简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

LiteFxTrading

Abstract:LiteFxTrading is allegedly a financial services company registered in the United Kingdom that specializes in forex trading.

| Aspect | Information |

| Company Name | LiteFxTrading |

| Registered Country/Area | United Kingdom |

| Founded Year | 2022 |

| Regulation | Not regulated |

| Market Instruments | Major currency pairs |

| Account Types | Basic & Premium Copy-Trading |

| Minimum Deposit | €10,000 |

| Maximum Leverage | N/A |

| Spreads | No |

| Trading Platforms | N/A |

| Demo Account | Not available |

| Customer Support | Phone: +421 902 142 304, Email: elitefxbb@gmail.com (9 AM to 5 PM daily) |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, e-wallets (PayPal, Skrill, Neteller) |

| Educational Resources | E-Book course (€999) |

Overview of LiteFxTrading

LiteFxTrading, founded in 2022, offers copy-trading services in major currency pairs like EUR/USD and GBP/USD. They have two account options: Basic (minimum €10,000) and Premium (minimum €20,000). However, a major cause for concern is the lack of any regulatory information.

Without regulatory oversight, there's no guarantee of fair trading practices or client fund protection. They offer customer support via phone and email, but details about spreads, maximum leverage, trading platforms, and demo accounts are not available. They do have an educational E-Book course, but it comes at a cost of €999.

Pros and Cons

| Pros | Cons |

| Potential for high returns | Lack of regulation |

| Straightforward account structure | Expensive educational resource |

| Educational resources | Limited customer support hours |

| Customer support | Risks associated with copy-trading |

Pros

Potential for High Returns: LiteFxTrading promises high monthly returns, with claims of 5% for Basic accounts and 7% for Premium accounts, translating to potential annual returns of up to 100%. This can be attractive to traders seeking significant growth on their investments.

Straightforward Account Structure: LiteFxTrading offers two clear and understandable account types (Basic and Premium) with defined minimum deposit requirements. This simplicity allows traders to easily choose the account that suits their investment level.

Educational Resources: LiteFxTrading provides an E-Book course designed to educate aspiring forex traders. This can be beneficial for those who are new to the forex market and want to learn the basics before investing.

Customer Support: LiteFxTrading offers customer support via phone and email, allowing traders to get assistance with any questions or issues they encounter.

Cons

Lack of Regulation: A major red flag is the absence of any regulatory information about LiteFxTrading. Forex brokers operating legitimately should be authorized by a recognized financial authority. Without regulatory oversight, there's no guarantee of fair trading practices, the safety of your funds, or mechanisms to resolve disputes.

Expensive Educational Resource: The E-Book course offered as an educational resource comes at a hefty price of €999. This cost can be a significant barrier for some potential traders, especially considering there might be other free or affordable educational resources available elsewhere.

Limited Customer Support Hours: Customer support is only available during regular business hours (9 AM to 5 PM daily). This limited accessibility could be inconvenient for traders who need assistance outside of these hours.

Risks Associated with Copy-Trading: Copy-trading does not guarantee success. Even if you copy the trades of a seemingly successful trader, there's always the possibility of losses. It's important to understand the inherent risks involved before using copy-trading.

Regulatory Status

LiteFxTrading's regulation status is concerning. The information provided does not mention any valid regulatory licenses. This is a red flag, as forex brokers operating legitimately should be authorized by a recognized financial authority. Without regulatory oversight, there's no guarantee of fair trading practices, client fund protection, or dispute resolution mechanisms.

Market Instruments

LiteFxTrading offers a comprehensive range of major currency pairs for trading, satisfying diverse investment needs. These pairs include EUR/USD (Euro against US Dollar), GBP/USD (British Pound against US Dollar), USD/CAD (US Dollar against Canadian Dollar), USD/JPY (US Dollar against Japanese Yen), USD/CHF (US Dollar against Swiss Franc), AUD/USD (Australian Dollar against US Dollar), and NZD/USD (New Zealand Dollar against US Dollar).

Each pair represents a significant portion of global forex trading volume, providing ample opportunities for investors to engage in the foreign exchange market. These pairs are widely traded due to their liquidity and volatility, making them popular choices among traders seeking to capitalize on currency fluctuations.

Account Types

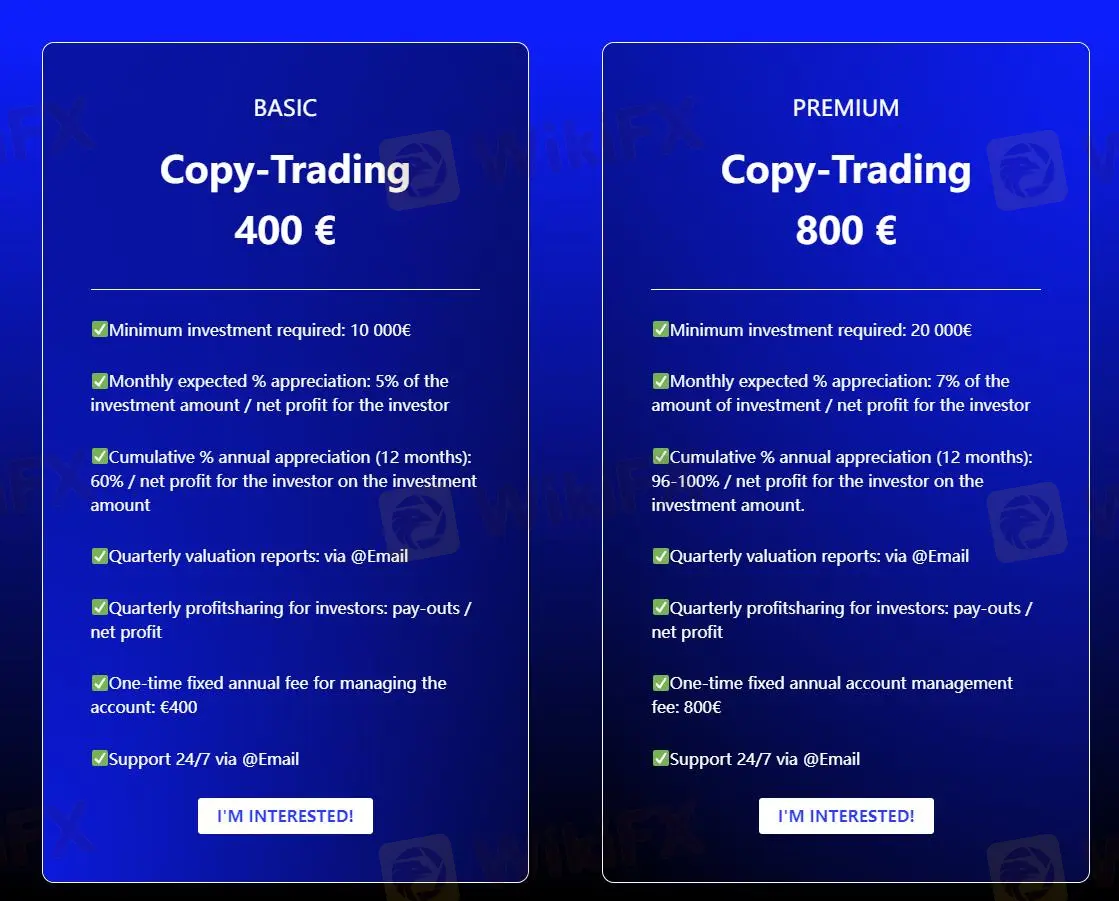

LiteFxTrading offers two distinct account types tailored to meet varying investment preferences: Basic and Premium Copy-Trading accounts.

The Basic account, requiring a minimum investment of €10,000, is ideal for investors seeking steady growth. With a monthly expected appreciation of 5% of the investment amount, investors can anticipate a cumulative annual appreciation of 60%. Quarterly valuation reports are conveniently delivered via email, keeping investors informed about their portfolio performance. Additionally, investors benefit from quarterly profit-sharing payouts based on net profits. The account management fee is a one-time fixed annual payment of €400. Furthermore, LiteFxTrading provides round-the-clock support via email, ensuring investors have assistance whenever needed.

For investors aiming for accelerated growth and higher returns, the Premium Copy-Trading account is the optimal choice. Requiring a minimum investment of €20,000, this account offers a monthly expected appreciation of 7% of the investment amount, leading to a cumulative annual appreciation ranging between 96% to 100%. Like the Basic account, investors receive quarterly valuation reports via email and enjoy profit-sharing payouts based on net profits. The annual account management fee for the Premium account is €800. LiteFxTrading continues to provide 24/7 support via email.

How to Open an Account?

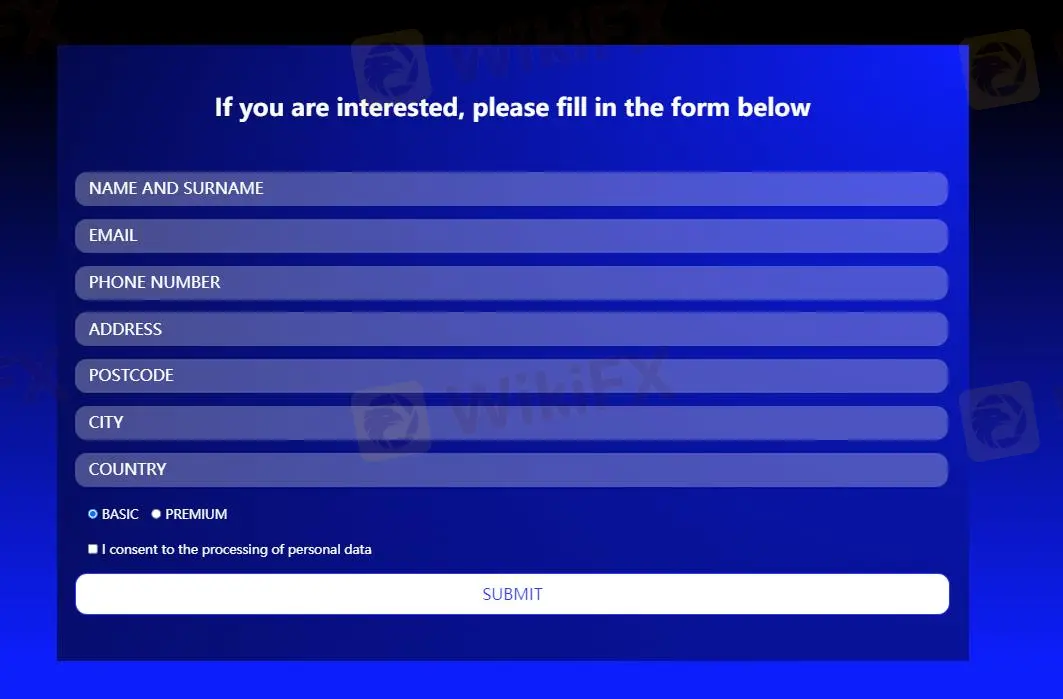

Here's a breakdown of the steps involved in opening a LiteFxTrading account:

To locate the Account Signup Page, visit the LiteFxTrading website at https://thelitefxtrading.sk/en/copy-trading/.

Complete the Online Application Form by providing your personal information such as Full Name, Email Address, Phone Number, and Country of Residence. Choose your preferred account type (Basic or Premium) based on your findings. Set a password for your account as prompted.

Fund your Account by locating the deposit section on the platform. Choose your preferred deposit method from the available options (credit card, bank transfer, e-wallets, etc.). Provide the necessary payment details and deposit the minimum investment amount for your chosen account type (€10,000 for Basic and €20,000 for Premium).

Accept Terms and Conditions by carefully reading and understanding LiteFxTrading's terms and conditions. Once you understand, locate and check the box acknowledging your acceptance.

Submit your Application by clicking on the button labeled “Submit”, after completing all the steps above.

Spreads &Commissions

LiteFxTrading does not charge any commission or fees on deposits or withdrawals made by clients. However, clients should be aware that third-party payment processors or banks impose their own fees or charges for transactions, which are beyond the control of LiteFxTrading.

Deposit & Withdrawal

LiteFxTrading offers a variety of payment methods to facilitate deposits and withdrawals for its clients. Clients can fund their accounts and make withdrawals using methods such as bank transfers, credit/debit cards, and popular e-wallet services like PayPal, Skrill, and Neteller. These payment methods provide flexibility and convenience for clients to manage their funds efficiently.

In terms of fees, LiteFxTrading charges a one-time fixed annual fee for managing the account, which is €400 for the Basic account and €800 for the Premium account. This fee covers the cost of account management services provided by LiteFxTrading throughout the year.

Customer Support

LiteFxTrading provides robust customer support to ensure clients receive prompt assistance whenever needed. Clients can reach out via phone at +421 902 142 304 or through email at elitefxbb@gmail.com. The support team is available every day from 9 AM to 5 PM, offering assistance during regular business hours to address any inquiries, resolve issues, or provide guidance regarding account management, trading platforms, or any other concerns clients have.

Educational Resources

LiteFxTrading offers an E-Book course as an educational resource for aspiring forex traders. This E-Book is designed for both complete beginners and those with some basic knowledge. It promises to cover the essential curriculum and information needed to understand the forex market and make informed trading decisions. The E-Book is 231 pages long in PDF format and includes illustrations to enhance learning. Upon purchase, you'll receive lifetime access to the E-Book and 1 month of email live support for any questions you have.

The E-Book is available for desktop and mobile devices via iOS and Android. However, it's important to note that this E-Book costs €999.

Conclusion

LiteFxTrading offers copy-trading in major currency pairs with the potential for high returns. Their simple account structure and educational resources might be appealing. However, the lack of regulation raises significant concerns about the safety of your funds and the legitimacy of the company. The expensive educational materials and limited customer support hours add to the drawbacks. Carefully weigh the potential advantages against the substantial risks before considering LiteFxTrading.

FAQs

Question: What is LiteFxTrading and what do they offer?

Answer: LiteFxTrading offers a copy-trading service where you can replicate the positions of experienced traders in the forex market. They specialize in major currency pairs like EUR/USD and GBP/USD.

Question: Are there different account options available?

Answer: Yes, LiteFxTrading has two main account types: Basic and Premium. The Basic account requires a minimum deposit of €10,000, while the Premium account requires €20,000.

Question: How much can I potentially earn with LiteFxTrading?

Answer: LiteFxTrading advertises monthly returns of 5% for Basic accounts and 7% for Premium accounts, translating to annual returns of up to 100%.

Question: Is LiteFxTrading a safe and regulated company?

Answer: This is a major concern. The information available doesn't mention any regulatory licenses for LiteFxTrading.

Question: Does LiteFxTrading offer any educational resources?

Answer: They do offer an E-Book course designed to teach forex trading basics. However, this E-Book comes at a cost of €999.

Question: How can I contact LiteFxTrading for support?

Answer: LiteFxTrading offers customer support via phone and email, but only during business hours (9 AM to 5 PM daily).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Broker Review: Is Exnova Legit?

A forex broker named Exnova has recently come to our attention. This broker is registered in Saint Vincent and the Grenadines and started its business in 2021. In this article, we will dig into this broker deeply and provide some information if you are interested.

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Capital.com transitions to a regional leadership model as Kypros Zoumidou steps down, promoting Christoforos Soutzis as CEO of its Cyprus operations.

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Online trading platform eToro has recently unveiled its latest investment offering—the Global-Edge Smart Portfolio. This new addition to eToro’s extensive portfolio options provides investors with a balanced approach to investing by combining global stocks and bonds, tailored for those looking for growth and stability.

Something You Need to Know About SogoTrade

Have you ever heard of a broker named SogoTrade? In this article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator