简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stock Markets Look to Earnings and FOMC, DAX to Eurozone GDP

Abstract:The US stock market will look to earnings from some of the major corporations like Microsoft, Amazon and Facebook. Elsewhere, the DAX will look to

Equity Fundamental Forecast: Mixed

Earnings have been a source of optimism for equities and the trend may continue if giants like Apple and Amazon impress investors this week

The DAX will look to Eurozone GDP and German employment data which could provide more insight on a potential German recession

Italian GDP and Eurozone CPI may also impact the European equity markets beyond the FTSEMIB

Amazon, Microsoft, Apple and Others Will Drive US Equities

Last week was relatively stable for US indices as they closed Friday moderately higher than they opened Monday. Despite a prolonged government shutdown that is sapping GDP from the country, domestic indexes pushed higher. Strong earnings from airlines and some chip makers buoyed the broader market while other sectors slipped on global growth concerns. In the week ahead, earnings will look to drive price action once again.

Think the stock market is headed for a crash? Learn some bear market trading strategies and techniques.

Over 440 corporations will report earnings next week with FAANG members Amazon, Apple and Facebook included. Other corporate behemoths like Caterpillar and Verizon have the potential to sway entire sectors on their own. With that in mind, performances from these companies could greatly influence the overall price action of the market.

Thus far, earnings have been generally positive. Given the concerns of global growth and trade wars, relatively on-target performances seem to be more impressive than in prior quarters, at least from a sentiment perspective. With this new-found leeway, on-target earnings in the week ahead could be all that traders require to continue the recent bull trend even as the January effect wanes. Follow me on Twitter @PeterHanksFX for commentary and updates on specific corporate earnings and the season overall.

Looking for a technical perspective on Equity? Check out the Weekly Equity Technical Forecast.

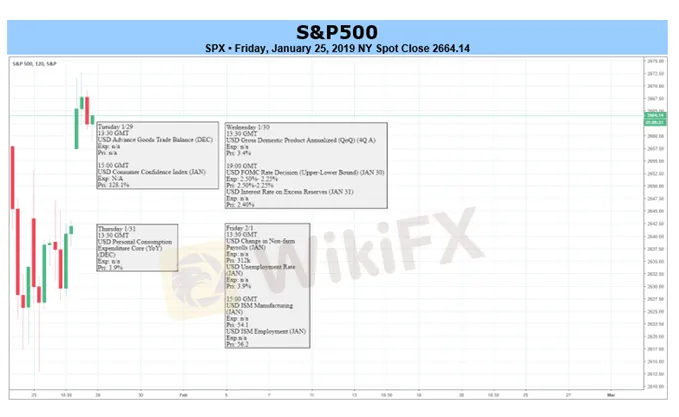

S&P 500 Price Chart Daily, February 2018 – January 2019 (Chart 1)

Learn about the differences between the Dow, Nasdaq, and S&P 500.

Another upcoming event for the S&P 500 is Wednesdays FOMC decision. While a change in the interest rate range is out of the question a change in tone, particularly to the hawkish side, could spell disaster for the US indexes. Luckily for bulls, it seems rather unlikely such a tone would be struck given the government shutdown implications on GDP and the fragile state of the equity markets.

Dax 30 Price Chart Daily, January 2018 – January 2019 (Chart 2)

German DAX Looks to Eurozone GDP and German Employment Data

As for the DAX, Eurozone GDP and German unemployment figures will command the most respect in the week ahead. Many speculators foresee the German economy entering a recession and the German index has shed over 17% from a recent high. On Christmas Eve, the index was down more than 23% from a year earlier.

View the economic events and data pieces due next week with our Economic Calendar.

If employment data impresses, a bear market could be staved off for some time longer. Similarly, an uptick in Eurozone GDP data could bolster the case for renewed German growth. With gloomy forecasts from the IMF, World Bank and other macroeconomic institutions, such positive surprises may be a longshot.

Italian GDP and the FTSEMIB

Elsewhere, other European equity markets will look to Italian GDP data due Thursday and Eurozone CPI on Friday. Italian GDP will be key for the FTSEMIB but also an important data point for other equity markets across the zone as it is one of the economies at risk. Further, the recent debate on acceptable levels of debt-to-GDP acceptable in the Italian economy will exacerbate the importance of this data print.

FTSEMIB Price Chart Daily, March 2018 – January 2019 (Chart 3)

Finally, Eurozone CPI could provide significant price movement across the continent as a surprise in either direction could spur the European Central Bank to alter policy. While a significant surprise is unlikely, it is an important risk to be wary of.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Trading Forecast: Risk Appetite Overcomes Growth Concerns

Speculative appetite – also called ‘animal spirits’ – is holding effective control over the capital markets. Despite regular warnings over the health of the global economy and infighting that suggests there is little capacity or will to fight future fires, the markets continue their advance in pursuit of capital gains.

Weekly Trading Forecast: Beware Volatility Between the Fed, NFPs, GDP and Trade Wars

The fundamental environment will grow increasingly tumultuous over the coming week. We wil continue to sort through general themes like the lifting of the US

Government Shutdown Weighs on GDP, Business-Leader Confidence

As the government shutdown drags on, investors are becoming increasingly concerned with the likelihood of a recession as business leader confidence dips.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator