简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/JPY Retail Longs Surge Even as Bullish Momentum Abates

Abstract:The recent rebound in USD/JPY has sparked a further adjustment in retail interest even as the RSI threatens the bullish formation from earlier this year.

Japanese Yen Talking Point

USD/JPY fails extend the series of lower highs & lows from the previous week, with the recent rebound sparking a further adjustment in retail interest, but developments in the Relative Strength Index (RSI) warn of a further decline in the exchange rate as the oscillator threatens the bullish formation from earlier this year.

The pullback from the monthly-high (112.14) appears to be sputtering even though the U.S. Non-Farm Payrolls (NFP) report saps bets for a Federal Reserve rate-hike, and USD/JPY may continue to consolidate ahead of the next interest rate decision on March 20 as the central bank is widely anticipated to retain the current policy.

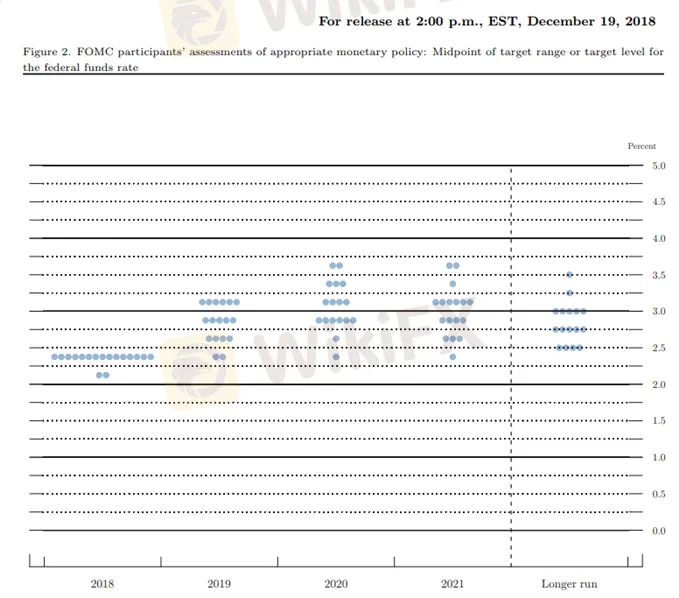

In turn, the updates to the Summary of Economic Projections (SEP) may sway foreign exchange markets as the central bank gradually alters the forward-guidance for monetary policy, and it remains to be seen if Fed officials will continue to forecast a longer-run interest rate of 2.75% to 3.00% as the Federal Open Market Committee (FOMC) appears to be abandoning the hiking-cycle.

Keep in mind, the shift in the forward-guidance comes as Fed officials warn ‘that some risks to the downside had increased, including the possibilities of a sharper-than-expected slowdown in global economic growth, particularly in China and Europe, a rapid waning of fiscal policy stimulus, or a further tightening of financial market condition,’ and the weakening outlook for the world economy may largely benefit the Japanese Yen as it drags on carry-trade interest.

Nevertheless, updates to IG Client Sentiment Report reveal a further adjustment in retail interest as 48.0% of traders are now net-long USD/JPY, with the ratio of traders short to long at 1.08 to 1. Traders have been net-short since February 27 when USD/JPY traded near 110.60, with the ratio slipping to an extreme reading earlier this month, but the IG Client Sentiment index has recovered as the exchange rate continues to fall back from the monthly-low (112.14).

A deeper look shows the number of traders net-long is 21.1% higher than yesterday and 23.9% higher from last week, while the number of traders net-short is 11.0% higher than yesterday and 14.8% lower from last week. The surge in net-long position suggests traders are looking for range-bound conditions as USD/JPY retraces the decline from earlier this month, but a further shift in retail interest may bring back the extreme readings that occurred ahead of the currency market flash-crash as the recent pickup in market volatility boosts participation.

With that said, a flip in the IG Client Sentiment index may warn of a broader shift in USD/JPY behavior, with the exchange rate at risk of threatening upward trending channel from earlier this year especially as the Relative Strength Index (RSI) highlights a similar dynamic. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

USD/JPY Daily Chart

Near-term outlook for USD/JPY remains constructive as both price and the RSI continue to track the upward trends from earlier this year, but the correction following the currency market flash-crash appears to be sputtering amid the lack of momentum to test the Fibonacci overlap around 112.40 (61.8% retracement) to 113.00 (38.2% expansion).

As a result, failure to hold above the 111.10 (61.8% expansion) to 111.80 (23.6% expansion) region raises the risk for a move back towards 109.40 (50% retracement) to 110.00 (78.6% expansion), which largely lines up with channel support.

Next downside region of interest comes in around 108.30 (61.8% retracement) to 108.40 (100% expansion), but failure to extend the series of lower highs & lows from the previous week may generate range-bound conditions over the coming days.

For more in-depth analysis, check out the Q1 2019 Forecast for the Japanese Ye

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

WikiFX Broker

Latest News

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Broker Review: Is FOREX.com a solid Broker?

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Tether to Discontinue EURt Stablecoin Amid Regulatory Shifts in Europe

Adani’s Bribery Scandal! SEC Charges, Major Fallout & Adani’s Stand

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

Currency Calculator