简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX international version officially landed in Thailand

Abstract:With the launch of WikiFX international version, more and more Forex investors of different countries can enjoy the unparalleled service of WikiFX.

With the launch of WikiFX international version, more and more Forex investors of different countries can enjoy the unparalleled service of WikiFX.

WikiFX received lots of requests from foreign investors to make the apps available in overseas market (outside China) during the initial stage of WikiFX official launch. Our team, therefore, put lots of effort and worked day and night in building the international version of WikiFX. Now, the apps has been launched in different countries with numerous language versions supported.

Today, WikiFX international version is officially launched in Thailand.

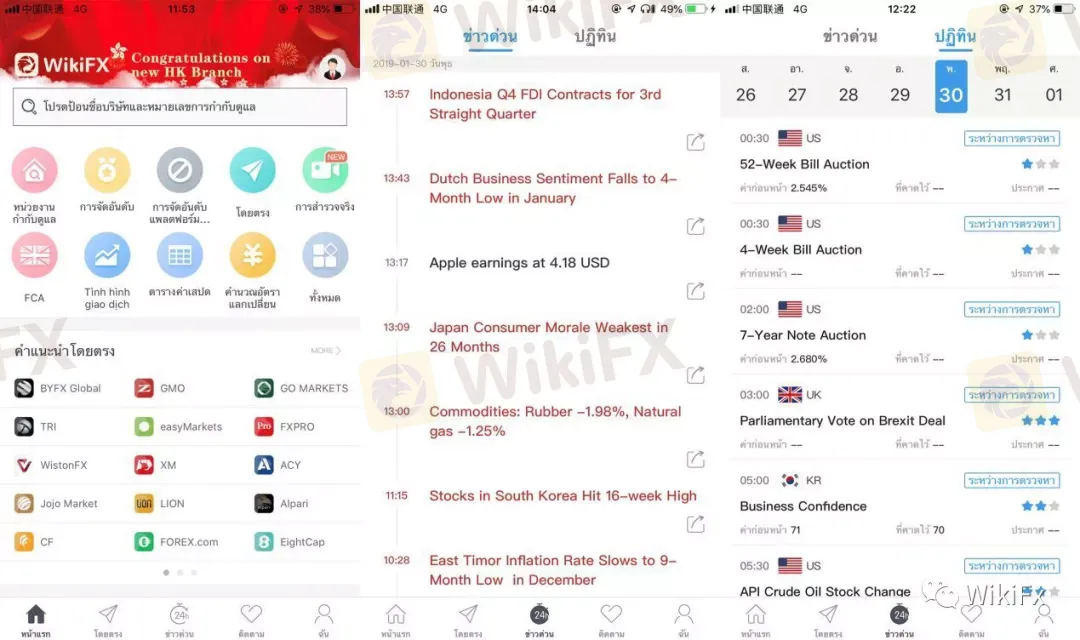

Screenshot of WikiFX in Thai

User can switch to Thai language at “ME” after loading the WikiFX APP.

Instructions of language switching

1. Go to the homepage of WikiFX and click on “Me” at the lower right corner.

2. Click on “Language” optio

3. Browse and choose the language you want.

4. Click on “Finish” at the upper right corner to finish the language setting

Expanding our service coverage does not merely enable user registration and provide more language options, we had to aggregate, analyze and present the information of Forex brokers and industry outlook of respective country market.

WikiFX aims at providing personalized, precise and accurate Forex information for investors of different countries.

Nowadays, WikiFX international versions can be used in 180 countries and regions and is expected to expand its coverage worldwide.

WikiFX interational version will keep on updated and upgrade on timely basis to meet the increasing demand of the user, aiming at providing more quality and effective information and safeguard the interest of users worldwide.

Now, WikiFX international version is available in bothApple Store and Google Play.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Will EU Lose After Brexit?

Britain has officially left the European Union on January 31st , 2020, and will soon start negotiations with the European Union regarding bilateral relations in the future. It is believed that Brexit will cause negative impacts on the European Union in multiple aspects.

AUD’s Trend Is Affected by Macro Economy

Latest statistics show Australia’s annualized CPI from Q4, 2019 to be 1.8%, lower than the central bank’s 2%-3% long term target range, which the inflation fails to reach ever since 2017.

What Do the Economic Indicators Say About GBP

British general election at the end of 2019 was conducted against a sluggish economy. Latest statistics show that Britain’s economy growth is stagnant and the once strong labor market has weakened. In the first half of 2020, the pound will need to navigate through the domestic economy, central bank policies and the crucial March budget. In addition, the Brexit negotiation is still in its preliminary stage, whether a free trade agreement can be successfully concluded will also be critical.

CAD Will Have Less Upward Momentum in the New Year

As the G10 currency that performed the best in 2019, Canadian dollar may see a rather smooth horizontal trend this year partly because weakening domestic economy, and partly because the positive influence of easing trade tensions has been fading. CAD rose 5% against the USD in 2019, with nearly half of the increase gained in the last few weeks, benefiting as several other currencies from a reduce of risk factors at the end of 2019.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator