简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ASEAN FX Eye Stock Losses, USD Gains. Crude Oil Fall May Boost PHP

Abstract:Stocks look more vulnerable, opening the door to US Dollar gains versus ASEAN currencies. Sentiment-linked crude oil prices may fall with weak demand, benefiting the

Trade all the major global economic data live and interactive at the DailyFX Webinars.

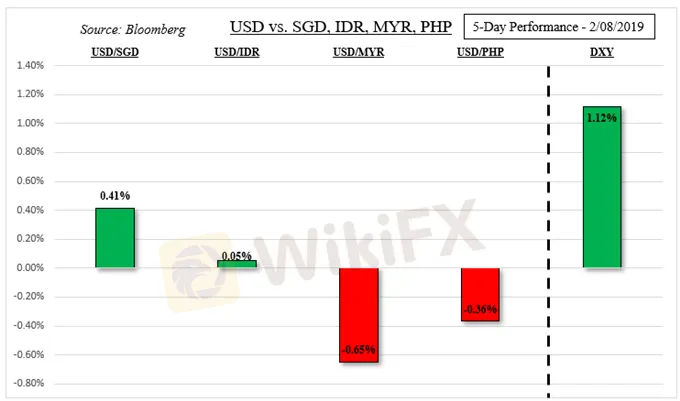

Despite a rally in the US Dollar last week triggered by a deterioration in sentiment, ASEAN currencies generally stood their ground excluding the Singapore Dollar (see chart below). Gains in the greenback were somewhat trimmed following the Bank of England ‘Super Thursday’ rate decision which boosted the British Pound. The Philippine Peso thus gained ground against USD, even after a mostly in-line BSP rate decision.

The Indonesian Rupiah ended the week little changed as expected, upheld by the Bank of Indonesia which sees its currency as undervalued. Arguably, it was the Malaysian Ringgit that showed the most resilience. After markets were closed for the Lunar New Year, Palm Oil futures (a key export for Malaysia) soared to their highest in about seven months. USD/MYR dropped sharply as a result.

The week ahead contains a plethora of trade data from the Philippines, Malaysia, Indonesia and China. The focus will probably be on the latter to continue gauging the impact of the worlds second largest economy slowing. Malaysia will also release GDP data, but USD/MYR could concentrate more on external developments relating to the impact of sentiment on financial markets.

Here, delayed US inflation data may surprise to the upside (as has been the tendency lately), perhaps helping to reduce dovish Fed monetary policy expectations. That could extend declines seen in the S&P 500 as of late as may be fundamentally running out of reasons to rally. The highly liquid US Dollar could benefit from these developments, perhaps continuing pressuring SGD.

The Greenback may struggle against IDR given how heavily the Bank of Indonesia is intervening in foreign exchange markets. Additional political risks include the US reentering a government shutdown if funding for President Donald Trump‘s border wall is not secured. He made a promise to construct it during last week’s rather uneventful State of the Union address. Meanwhile, the threat of a no deal Brexit inches closer.

The Philippine Peso could emerge unharmed next week if the monthly OPEC production report shows that despite continued supply cuts, demand could fall going forward as global growth slows. The commodity is a key import in the Philippines, the sharp decline in oil prices late last year bolstered PHP. If sentiment-sensitive oil prices fall with stocks and weakening demand, USD/PHP may rise.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Unconfirm Explosion in Middle East Stimulates Commodities Prices

The market was roiled by unconfirmed reports of explosions in Iran, Iraq, and Syria, adding to the already tense atmosphere following Iran's recent attack on Israel over the weekend. Anticipation of potential retaliation from Israel contributed to heightened nervousness in the markets throughout the week. Gold prices surged above the $2400 mark, while oil prices saw a gain of over 4% in the Asia opening session on Friday

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

GemForex - weekly analysis

The week ahead: US Dollar struggles to find demand

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator