简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar May Rise as Data Shows Consumers Mood Has Darkened

Abstract:The US Dollar may rise, finding support in haven demand as data from the University of Michigan shows consumers mood darkened in January.

- US Dollar may rise on soggy UofM consumer confidence data

- Yen lower as trade war de-escalation hopes lift APAC bourses

- Norwegian Krone gains as Prime Minister shores up coalition

The University of Michigan measure of US consumer confidence stands out on an otherwise dull economic calendar through the end of the trading week. The US government shutdown has dramatically slowed incoming news-flow, leaving investors pining for timely indicators offering a view of near-term economic conditions. That might make this release more market-moving than usual.

The headline sentiment index is seen ticking lower to 96.8. While that would be a five-month low, it would not amount to a dramatic departure from the prevailing upward trend. A disappointing outcome reflecting a raft of worries – like fiscal headwinds from the shutdown as well as disruption and uncertainty linked to the US-China trade war – may translate into broad-based risk aversion.

Perhaps counter-intuitively, the US Dollar might fare relatively well against such a backdrop. The benchmark currency has proven to be remarkably resilient despite the collapse of priced-in Fed rate hike expectations over the past two months. In fact, it rose to a 20-month high amid a vicious late-year market rout before pulling back as risk appetite steadied. That speaks to strong haven appeal waiting to entice anew.

YEN DOWN AS APAC STOCKS RISE, NOK UP AS PM SHORES UP COALITIONThe Japanese Yen narrowly underperformed in otherwise quiet Asia Pacific trade. The perennially anti-risk unit tracked lower as local stock markets followed Wall Street higher. The newswires chalked optimism to rumors that US Treasury Secretary Steven Mnuchin is pushing to scale back tariffs on China, despite a forceful official denial of any such effort.

Meanwhile, the Norwegian Krone traded broadly higher after Prime Minister Erna Solberg reached a deal with the Christian Democratic Party to broaden her ruling coalition. The move secures a legislative majority aimed at pushing through a raft of market-friendly policies, including tax cuts.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

ASIA PACIFIC TRADING SESSION

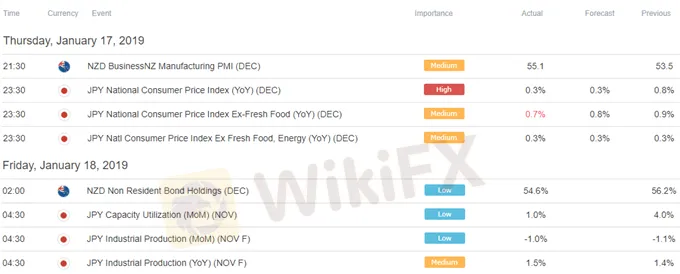

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES- Just getting started? See our beginners‘ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Volatility and Strategic Moves by Major Economies and Companies

Global markets face volatility with significant declines in US and Asian stocks due to central bank rate decisions and economic uncertainties. JPMorgan's recession forecast, and Cathie Wood's tech stock acquisitions. Additionally, geopolitical tensions, market shifts in New York and Thailand, and rising energy prices in Europe highlight the diverse factors influencing the global financial landscape.

Dovish Fed’s Statement Hammers Dollar

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

<Part 2> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

<Part 1> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator