简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

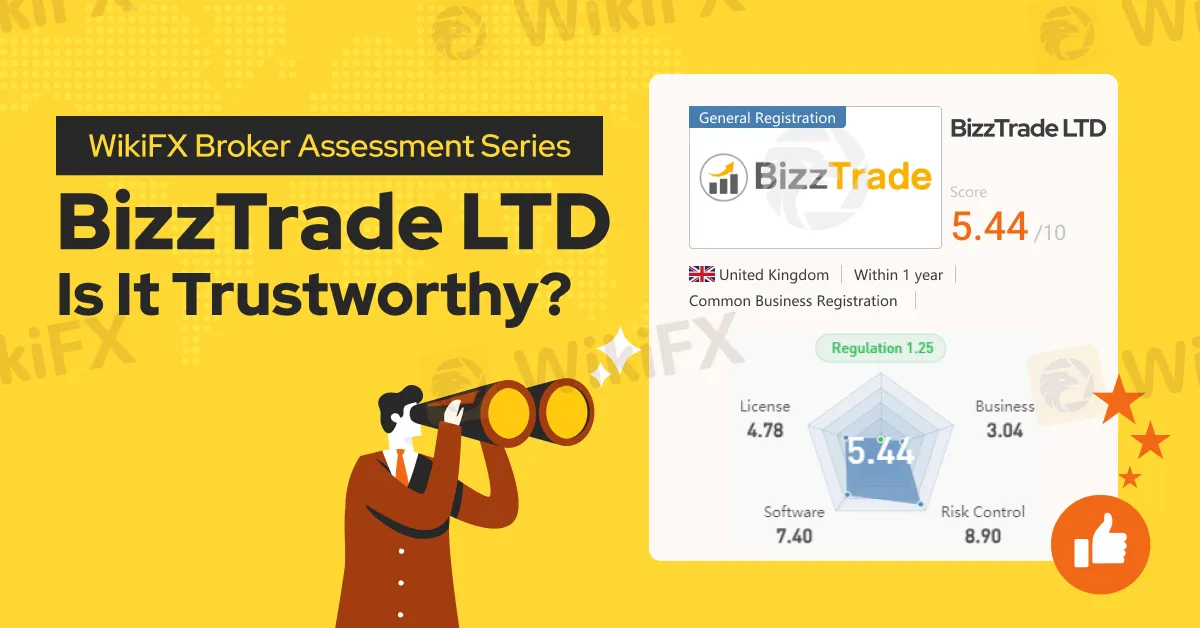

WikiFX Broker Assessment Series | BizzTrade Ltd: Is It Trustworthy?

Abstract:In this article, we conduct a comprehensive examination of BizzTrade Ltd, exploring its key features, fees, safety measures, deposit and withdrawal options, trading platforms, and customer service. WikiFX endeavors to provide you with essential information to help you make an informed decision about using this platform.

Background:

Registered in the United Kingdom, BizzTrade Ltd (BizzTrade) operates as an online brokerage specializing in the trading of exchange-traded CFDs.

BizzTrade offers a diverse range of tradable assets, including currency pairs, precious metals, cryptocurrencies, stock indices, and commodities.

Types of Accounts:

BizzTrades official website does not display multiple account options, leading to the conclusion that BizzTrade likely offers only one type of trading account by default.

Deposits and Withdrawals:

BizzTrade strives to process client deposit and withdrawal requests promptly. These options are available only within the client login portal.

Trading Platforms:

BizzTrade provides MetaTrader 5 (MT5) as its sole trading platform. MT5, available on PC, mobile, and web, is renowned for its technological sophistication, offering depth-of-market access and various advanced solutions. It features buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, delivering a customizable platform with numerous online tools for integration. Additionally, MT5 supports quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and intuitive market search and grouping functionality, contributing to a comprehensive and user-friendly trading experience.

Research and Education:

Upon reviewing BizzTrades website, there is no indication of research and educational resources provided by the broker.

Customer Service:

BizzTrade offers 24/7 customer support in multiple languages, including English, French, Thai, Italian, Vietnamese, Chinese, and more. Clients can reach BizzTrade via email at support@bizzltd.com.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned BizzTrade a WikiScore of 5.44 out of 10.

Upon examining BizzTrade‘s license, WikiFX found that the broker is regulated by the United Kingdom’s Financial Conduct Authority (FCA). WikiFX has also validated the legitimacy of the said license.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator