简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

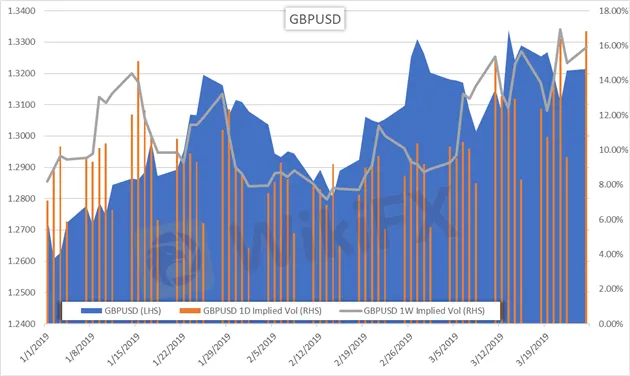

GBPUSD: Brexit Latest Pushes Overnight Implied Volatility to Extremes

Abstract:Spot GBPUSD could skyrocket or plummet over the next 24-hours according to implied volatility priced in to overnight option contracts as the Brexit saga continues.

GBPUSD IMPLIED VOLATILITY – TALKING POINTS

Prime Minister Theresa May stated that she will not put her Withdrawal Agreement to a vote tomorrow due to continued lack of majority support as the latest Brexit drama drags on

Currency markets still await clarity on the next direction of Brexit and its impact on the Sterling as the risk of UK departing the EU without a deal remains elevated

Want to sharpen your GBP knowledge? Read up on What Every Trader Needs to Know about the British Pound

GBPUSD overnight implied volatility has jumped to its highest level since November 15 as forex option traders price in the latest Brexit uncertainty. Increasing implied volatility reflects higher ‘insurance’ costs for GBPUSD currency traders who utilize options to hedge their positions and reflects the market‘s view that spot prices could experience significant swings over the contract’s respective duration.

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Prime Minister Theresa May still faces an uphill battle to get her Brexit deal passed through the House of Commons as British MPs remain opposed to supporting the Withdrawal Agreement negotiated with the EU. Parliament has previously rejected the Brexit deal twice and has led the UK government to request an extension to Article 50 in a last-minute attempt to save Brexit.

The European Council agreed to delay Brexit until April 12, but the new deadline is contingent on the UK approving the Brexit deal on the table – a deal that is not open for further negotiations according to EUCO President Donald Tusk. Moreover, the so-called Strasbourg Agreement offered by the EU to extend the March 29 Brexit deadline is not legally binding and is contingent on the UK to approving the Brexit deal. In other words, the UK is still largely at risk of a ‘hard’ no-deal Brexit departure from the EU this Friday.

Check out this Brexit Timeline for key events driving the UKs departure from the EU

The struggle continues for Theresa May as she keeps fighting for enough Parliamentary support to secure a Brexit deal this week. Despite the PMs efforts to get majority backing for her Brexit deal, she has just announced to Parliament that “there is not sufficient support in the Commons to bring back the Withdrawal Agreement for a third meaningful vote.”

PM May added to her statement that the government will oppose the Letwin Amendment but will still provide time for Parliament to vote on it tonight around 22:00 GMT. The motion could provide MPs with options over the direction of Brexit that has potential to pass with majority. Although, as things stand currently, it increasingly appears that only 2 choices remain for Brexit: revoke Article 50 and stop Brexit or depart the EU with no deal.

GBPUSD TRADER CLIENT SENTIMENT

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

Given the vast Brexit uncertainty, GBPUSD client positioning according to IG data indicates a mixed bias with 50.1 percent of traders holding net-long positions. The number of traders net-long is 1.7 percent higher than Friday but 3.7 percent lower than last week.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

BoJ Holds Firm on Tightening Path Fuels Yen

The Bank of Japan (BoJ) remains on course with its monetary tightening policy, according to the BoJ Chief, following his hearing at the Japan Lower House.

Eye on Today’s FOMC Meeting Minutes

Wall Street took a pause in the last session, with all three major indexes remaining relatively flat as investors awaited the highly anticipated FOMC meeting minutes.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Standard Chartered Secures EU Crypto License in Luxembourg

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator