简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

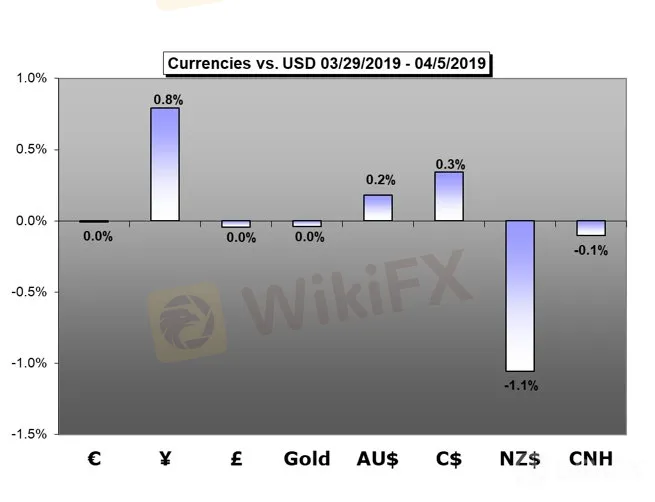

Weekly Trading Forecast: Risk Appetite Overcomes Growth Concerns

Abstract:Speculative appetite – also called ‘animal spirits’ – is holding effective control over the capital markets. Despite regular warnings over the health of the global economy and infighting that suggests there is little capacity or will to fight future fires, the markets continue their advance in pursuit of capital gains.

Australian Dollar Forecast – Australian Dollar Could Ride US-China Trade Hopes Higher Again

澳大利亚元预测 - 澳元兑美元可能再次走高美中贸易希望

The Australian Dollar still completely lacks domestic monetary policy support, and that will weigh on it more heavily in time. However, for now trade is running the table.

澳元仍然完全缺乏国内货币政策支持,这将对它在时间上更加重要。然而,目前交易仍处于亏损状态。

Oil Forecast– Crude Oil Prices Risk Fresh 2019 Highs as RSI Sits in Overbought Territory

原油预测 - 原油价格风险新高2019年高位因RSI在超买区域出现

Crude oil prices may trade higher over the coming days as the Relative Strength Index (RSI) sits in overbought territory for the first time in 2019.

原油价格可能在未来几天内走高,因为相对强弱指数(RSI)在2019年首次处于超买区域。

{5}

Gold Forecast –Prices at Risk with ECB Rate Decision, FOMC Minutes in Focus

黄金预测 - 欧洲央行利率决定风险价格,FOMC焦点会议纪要

Gold prices may fall if downbeat comments from the ECB and the Fed spur haven demand for US Dollar. Lower bond yields may help cap the downside.

黄金如果欧洲央行和美联储的悲观评论刺激避险资产对美元的需求,价格可能会下跌。较低的债券收益率可能有助于抑制下行。

Euro Forecast – Bearish, EURUSD May Fall on ECB. Brexit Deadline Near

欧元预测 - 看跌,欧元兑美元可能会下跌至欧洲央行。英国脱欧截止日期

The Euro outlook is bearish as EUR/USD might fall on the ECB and Mario Draghi press conference.

由于欧元/美元可能会因欧洲央行和马里奥德拉吉新闻发布会而下滑,欧元前景看跌。

Equities Forecast – Dow Jones, S&P 500, DAX 30 and FTSE 100 Fundamental Forecast

股市预测 - 道琼斯,标准普尔500指数,DAX 30和富时100基本预测

The start of earnings season in the United States will play a key fundamental role for both the S&P 500 and Dow Jones. Elsewhere, Brexit and trade wars remain key themes.

美国收益季节的开始将对标准普尔500指数和道琼斯指数起到关键作用。在其他地方,英国退欧和贸易战仍然是关键主题。

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

了解在DailyFX网络研讨会日历上计划覆盖外汇和资本市场关键事件风险的实时承保范围。

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.

了解零售交易者如何使用情绪页面上的IG客户端情绪读数来定位大公司。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator