak U.S. Data and Inflation Concerns

Gold prices are buoyed by weak U.S. economic data, reduced Fed rate hike expectations, and ongoing geopolitical tensions. The precious metal is set for its third consecutive quarterly gain, with upcoming U.S. inflation data being closely monitored.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

WikiFX Broker

Latest News

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Spain plans 100% tax for homes bought by non-EU residents

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Currency Calculator