简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

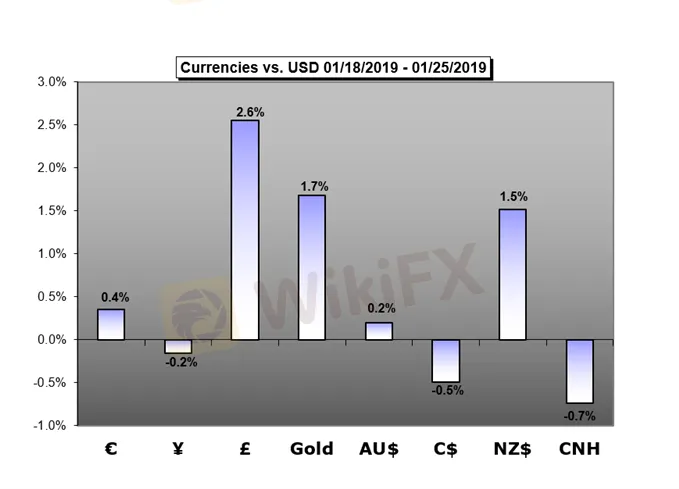

Weekly Trading Forecast: Beware Volatility Between the Fed, NFPs, GDP and Trade Wars

Abstract:The fundamental environment will grow increasingly tumultuous over the coming week. We wil continue to sort through general themes like the lifting of the US

Australian Dollar Forecast – Australian Dollar May Look Past CPI Report for the Fed and US Data

Why did the Australian Dollar fall after an upbeat jobs report? The same logic may undermine the impact of CPI data as AUD eyes the Fed and a plethora of US economic statistics ahead.

Crude Oil Forecast - Prices May Continue CLimb on GDP Growth Recovery Bet

Factors that dragged global growth forecasts lower could subside which has potential to rejuvenate the world economy and oil demand.

British Pound Forecast – Positive Backdrop, Bullish Outlook

Sterling is coming off its weekly highs heading into the weekend, but the outlook for a reinvigorated British Pound remains bullish.

US Dollar Forecast – US Dollar Torn Between Domestic Strength, Global Headwind

The US Dollar may be torn between signs of economic resilience domestically and worrying developments abroad. Another round of trade war negotiations is a wild card.

Gold Forecast – Gold Prices Eye Fed Rate Decision and US-China Trade Talks Next

After Golds sharp rally on Friday, price rests at a crucial inflection point ahead of the Fed rate decision and US-China trade talks.

Equities Forecast – Stock Markets Look to Earnings and FOMC, DAX to Eurozone GD

The US stock market will look to earnings from some of the major corporations like Microsoft, Amazon and Facebook. Elsewhere, the DAX will look to German employment data.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

Vietnamese Police Bust $1.2 Million Crypto Fraud Case

WikiEXPO Global Expert Interview: Loretta Joseph——Unlock the forefront of digital finance

XTB Receives Licenses to Operate in Indonesia & UAE

SEBI Bans Big "Finfluencers for Misleading Investors"

WikiFX New Year Bash: Chance to Win 70 USDT

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

Will Gold Shine Brighter in 2025?

WikiFX Review: Is HYCM still reliable in 2024?

Currency Calculator